Blank Ohio 3 Q Template

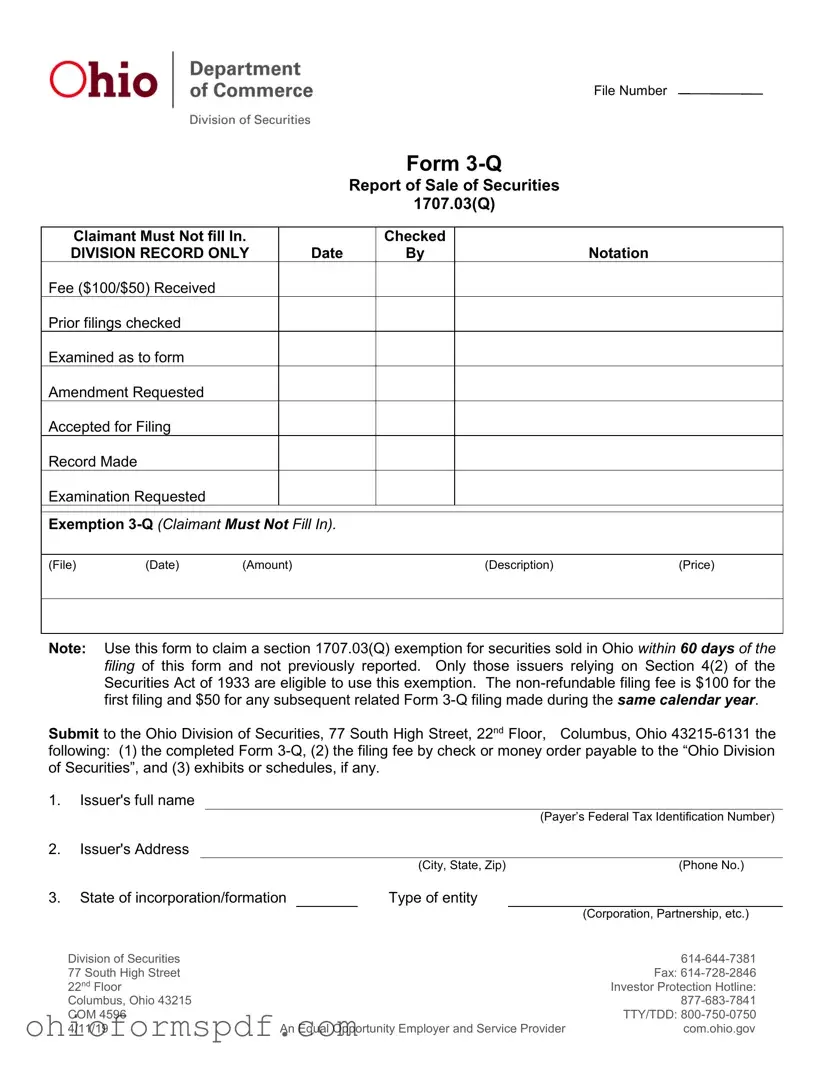

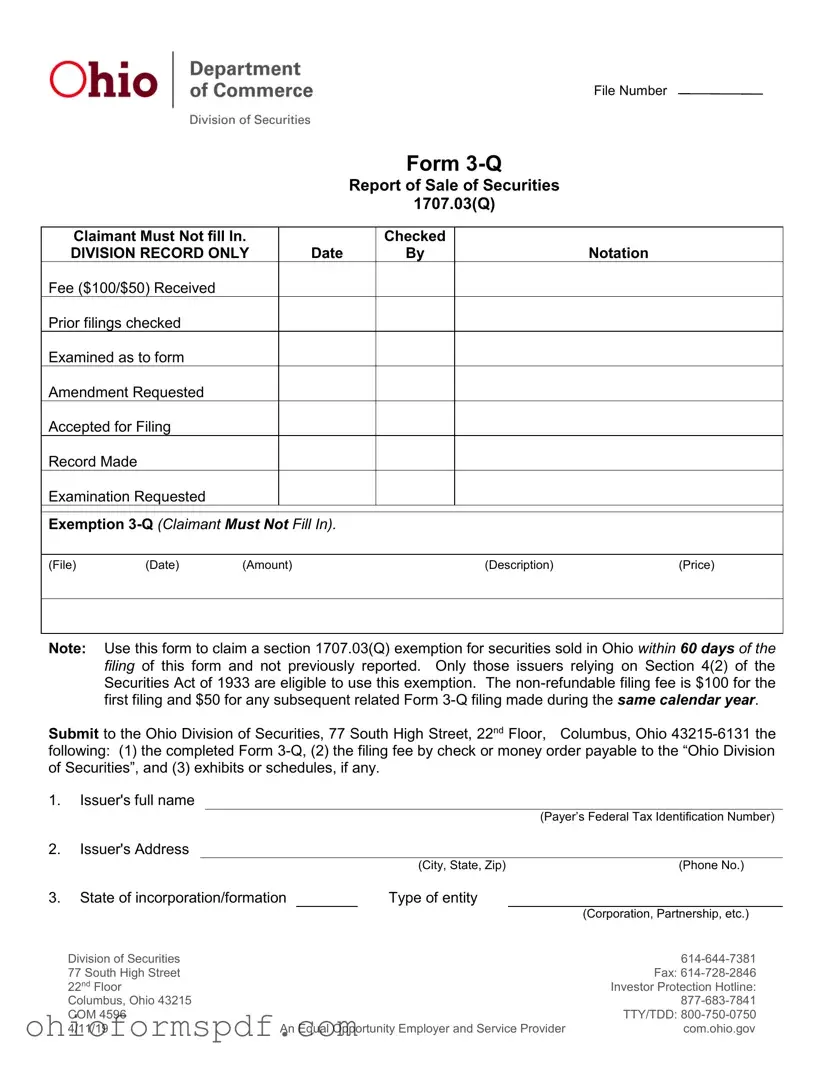

The Ohio 3-Q form is an essential document for issuers aiming to claim exemption under section 1707.03(Q) for securities sold in Ohio that have not been previously reported. This form is relevant for issuers relying on Section 4(2) of the Securities Act of 1933, allowing them to report sales of securities within 60 days of filing. With a non-refundable filing fee, the form mandates the submission of complete details regarding the issuer, the securities sold, and associated legal claims for exemption.

Prepare Form

Blank Ohio 3 Q Template

Prepare Form

Prepare Form

or

⇩ Ohio 3 Q PDF

You’re in the middle of the form

Complete Ohio 3 Q online — edit, save, and download smoothly.