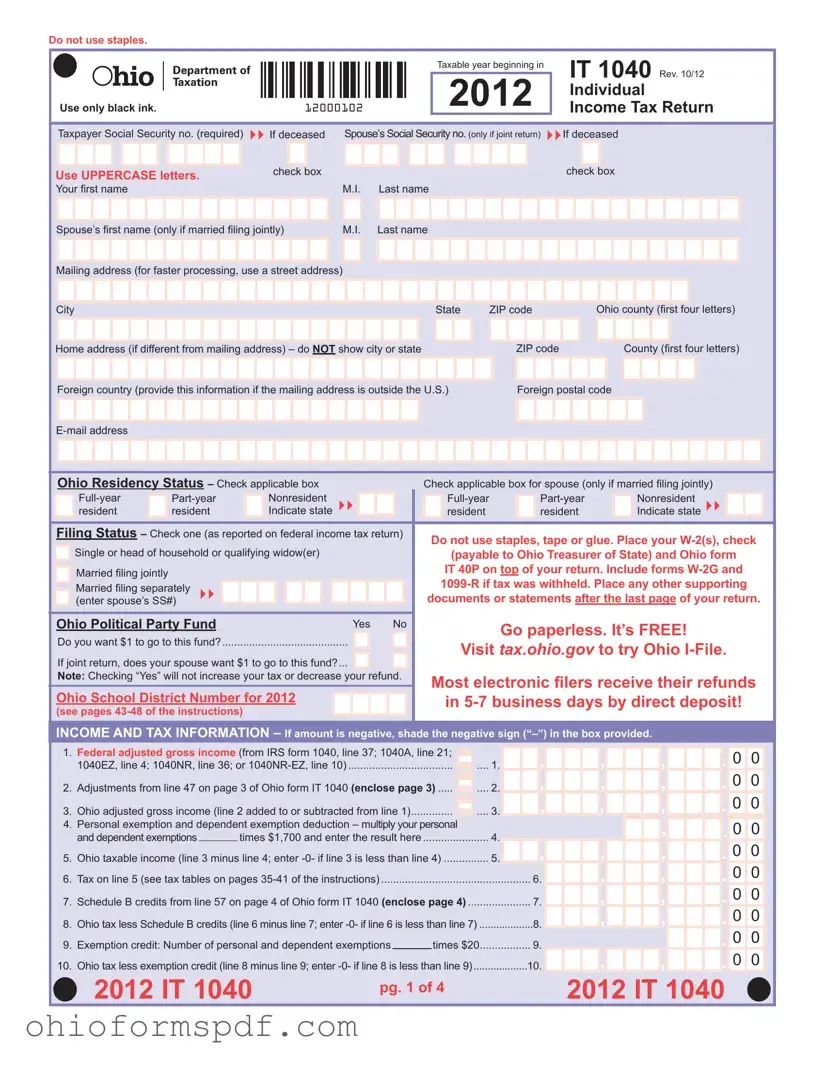

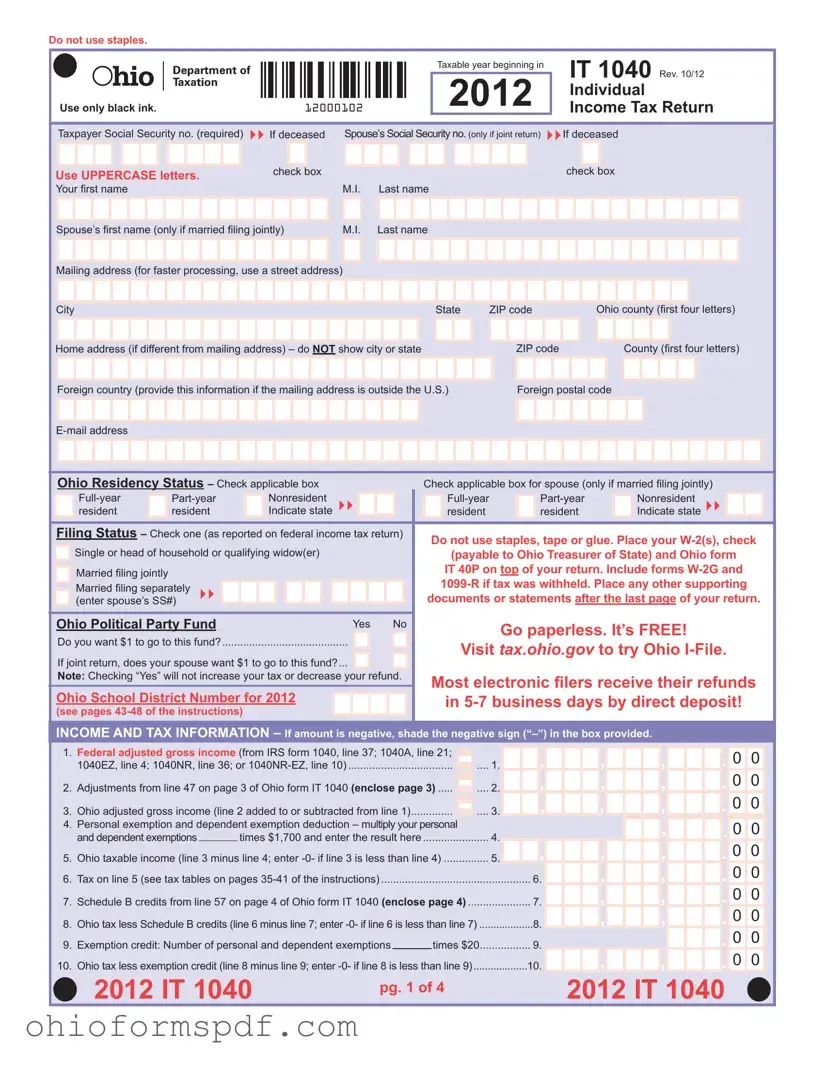

What is the IT 1040 Ohio form?

The IT 1040 Ohio form is an Individual Income Tax Return document that residents, part-year residents, and non-residents who have earned income in Ohio are required to file. It's used to report income, calculate state tax owed, and determine eligibility for any refunds or tax credits.

Who needs to file the IT 1040 Ohio form?

Any Ohio resident, part-year resident, or non-resident who has received income from Ohio sources during the taxable year is required to file this form. This includes individuals who work in Ohio, those who own property in the state, and others earning income within Ohio boundaries.

Can I file the IT 1040 Ohio form electronically?

Yes, individuals are encouraged to file electronically for faster processing and quicker refunds. Ohio offers a free e-filing option through the Ohio I-File system, available on the Ohio Department of Taxation's website. Electronic filers often receive their refunds within 5-7 business days via direct deposit.

What should I do if my address is outside the U.S.?

If your mailing address is outside the U.S., you are required to provide both the foreign country name and the foreign postal code in the designated areas on the IT 1040 form. This ensures that any communication or refunds can be properly directed to an international address.

How should I prepare my IT 1040 form?

When preparing your IT 1040 form, use only black ink and write in UPPERCASE letters for clarity. Do not use staples, tape, or glue. Place your W-2(s) and any other documents, such as forms W-2G and 1099-R if tax was withheld, on top of your return. Any other supporting documents should follow the last page of your return.

What information do I need to file?

You need your federal adjusted gross income, details of any adjustments, your personal and dependent exemption deductions, and any eligible credits. Supporting documents such as W-2s, 1099 forms, and any other statements reflecting Ohio income or tax withheld must also be included.

What if I owe less than $1.01 or my refund is less than $1.01?

If the amount you owe is less than $1.01, you're not required to make a payment. Similarly, if your calculated refund is less than $1.01, the state will not issue a refund.

What are the filing requirements for joint returns?

If filing jointly, you must include your spouse's Social Security number on the form. You may also be eligible for a joint filing credit, but specific requirements outlined in the instructions must be met. Additionally, both individuals must sign the form, indicating their agreement with the information presented.

Where do I mail my IT 1040 Ohio form?

The mailing address depends on whether you're including a payment with your return. Without a payment, mail to the Ohio Department of Taxation, P.O. Box 2679, Columbus, OH 43218-2679. If including a payment, mail to the Ohio Department of Taxation, P.O. Box 2057, Columbus, OH 43218-2057. Make sure to enclose your federal income tax return if your line 1 is -0- or negative.

2012 IT 1040

2012 IT 1040

,

,

,

,

Yes

Yes

No

No

,

,

,

,