What is the main purpose of the Job And Family Services Hamilton Ohio form?

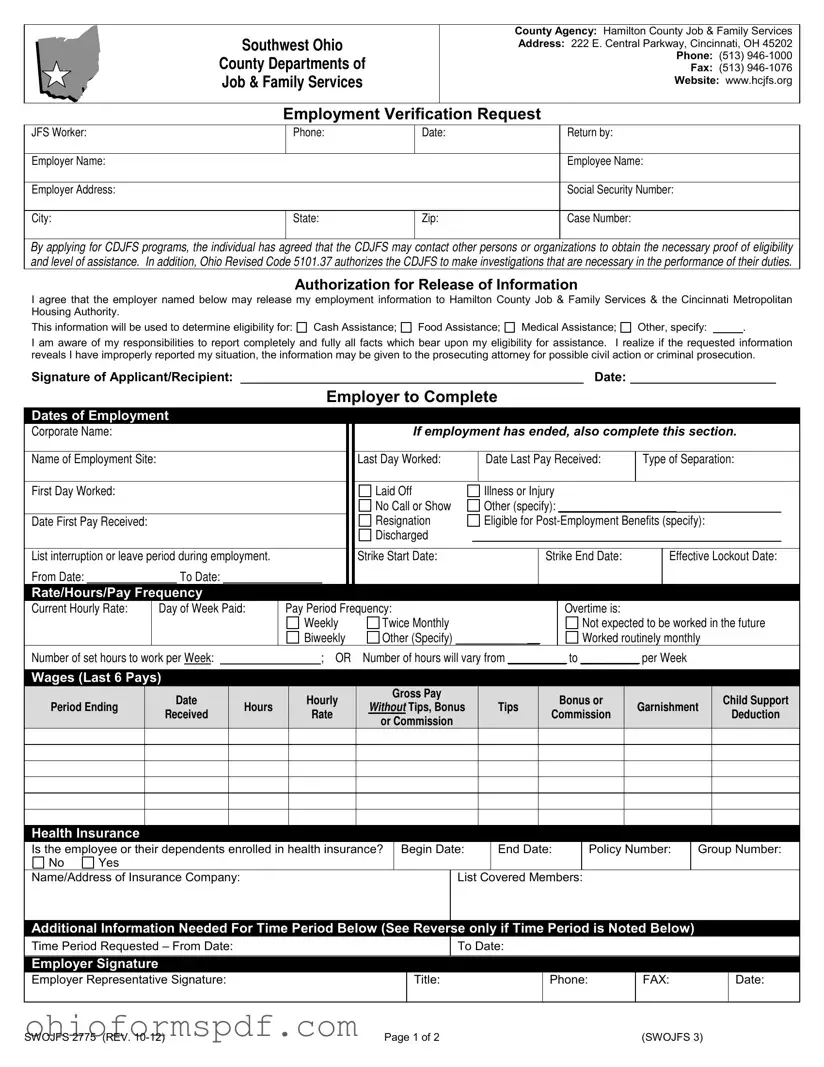

This form serves a critical role in determining an individual's eligibility for various assistance programs provided by Hamilton County Job & Family Services, including Cash Assistance, Food Assistance, Medical Assistance, among others. It facilitates the collection of necessary employment information from employers, under the authorization of the applicant, to accurately assess their eligibility for assistance.

How does one authorize the release of their employment information?

By signing the "Authorization for Release of Information" section of the form, an applicant consents for their employer to disclose their employment information to Hamilton County Job & Family Services and the Cincinnati Metropolitan Housing Authority. This consent is vital for processing the application for assistance programs.

What employment details must the employer provide?

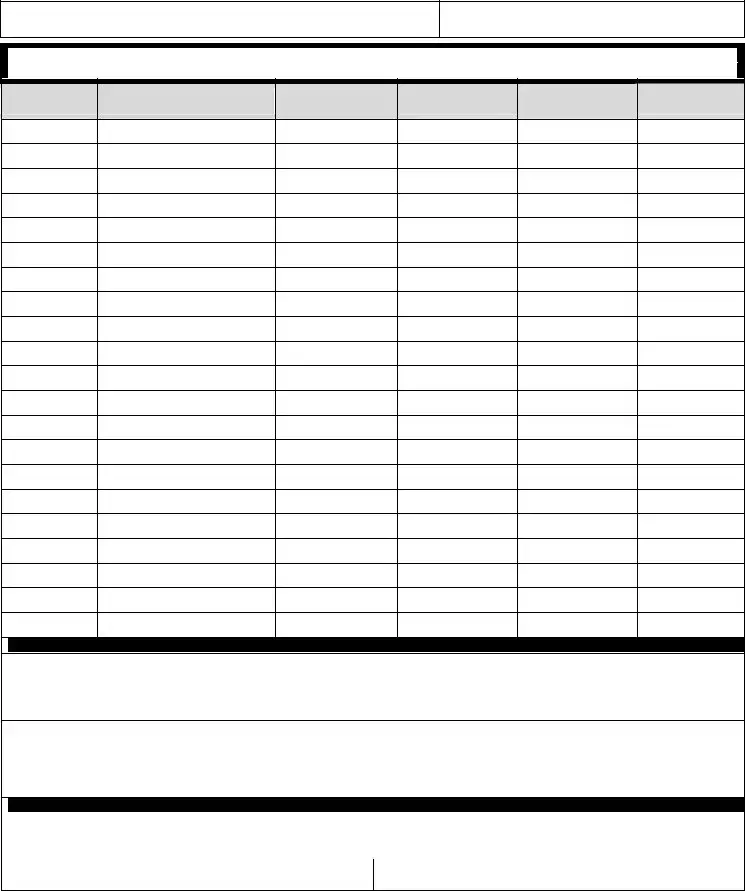

The employer is required to fill in comprehensive details about the employee's job tenure. This includes dates of employment, positions held, reasons for separation if applicable, details regarding pay rate and frequency, information about health insurance, and any interruptions or leave periods during employment. Additionally, details of wages in the last six pays are needed for a thorough review.

What responsibilities does the applicant have when filling out this form?

Applicants must accurately and fully report all facts affecting their eligibility for assistance. Any false reporting or omission of critical information not only affects their eligibility but may also lead to civil or criminal prosecution. Therefore, honesty in providing all requested information is imperative.

How is the provided information used?

The data collected through this form is strictly used to evaluate the applicant's need and eligibility for assistance programs like Cash Assistance, Food Assistance, and Medical Assistance. It ensures that aid is appropriately allocated to those truly in need, based on verifiable employment information.

What happens if there is a change in employment status after submitting the form?

It is the applicant's responsibility to immediately report any changes in income or employment status to Hamilton County Job & Family Services. Such changes could affect their eligibility for assistance or the level of assistance they receive.

Can an employer refuse to fill out this form?

Employers are obligated to provide the requested employment information as part of the application process for assistance programs. Failure to do so could impact the employee's application negatively. The form acts as a formal request, backed by the individual’s consent and legal provisions, compelling the accurate and timely provision of the necessary information.

Where should the completed form be sent?

Once filled, the completed form should be returned to Hamilton County Job & Family Services by the specified return date. The address is provided at the top section of the form, and it can be returned via fax or through other indicated means by the agency. Prompt submission of the completed form is crucial for the timely processing of the applicant's request for assistance.

Dates of Employment

Dates of Employment

Other Information Requested

Other Information Requested Employer Signature

Employer Signature