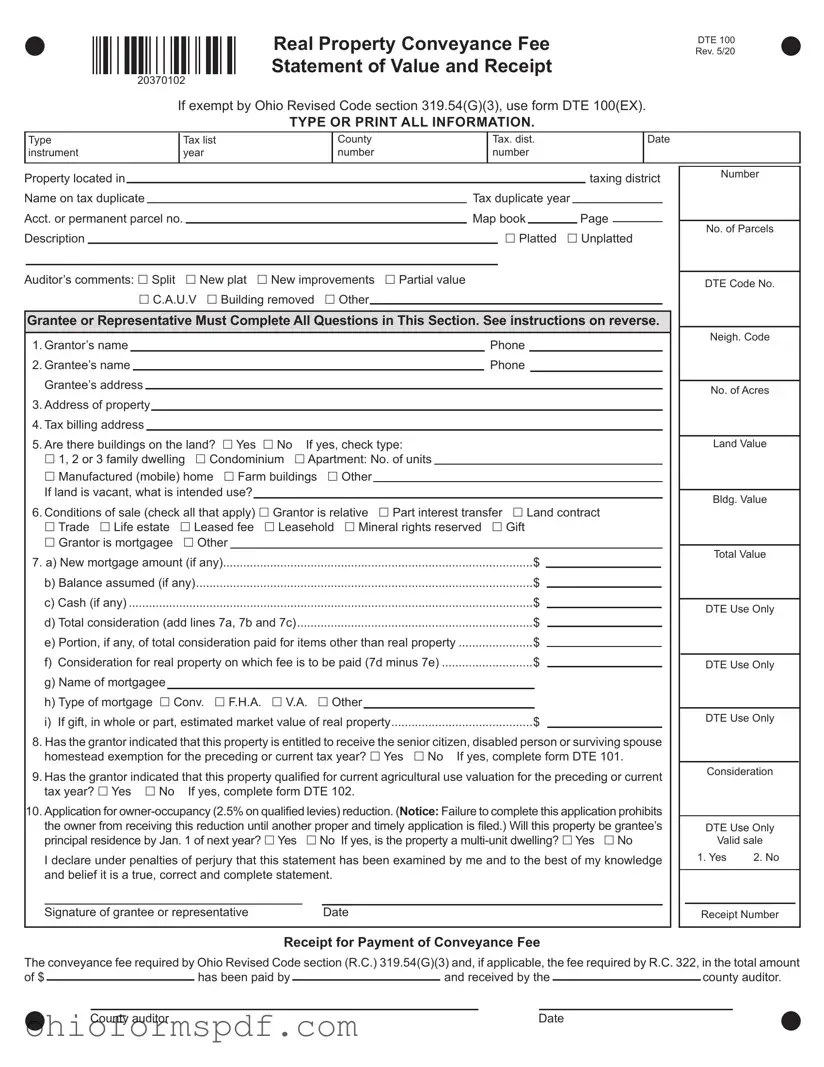

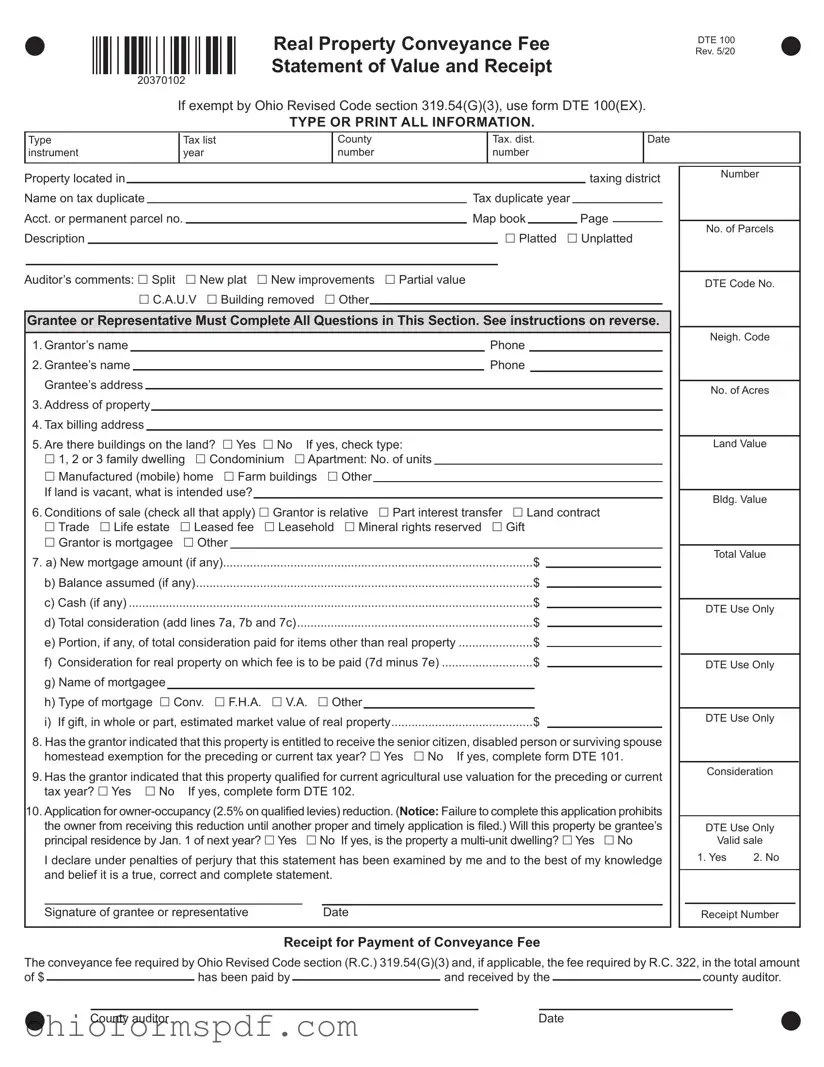

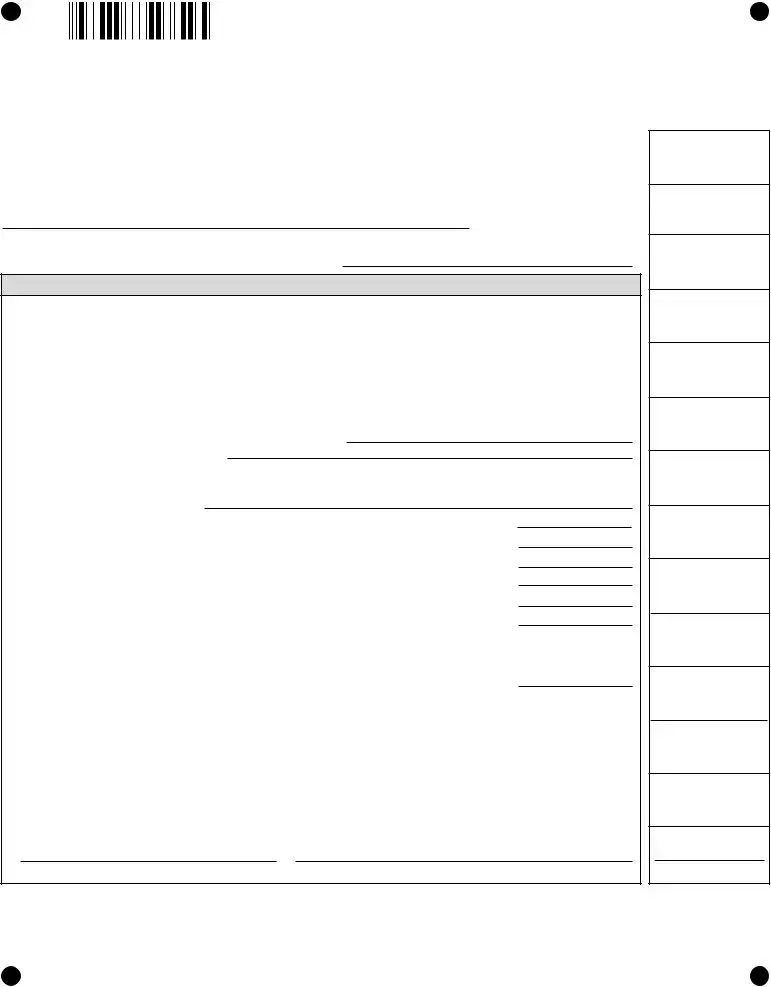

WARNING: All questions must be completed to the best of your knowledge to comply with Ohio Revised Code (R.C.) section 319.202.

Persons willfully failing to comply or falsifying information are guilty of a misdemeanor of the first degree (R.C. section 319.99(B)). It is important that the information on this form be accurate as it will be used to determine whether all real property, including this property, is uniformly assessed for real property tax purposes.

Note: The county auditor has discretionary power under R.C. section 319.202(A) to request additional information in any form of documentation deemed necessary to verify the accuracy of the information provided by the grantee on the front of the form.

Line 1 List grantor’s name as shown in the deed or other instrument conveying this real property.

Line 2 List grantee’s name as shown in the deed or other instrument conveying this real property and the grantee’s mailing address.

Line 3 List address of property conveyed by street number and name.

Line 4 List complete name and address to which tax bills are to be sent. CAUTION: Each property owner is responsible for paying the property taxes on time even if no tax bill is received.

Line 5 If there are no buildings on the land conveyed, check “no.” If there are buildings, check “yes” and the appropriate box that describes the type of buildings. If other, describe briefly the type of buildings, such as “office building.”

Line 6 Show any special condition of sale that would affect the consideration. If any of the special conditions noted are involved, check the appropriate box. Briefly describe other conditions in the space provided.

Line 7 a) Enter amount of new mortgage on this property (if any).

b)Enter amount of the balance assumed on an existing mortgage (if any).

c)Enter cash paid for this property (if any).

d)Add lines 7a, 7b and 7c.

e)If any portion of the consideration reported on line 7d was paid for items other than real property, enter the portion of the consideration paid for those items.

f)Deduct line 7e from line 7d and enter the difference on this line.

g)List mortgagee or mortgagees (the party who advances the funds for a mortgage loan).

h)Check type of mortgage.

i)In the case of a gift, in whole or part, enter the estimated price that the real estate would bring in the open market.

Line 8 If the grantor has indicated that the property to be conveyed will receive the senior citizen, disabled person or surviving spouse homestead exemption for a proceeding or current tax year under R.C. section 323.152(A), grantor must complete DTE 101 or submit a statement that complies with the provisions of R.C. section 319.202(A)(2), and the grantee must submit such form to the county auditor along with this statement.

Line 9 If the grantor has indicated that the property to be conveyed qualified for current agricultural use valuation for the preceding or

current tax year under R.C. section 5713.30, the grantor must complete DTE 102 or a statement that complies with R.C. section 319.202(B)(2), and the grantee must submit such form to the county auditor along with this statement.

Line 10 Complete line 10 (application for owner-occupancy reduction on qualified levies) only if the parcel is used for residential purposes. To receive the owner-occupancy homestead tax reduction on qualified levies for next year, you must own and occupy your home

as your principal place of residence (domicile) on Jan. 1 of that year. A homeowner and spouse may receive this reduction on

only one home in Ohio. Failure to complete this application prohibits the owner from receiving this reduction until another proper and timely application is filed.

The real property conveyance fee is payable on the amount of money reported on either item 7f or 7i.