The City of Tiffin, Ohio Income Tax form bears resemblance to the Federal 1040 Income Tax form. Both documents are crucial for reporting yearly income and calculating taxes owed to the government. They guide taxpayers through various types of income, deductions, and credits to establish an accurate tax liability. The structure and purpose of these forms are fundamentally aligned; however, they apply to different tiers of government - one for federal and the other for municipal tax obligations.

Similarly, the form mirrors state income tax forms found in states like Ohio's IT 1040. State forms, much like the Tiffin city form, are designed for taxpayers to declare their income, claim deductions, and compute the tax due at the state level. While the specifics regarding deductions, credits, and income types might vary, the overarching goal of facilitating accurate tax collection is a common thread shared between them.

The Schedule C (Form 1040), used by sole proprietors to report business income and expenses, also parallels the Tiffin tax form in its function. Although the Schedule C is more specifically targeted toward business financial activities, both it and the Tiffin form require detailed income reports and allow for deductions that ultimately determine the tax liability of the individual or entity submitting the form.

Another document akin to the Tiffin Income Tax form is the W-2 form. Employers issue the W-2 to employees to report annual wages and taxes withheld. Although it is primarily a document for reporting rather than calculating taxes, the information on a W-2 is pivotal for filling out income tax forms, including Tiffin's. It provides essential data that taxpayers need to accurately report their earnings and calculate their taxes due.

The 1099 form, utilized for reporting various types of non-employment income, shares similarities with the Tiffin form as well. Freelancers, independent contractors, and others receive 1099s for work that doesn't fall under traditional employee status. Like the Tiffin income tax form, 1099 forms are critical for ensuring all income is accounted for and the correct amount of tax is paid, albeit from a different income source perspective.

Forms like the Estimated Tax Payment voucher, exemplified by the federal 1040-ES, also resemble the Tiffin tax form in their purpose. These vouchers are used by individuals, including sole proprietors, partners, and S corporation shareholders, to pay tax on income that isn't subject to withholding. While serving different segments of the taxpayer population, both the 1040-ES and the Tiffin form address the critical need for pre-emptive tax payments to avoid underpayment penalties.

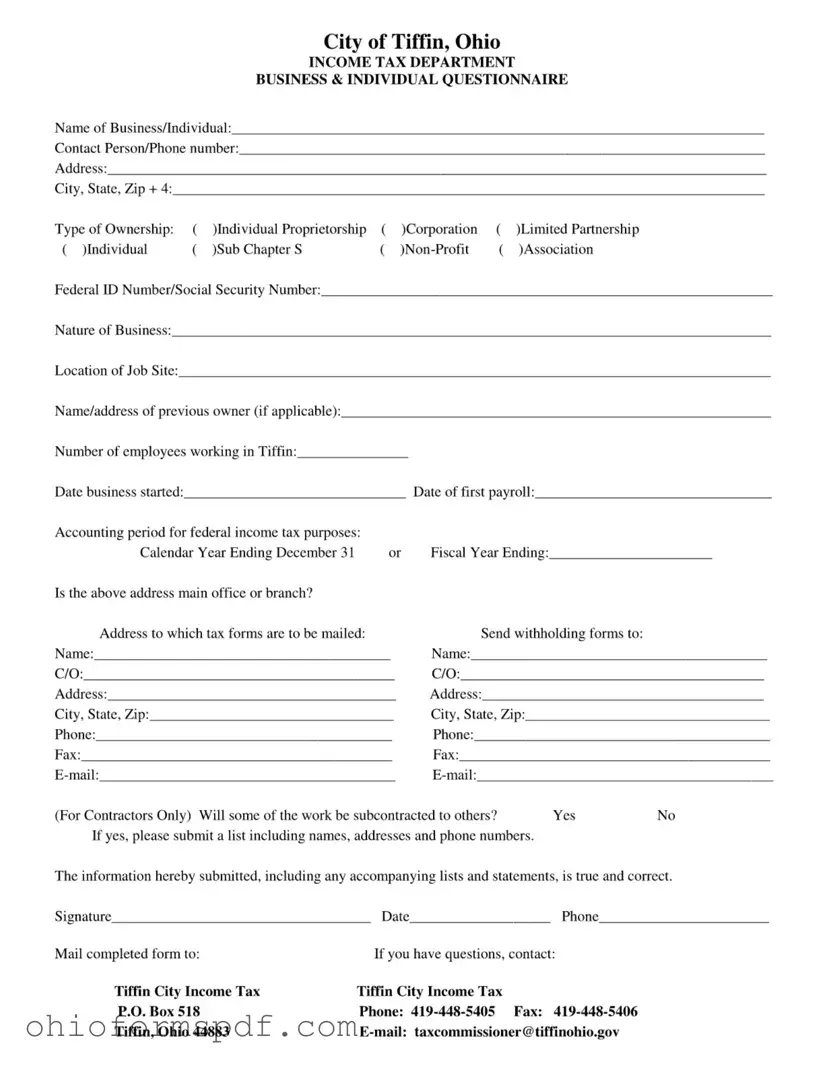

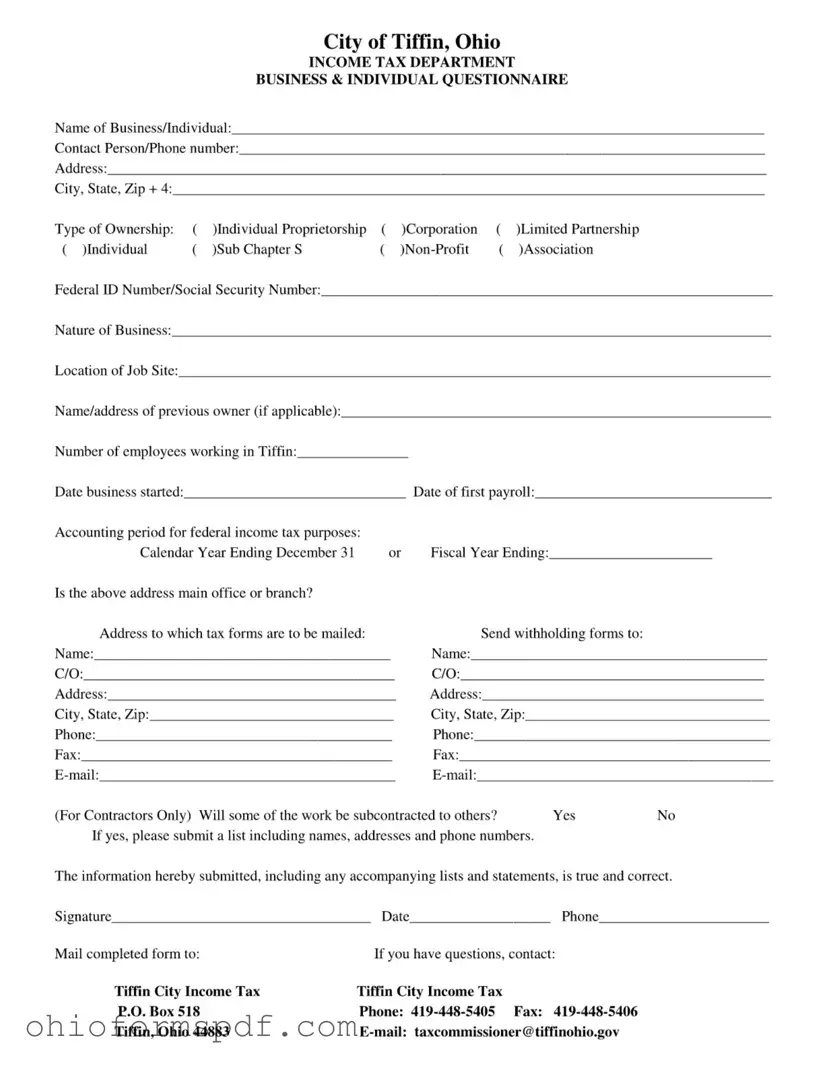

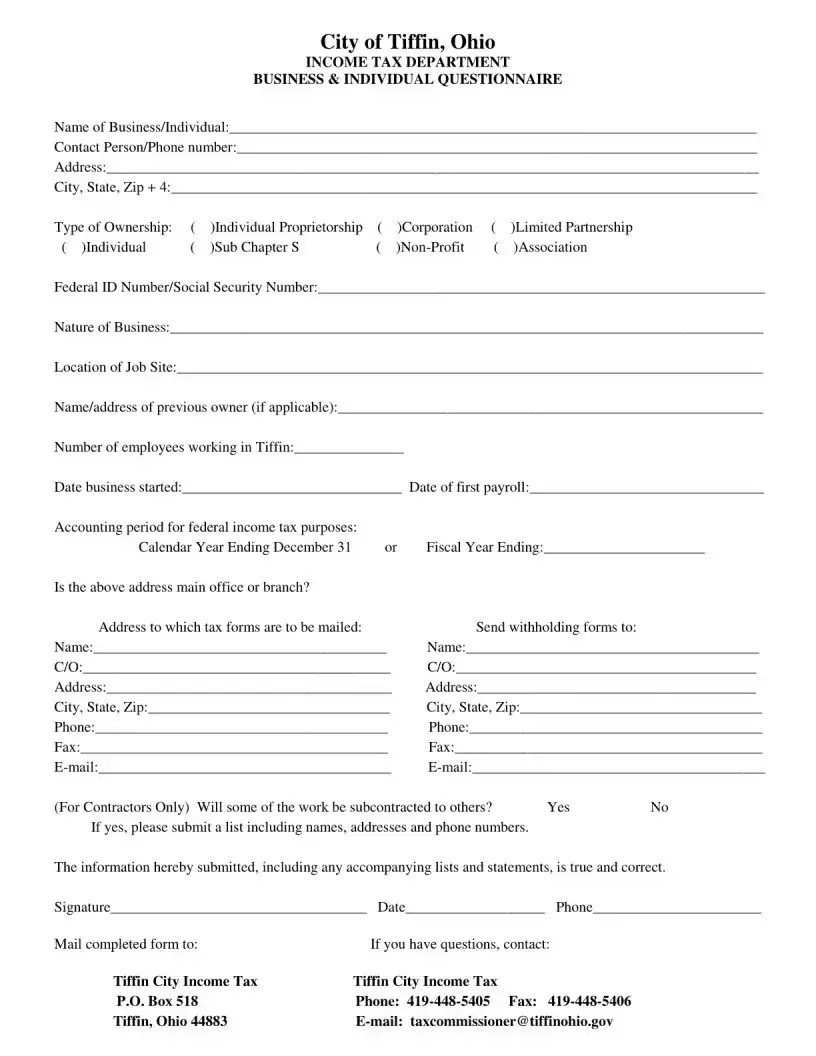

Lastly, the Local Earned Income Tax Return forms, which many municipalities require for local tax reporting and payment, are directly analogous to the Tiffin Income Tax form. Though specific forms can vary significantly from one locality to another, their fundamental purpose aligns closely with Tiffin's form. They necessitate a detailed accounting of income, applicable deductions, and calculation of taxes due on a local level, ensuring that communities have the necessary funding for public services.