What is the purpose of the Ohio 532B form?

The Ohio 532B form is used for filing Initial Articles of Incorporation for a Domestic Nonprofit Corporation. It allows an entity to officially form a nonprofit corporation under the laws of Ohio. This form is essential for setting up a nonprofit with a defined purpose, appointing a statutory agent, and ensuring compliance with Ohio's legal requirements for nonprofits.

How can I file the Ohio 532B form?

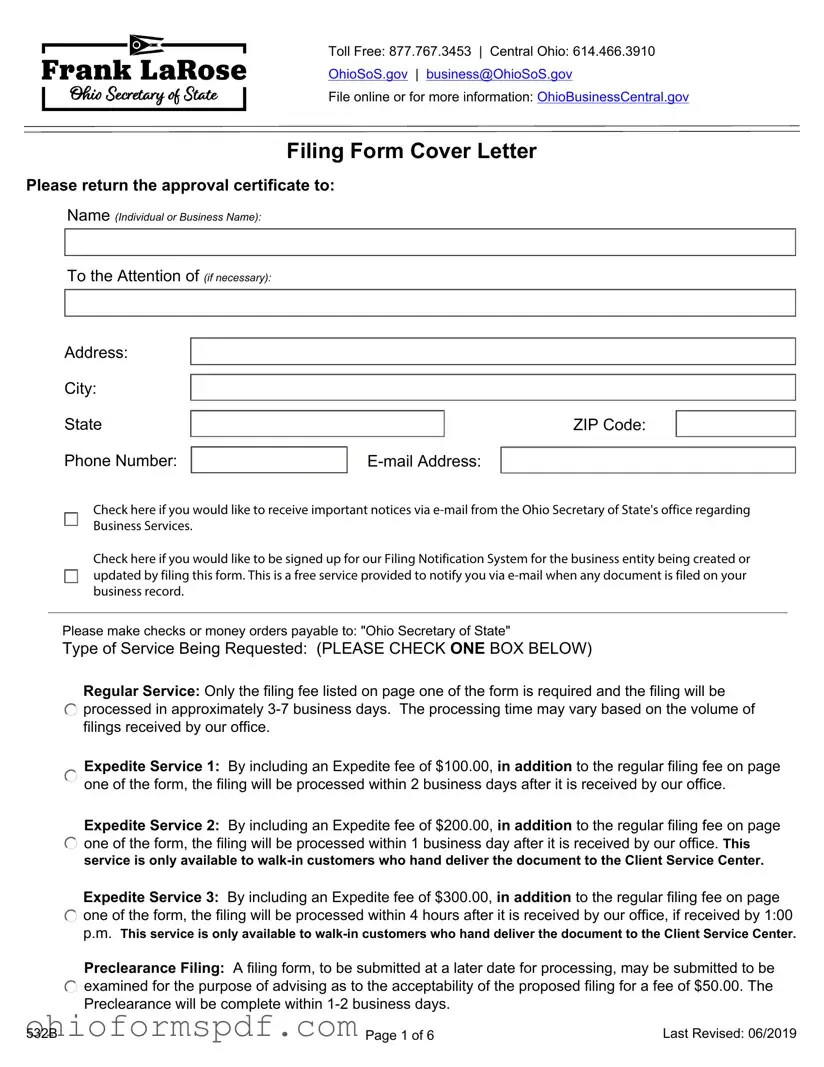

Filing can be completed online at OhioBusinessCentral.gov or by mailing the completed form to the appropriate address provided in the form instructions. For regular filings, mail to P.O. Box 670, Columbus, OH 43216. For expedited filings, the form can be mailed to P.O. Box 1390, Columbus, OH 43216.

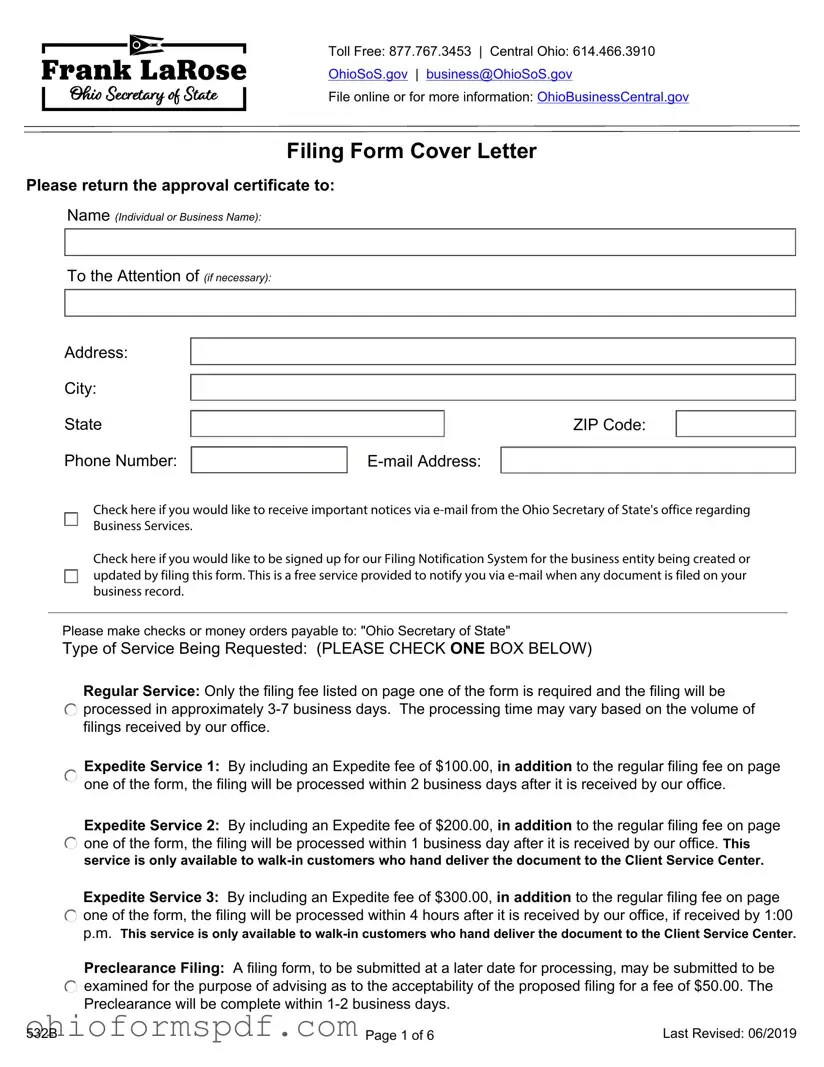

What are the service options available for filing the Ohio 532B form?

There are several service options: Regular Service, which requires only the filing fee and is processed in approximately 3-7 business days; Expedite Service 1 for a $100 fee with a 2 business days processing time; Expedite Service 2 for a $200 fee with a 1 business day processing time available only for walk-in customers; and Expedite Service 3 for a $300 fee, offering processing within 4 hours for walk-in customers if received by 1:00 p.m. Additionally, a Preclearance Filing option is available for $50 to examine the filing for acceptability.

What is the filing fee for the Ohio 532B form?

The filing fee for the Initial Articles of Incorporation (Nonprofit, Domestic Corporation) is $99. This fee is required when submitting the form. If expedited services are requested, additional fees as detailed in the form instructions are also required.

Can I appoint any entity as the Statutory Agent on the form?

A statutory agent must be one of the following: a natural person who is a resident of Ohio; or a business entity with a business address in Ohio that meets the requirements to transact business or exercise privileges in Ohio. The chosen statutory agent must sign the Acceptance of Appointment section of the form.

Is it possible to specify an effective date for the corporation’s existence?

Yes, an effective date can be specified on the form, but it is optional. The date cannot precede the filing date and must not be more than 90 days after the file date. If not specified, the effective date is the date the Ohio Secretary of State files the articles.

Where should I send the Ohio 532B form if I prefer regular filing?

For regular filing, send the completed form to P.O. Box 670, Columbus, OH 43216. This option does not require an additional fee beyond the standard filing fee.

What happens if I need to include additional provisions that do not fit on the Ohio 532B form?

If additional provisions are necessary, they can be included on a separate single-sided, 8 ½ x 11 sheet(s) of paper and attached to the form. This allows for flexibility in complying with specific legal or operational requirements for the nonprofit corporation.

Does filing the Ohio 532B form secure state or federal tax exemptions for the nonprofit corporation?

No, filing the Ohio 532B form with the Ohio Secretary of State does not grant tax exempt status. To secure state and federal tax exemptions, contact the Ohio Department of Taxation and the Internal Revenue Service (IRS). These agencies may require a purpose clause, which should be provided in the Articles of Incorporation.

processed in approximately

processed in approximately  one of the form, the filing will be processed within 1 business day after it is received by our office.

one of the form, the filing will be processed within 1 business day after it is received by our office.  one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00 examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The