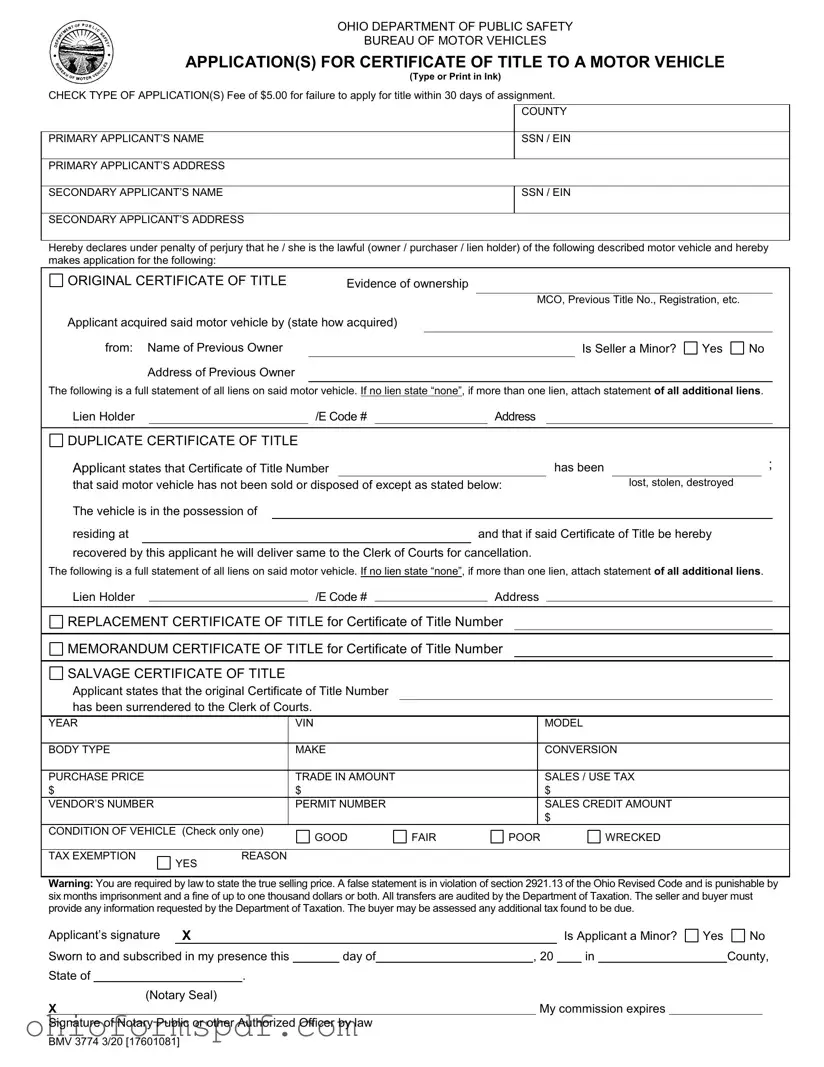

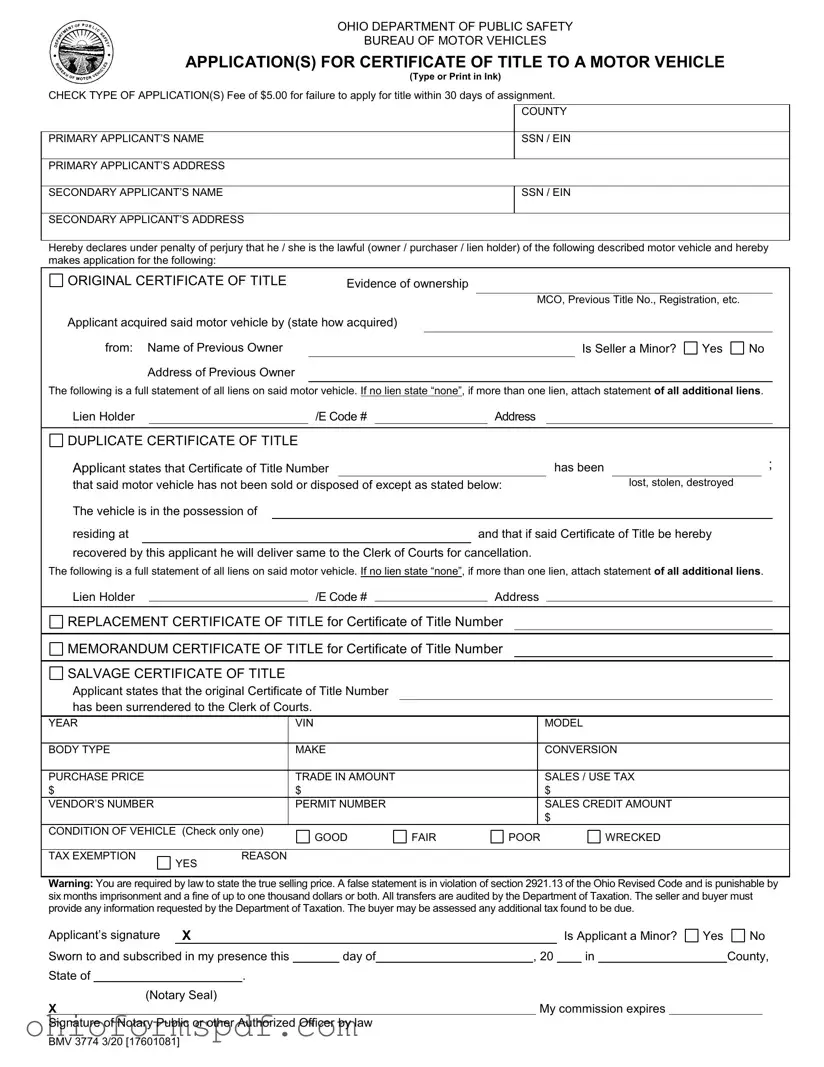

What is the purpose of the Ohio BMV Application for Certificate of Title?

This application is used to officially register the ownership of a motor vehicle with the Ohio Bureau of Motor Vehicles (BMV). It serves various purposes such as applying for an original certificate of title, a duplicate certificate of title in case the original is lost, stolen, or destroyed, a replacement certificate of title, a memorandum certificate of title, and a salvage certificate of title if the vehicle is deemed as salvage.

Who needs to fill out this form?

Any lawful owner, purchaser, or lienholder of a motor vehicle who wants to have the vehicle titled in Ohio needs to complete this form. This includes individuals who have just bought a vehicle, are current vehicle owners needing a new title due to loss or damage to the original title, or those who need to correct or update information on a current title.

Is there a deadline for applying for a certificate of title?

Yes, there is a requirement to apply for a certificate of title within 30 days of the vehicle's assignment. If the application is made after 30 days, there will be a fee of $5.00 for late application.

What documents are needed along with this application?

Evidence of ownership is required when submitting this application. This can include a Manufacturer's Certificate of Origin (MCO), the previous title, registration, etc. Additionally, all liens on the vehicle must be declared, and if there is more than one lien, a statement of all additional liens must be attached.

What happens if I am purchasing a vehicle from a seller who is a minor?

If the seller of the vehicle is a minor, this fact must be disclosed on the application. Legal transactions involving minors may have additional requirements or restrictions, so it’s important to note this information as part of the process.

How do I declare the purchase price and condition of the vehicle?

The application requires you to state the true selling price of the vehicle. You must also check the condition of the vehicle, choosing from options like good, fair, poor, or wrecked. It is important to provide accurate information, as the declared value and condition can affect taxes and the legality of the transfer. Bewarninged: providing false information can lead to penalties, including imprisonment and fines.

What are the consequences of not accurately disclosing the vehicle's selling price?

Failing to accurately disclose the vehicle's selling price is a violation of section 2921.13 of the Ohio Revised Code. It is punishable by up to six months in prison and a fine of up to one thousand dollars, or both. All transfers are audited by the Department of Taxation, and the seller and buyer must provide any requested information. If additional tax is found to be due, it may be assessed to the buyer.

Yes Address of Previous Owner

Yes Address of Previous Owner