What is a transient vendor's license and who needs one in Ohio?

In Ohio, a transient vendor's license is required for individuals or businesses that intend to make sales at temporary locations within the state but do not have a fixed place of business within a county where sales are conducted. This type of license allows vendors to sell goods or services across different locations in Ohio. It's essential for those who attend trade shows, festivals, or sell goods door-to-door, for example.

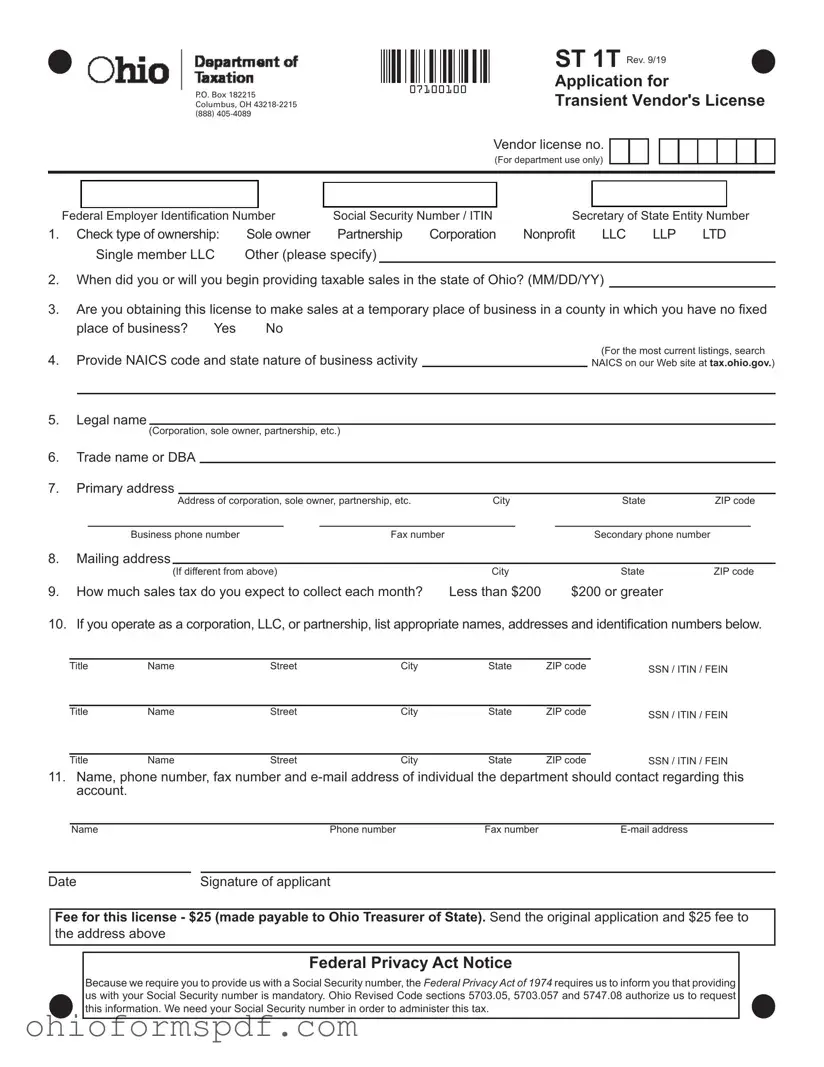

How can I apply for a transient vendor's license in Ohio?

To apply for a transient vendor's license in Ohio, you need to complete the ST 1T form, also known as the Application for Transient Vendor's License. This form requires information about your business, such as type of ownership, legal and trade names, primary and mailing addresses, the nature of business activity, and projected monthly sales tax collection. After filling out the form, submit it along with a $25 fee to the Ohio Department of Taxation at the address provided on the form.

What information do I need to provide on the Ohio Application For Vendors License form?

The form requires several pieces of information, including: your Federal Employer Identification Number (FEIN), Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and if applicable, your Secretary of State Entity Number. You'll also need to indicate your business ownership type, the start date of taxable sales in Ohio, whether the sales are at a temporary location, your NAICS code, primary and secondary business activities, contact information, and the names and ID numbers of any partners or corporate officers.

What is the fee for applying for a transient vendor's license in Ohio, and how can I pay it?

The application fee for a transient vendor's license in Ohio is $25. Payments should be made payable to the Ohio Treasurer of State. You can submit your payment together with your completed application form to the provided address. Ensure your payment method complies with state requirements for processing.

Is my Social Security Number required when applying for a transient vendor's license in Ohio?

Yes, providing your Social Security Number (SSN) is mandatory when applying for a transient vendor's license in Ohio. The requirement is in compliance with the Federal Privacy Act of 1974, which mandates the collection of your SSN to administer tax laws effectively as authorized under Ohio Revised Code sections 5703.05, 5703.057, and 5747.08.

How do I determine my business's NAICS code for the application?

To find your business's North American Industry Classification System (NAICS) code, you can search the most current listings on the Ohio Department of Taxation's website at tax.ohio.gov. The NAICS code is a federal classification system that categorizes your business based on its specific type of economic activity. This code helps in understanding the nature of your business operations for tax purposes.

What should I do if my business's mailing address is different from my primary address?

If your mailing address is different from your business’s primary location, make sure to provide both addresses on the ST 1T form. The primary address should reflect where your business operates, while the mailing address is where you receive correspondence. Accurately providing both addresses ensures that you receive all pertinent information regarding your transient vendor's license without delay.