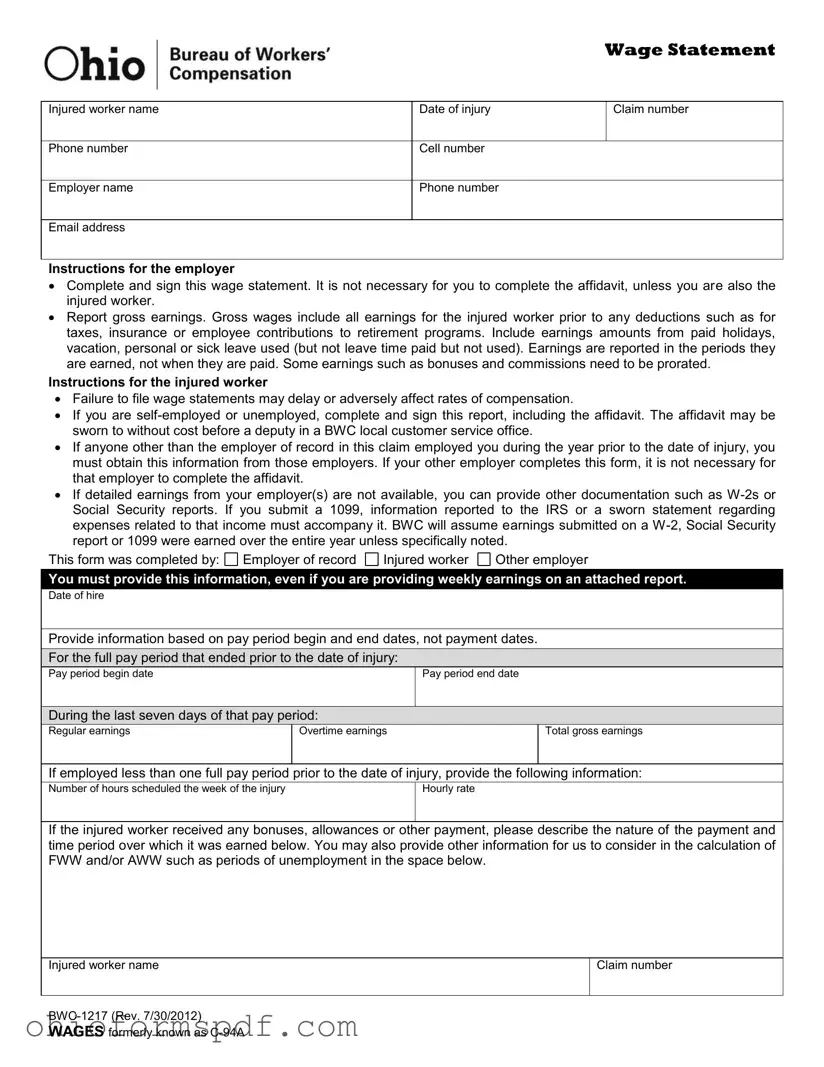

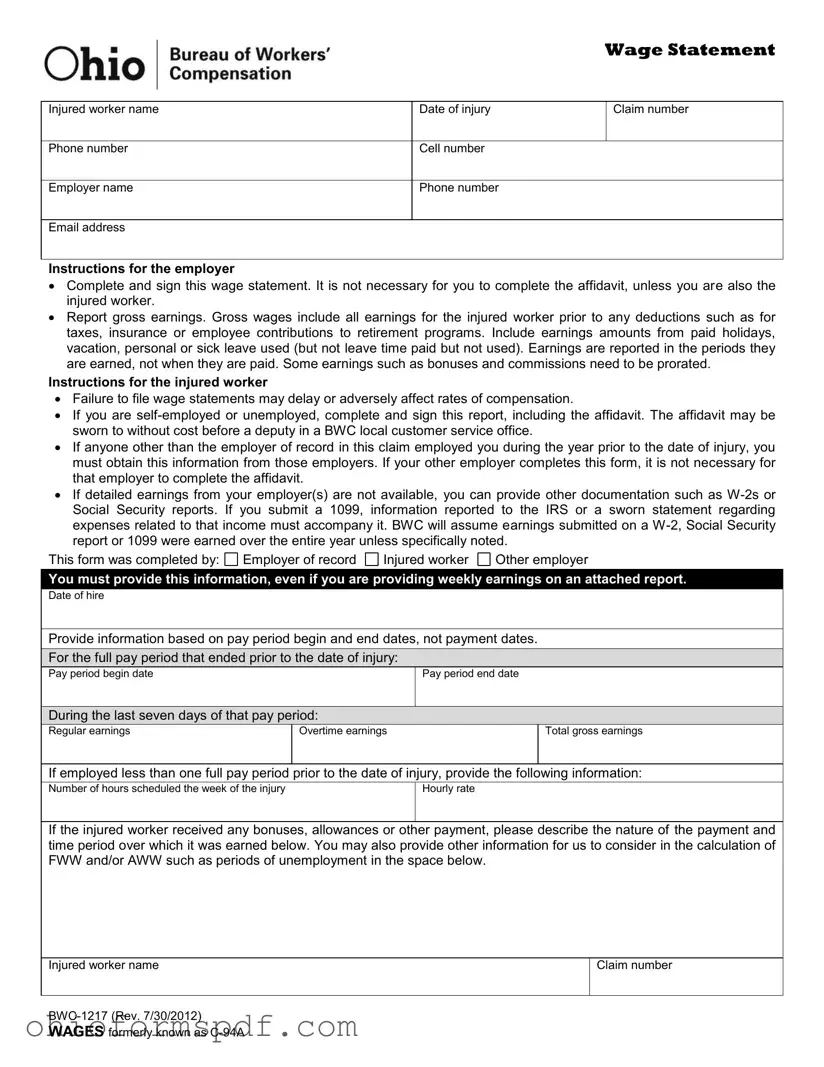

What is the Ohio BWC 1217 form used for?

The Ohio BWC 1217 form, also known as the Wage Statement, is used by employers, injured workers, or other relevant parties to report the gross earnings of an injured worker prior to their injury. This form plays a crucial role in determining the compensation rate for workers' compensation claims by detailing earnings, including regular pay, overtime, bonuses, and other types of payments for the period leading up to the injury.

Who needs to complete the Ohio BWC 1217 form?

This form must be completed by the employer of record when an employee has suffered a work-related injury. However, if the injured party is self-employed, unemployed, or was employed by someone other than the employer of record in the claim during the year prior to the injury, the injured worker themselves may need to complete and sign this form. Additionally, other employers may need to fill out the form if they employed the injured worker during the specified timeframe.

What information is required on the Ohio BWC 1217 form?

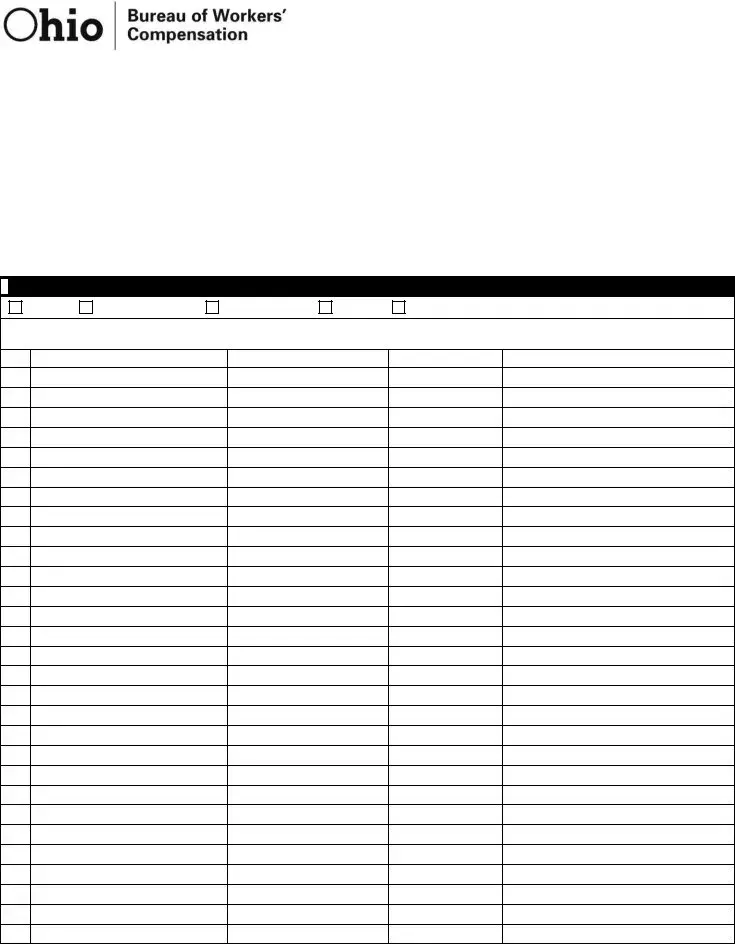

The form requires detailed information about the injured worker's earnings, including the dates of the pay periods, gross amounts earned, and a description of any bonuses, allowances, or other types of payments. It also requires personal information about the injured worker, details regarding the employment and injury, and a certification that the information provided is accurate.

How are earnings reported on the Ohio BWC 1217 form?

Earnings should be reported based on the period they were earned, not when they were paid. This includes all gross wages before deductions such as taxes or retirement contributions. Payments for holidays, vacation, personal, or sick leave used (but not unpaid leave) should be included. Bonuses and commissions need to be prorated over the time they were earned.

What happens if the Ohio BWC 1217 form is not filed?

Failure to file the Wage Statement in a timely and accurate manner may delay the processing of workers' compensation claims or adversely affect the determination of compensation rates. For injured workers, it is essential to submit this form along with any required documentation to ensure proper calculation of benefits.

Can I attach additional documentation to the Ohio BWC 1217 form?

Yes, additional documentation such as weekly earnings reports, W-2s, Social Security reports, or 1099 forms can be attached to the form. However, if a 1099 form is submitted, it must be accompanied by information reported to the IRS or a sworn statement regarding expenses related to that income. These documents help in accurately determining earnings and any periods of unemployment.

Is it necessary to complete an affidavit with the Ohio BWC 1217 form?

An affidavit is not required for the employer of record unless they are also the injured worker. Self-employed or unemployed individuals completing the form will need to complete and sign the affidavit section. The affidavit helps to verify the accuracy of the reported earnings and is a crucial part of the form that provides legal attestation to the information provided.

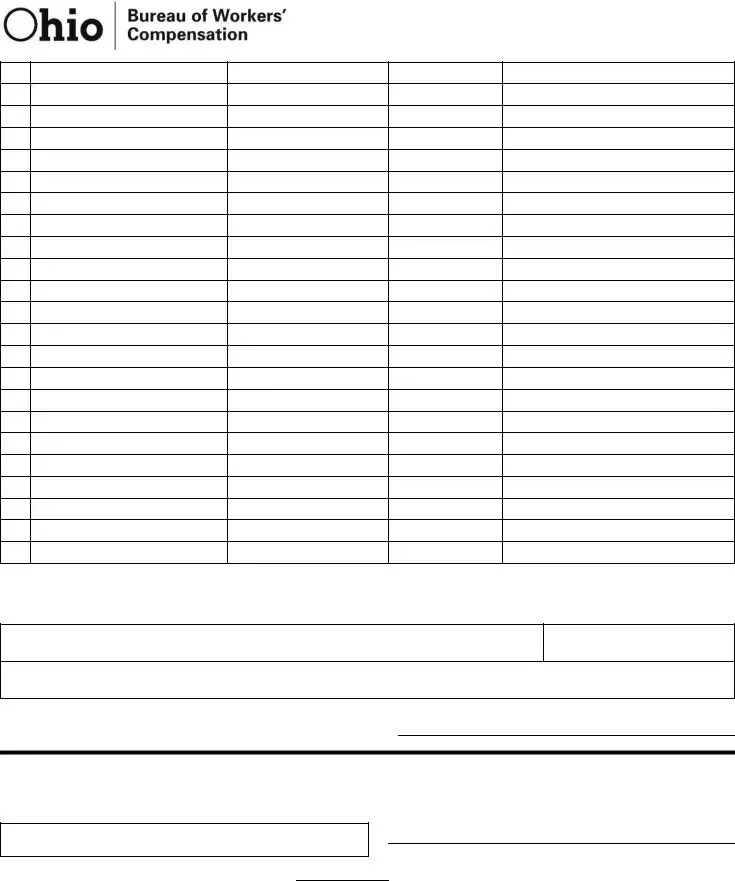

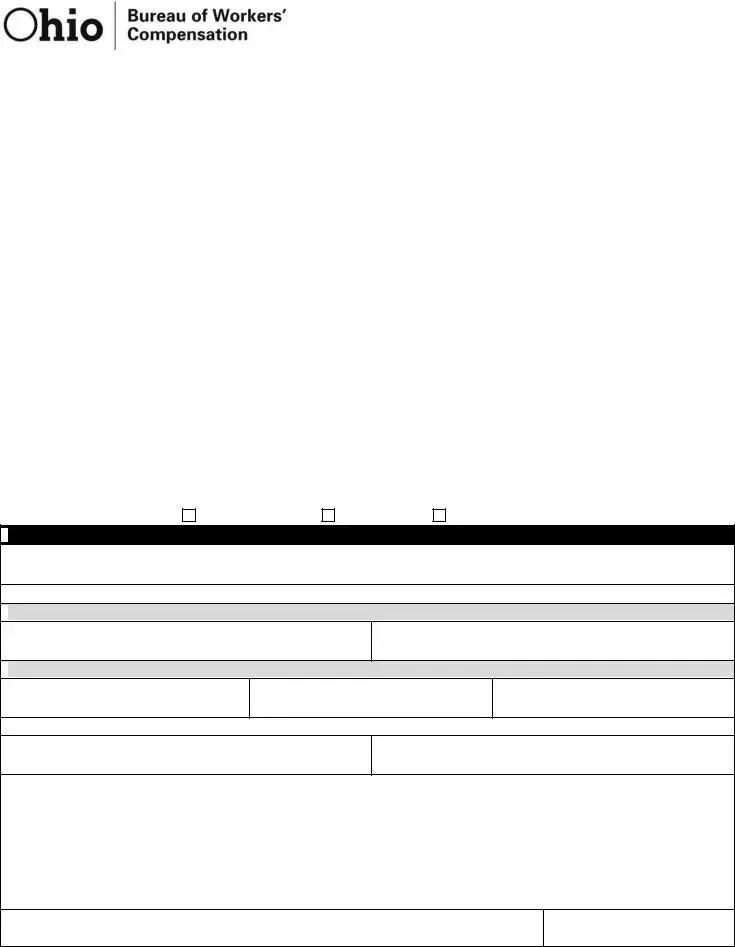

You must provide this information, even if you are providing weekly earnings on an attached report.

You must provide this information, even if you are providing weekly earnings on an attached report. For the full pay period that ended prior to the date of injury:

For the full pay period that ended prior to the date of injury: During the last seven days of that pay period:

During the last seven days of that pay period:

Payment is made (check one)

Payment is made (check one)