What is the CAT CR Ohio form used for?

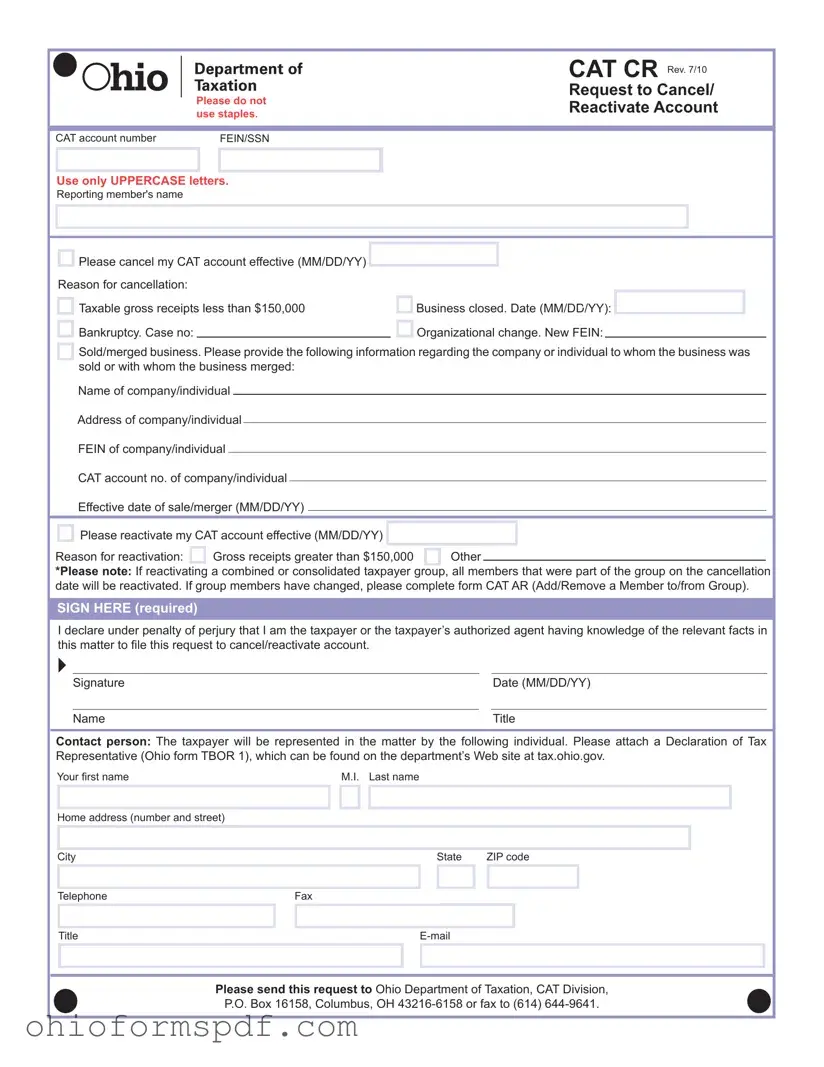

The CAT CR Ohio form is a document used by businesses to request the cancellation or reactivation of their Commercial Activity Tax (CAT) account with the Ohio Department of Taxation. The form covers various reasons for cancellation, such as gross receipts falling below $150,000, bankruptcy, business closure, or organizational changes, and for reactivation, like gross receipts exceeding $150,000.

When should a business cancel its CAT account?

A business should consider canceling its CAT account when it is no longer operating in Ohio or if its taxable gross receipts are consistently less than $150,000 annually. Other instances include bankruptcy, business closure, or if there's an organizational change requiring a new Federal Employer Identification Number (FEIN).

Can a business reactivate its CAT account once it has been cancelled?

Yes, a business can reactivate its CAT account. Reactivation is necessary when a business's gross receipts again surpass the $150,000 threshold or if the reason for initially cancelling the CAT account no longer applies. The form requests the effective date of reactivation and reasons for it.

What happens if a business is sold or merged?

If a business is sold or merged, the CAT CR form requires the name, address, FEIN, and CAT account number of the acquiring company or the new company formed after the merger, along with the effective date of the sale or merger. This information ensures the continuity of tax obligations and entitlements.

Is there a penalty for not filing the CAT CR form?

Failing to file the CAT CR form when necessary could lead to inaccurate tax obligations and potentially result in penalties for non-compliance. It's important to update the Ohio Department of Taxation regarding changes in your business that affect your CAT account to remain in good standing.

How can a taxpayer authorize a representative on the CAT CR form?

To authorize a representative, a taxpayer must attach a Declaration of Tax Representative, known as Ohio form TBOR 1, to the CAT CR form. This grants the named individual the authority to represent the taxpayer in matters related to the cancellation or reactivation of the CAT account.

What are the steps to follow after completing the CAT CR form?

After filling out the CAT CR form, the taxpayer should sign it, confirming under penalty of perjury that the information provided is accurate and they are authorized to make this request. The completed form, along with any necessary attachments, should be sent to the specified address or fax number of the Ohio Department of Taxation, CAT Division.

How long will it take for the Ohio Department of Taxation to process a CAT CR form?

The processing time can vary depending on the current workload of the Ohio Department of Taxation and whether the form was filled out correctly and completely. To avoid delays, ensure all required information is provided, and consider contacting the department for an estimate on processing times.

Please cancel my CAT account effective (MM/DD/YY)

Please cancel my CAT account effective (MM/DD/YY)

Bankruptcy. Case no:

Bankruptcy. Case no: Business closed. Date (MM/DD/YY):

Business closed. Date (MM/DD/YY):

Organizational change. New FEIN:

Organizational change. New FEIN: