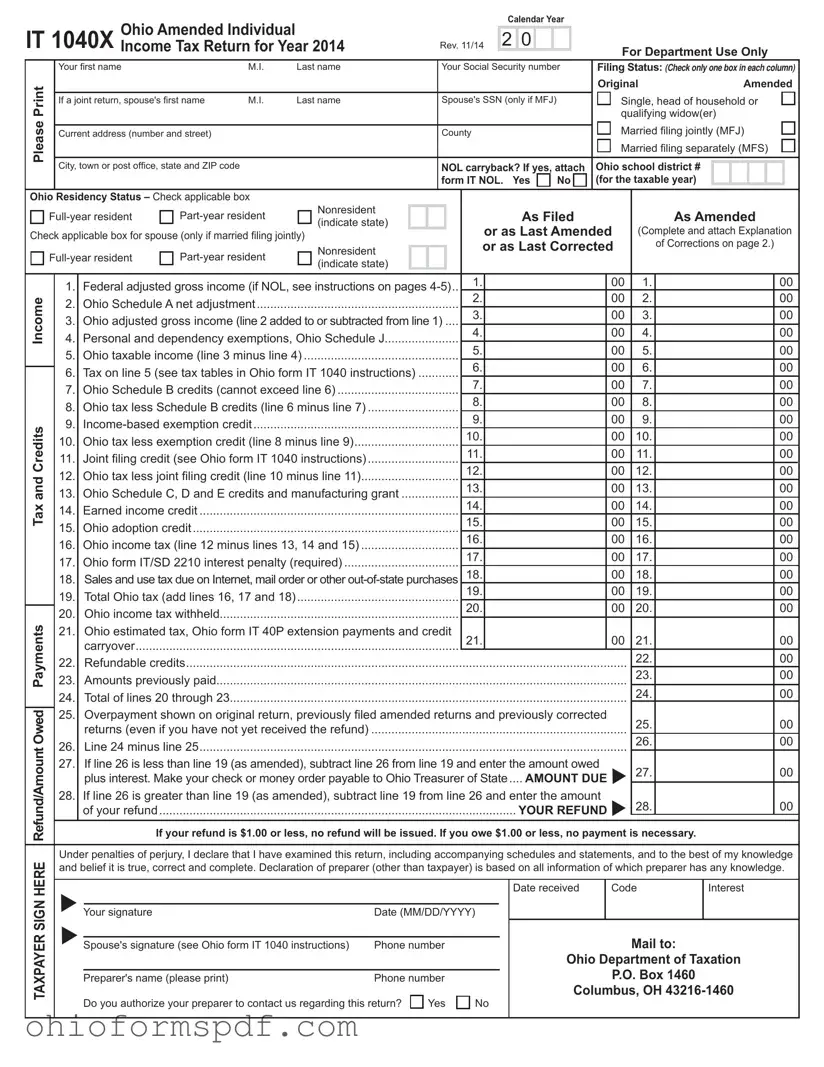

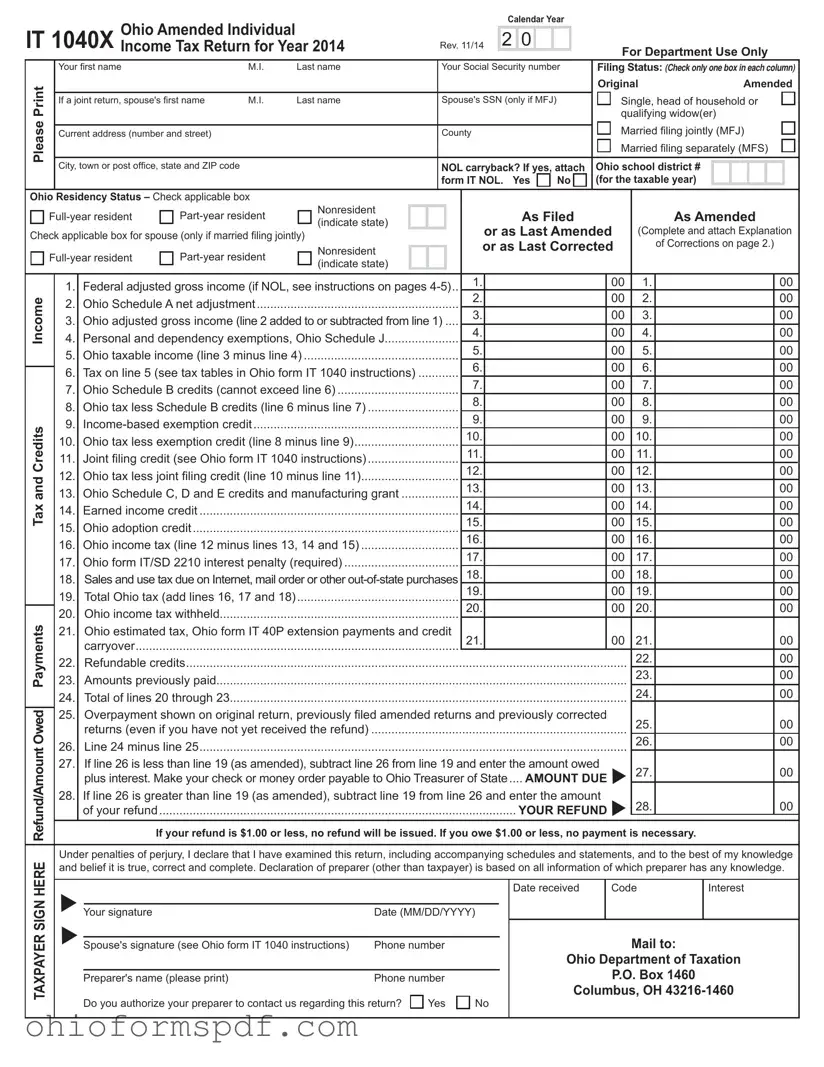

The Form 1040X, Amended U.S. Individual Income Tax Return, similarly to the Ohio IT 1040X, is utilized by taxpayers needing to correct or amend an already filed tax return. Both forms require individuals to report their original figures, the corrected numbers, and the differences, effectively updating their tax obligations or refund entitlements based on changes in income, filing status, deductions, or credits. While the Ohio IT 1040X specifically amends a state income tax return for Ohio, the Form 1040X addresses the federal income tax return, reflecting the broader scope required by the Internal Revenue Service.

The IT 40XP, Amended Income Tax Payment Voucher, which accompanies the Ohio IT 1040X, serves as a method for taxpayers to submit additional payment required due to the amendment, similar to the IRS Form 1040-V, Payment Voucher, for federal returns. The IT 40XP and Form 1040-V are both designed to facilitate the payment process, ensuring the correct allocation of taxpayers' payments toward their outstanding tax liabilities. These payment vouchers are crucial for accurately processing and crediting the taxpayers' accounts, minimizing errors in payment allocation.

Ohio form IT NOL, mentioned as an attachment for NOL carrybacks in the Ohio IT 1040X, parallels the federal Form 1045, Application for Tentative Refund. These documents are used by taxpayers to apply a net operating loss (NOL) to previous tax years to obtain a refund of taxes paid in those years. Both forms are critical for individuals or entities that have experienced a net operating loss and seek to adjust their tax liabilities accordingly, offering a financial recovery mechanism during loss-making periods.

The Ohio Schedule A, for net adjustments, shares similarities with the federal Schedule 1, Additional Income and Adjustments to Income. Both schedules are meant to report specific types of income or adjustments that are not reported directly on the main tax form. These adjustments could include deductions for educator expenses, student loan interest deduction, or adjustments for alimony received, effectively influencing the adjusted gross income.

Ohio Schedule J for personal and dependency exemptions on the Ohio IT 1040X is akin to the provisions found in previous versions of the federal Form 1040 or 1040-SR, which allowed taxpayers to claim exemptions for themselves, their spouses, and dependents. Despite recent tax law changes affecting exemptions at the federal level, the concept remains integral to understanding how taxpayers can reduce taxable income through exemptions for eligible dependents, reflecting the taxpayer's personal situation.

The Ohio IT/SD 2210 form for calculating interest penalties due to underpayment of estimated tax compares to the federal Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts. Both forms serve to calculate penalties that may be due if a taxpayer did not adequately pay their estimated tax throughout the year, providing a structure for determining the extent of the underpayment and computing the associated penalty.

Ohio Schedules B, C, D, and E, for various credits and deductions, have counterparts in the multiple schedules and forms used in the federal system, such as Schedule 3 for Non-refundable Credits, Schedule A for Itemized Deductions, and others. These forms enable taxpayers to claim eligible credits and deductions, reduce their taxable income, and enhance the specificity and accuracy of their tax filings by accounting for a wide array of financial factors, from education expenses to investments.

Finally, the detailed explanation of corrections page in the Ohio IT 1040X is conceptually similar to the explanation part of the federal Form 1040X. In both cases, taxpayers must provide a clear rationale for each amendment made to previously filed returns. This requirement ensures transparency and facilitates the review process by giving tax authorities context and justification for the modifications, increasing the efficiency of the amendment processing and reducing the likelihood of errors.