The Ohio C-240 form, known as the Settlement Agreement and Application for Approval of Settlement Agreement, is used primarily in the context of workers' compensation claims involving state-fund employers. A similar document in concept is the Settlement Agreement and Release form often utilized in personal injury claims. This type of agreement is designed to resolve a dispute between an injured party and an at-fault party (or their insurer) without further litigation. Both documents include provisions regarding the resolution of claims, detailing compensation, and possibly addressing future liabilities related to medical expenses, showing a likeness in structure and purpose.

Another document akin to the Ohio C-240 form is the General Release Agreement. Though General Release Agreements can apply to various scenarios beyond workers' compensation, such as property damage or contract disputes, they share the primary function of releasing one or more parties from certain claims or liabilities. Both documents necessitate the involved parties' agreement to forgo litigation and settle claims outside the court, emphasizing a mutual understanding and consent to the terms detailed within.

The Compromise Agreement, usually employed in employment law to resolve disputes between employers and employees, bears resemblance to the Ohio C-240 form. Both documents necessitate the inclusion of specific terms and conditions agreed upon by the parties, including compensation and the relinquishment of further claims related to the subject matter of the agreement. This process allows for a formal conclusion to disputes without engaging in lengthy or costly litigation.

The Severance Agreement often parallels the Ohio C-240 in its function related to employment matters. While the Severance Agreement is typically used when an employment relationship ends, providing for compensation and possibly continued benefits for the employee, it also includes clauses that waive future claims against the employer, similar to the claims resolution features in the Ohio C-240 form. This highlights the shared goal of preventing future disputes or claims.

Self-Insured Retention (SIR) Endorsements in liability insurance policies also share similarities with the C-240 form, especially when the employer is self-insured, as noted within specific provisions of the document. SIR Endorsements dictate the responsibilities of the insured in managing and funding defense and settlement costs up to a certain amount before insurance coverage responds. Both types of agreements involve the management of liabilities and settlements in a structured manner to reduce further liabilities.

The Medicare Set-Aside Arrangement (MSA) is notably akin to the Ohio C-240 form in regards to the special notice to Medicare beneficiaries outlined within the form. MSAs are used to earmark a portion of the settlement for future medical expenses that Medicare would otherwise cover, ensuring Medicare is not prematurely billed for injury-related care. Similar to the Ohio C-240, these arrangements require careful allocation of settlement funds to comply with legal requirements.

Debt Settlement Agreements offer another point of comparison. These agreements are negotiated between creditors and debtors to resolve outstanding debts under agreed-upon terms, similar to how the Ohio C-240 form facilitates the resolution of workers' compensation claims. Both documents encapsulate an agreed settlement to prevent further legal action or claims on the specific matters addressed.

The Property Damage Release form, used when settling claims related to property damage, overlaps with the Ohio C-240 form in its objective to finalize the settlement of claims and prevent future disputes. Whether addressing personal injury, workers' compensation, or property damage, these documents finalize agreements between parties to forego additional legal claims related to the settled matter.

Non-Disclosure Agreements (NDAs) are often included within or accompany settlement agreements like the Ohio C-240 form, especially when confidentiality about the settlement terms or the underlying facts is desired by one or both parties. While NDAs primarily focus on confidentiality and the non-disclosure of specific details, they are often part of broader settlement agreements to ensure certain terms, including settlements or resolutions, are not publicly disclosed.

The Mutual Release Agreement, akin to the Ohio C-240, is used when two parties agree to release each other from all types of claims, known or unknown, up to the date of the agreement. This type of agreement is broader than the Ohio C-240 form, which is specific to workers' compensation claims, but both serve to comprehensively resolve disputes and prevent future litigation on the matters addressed within the agreements.

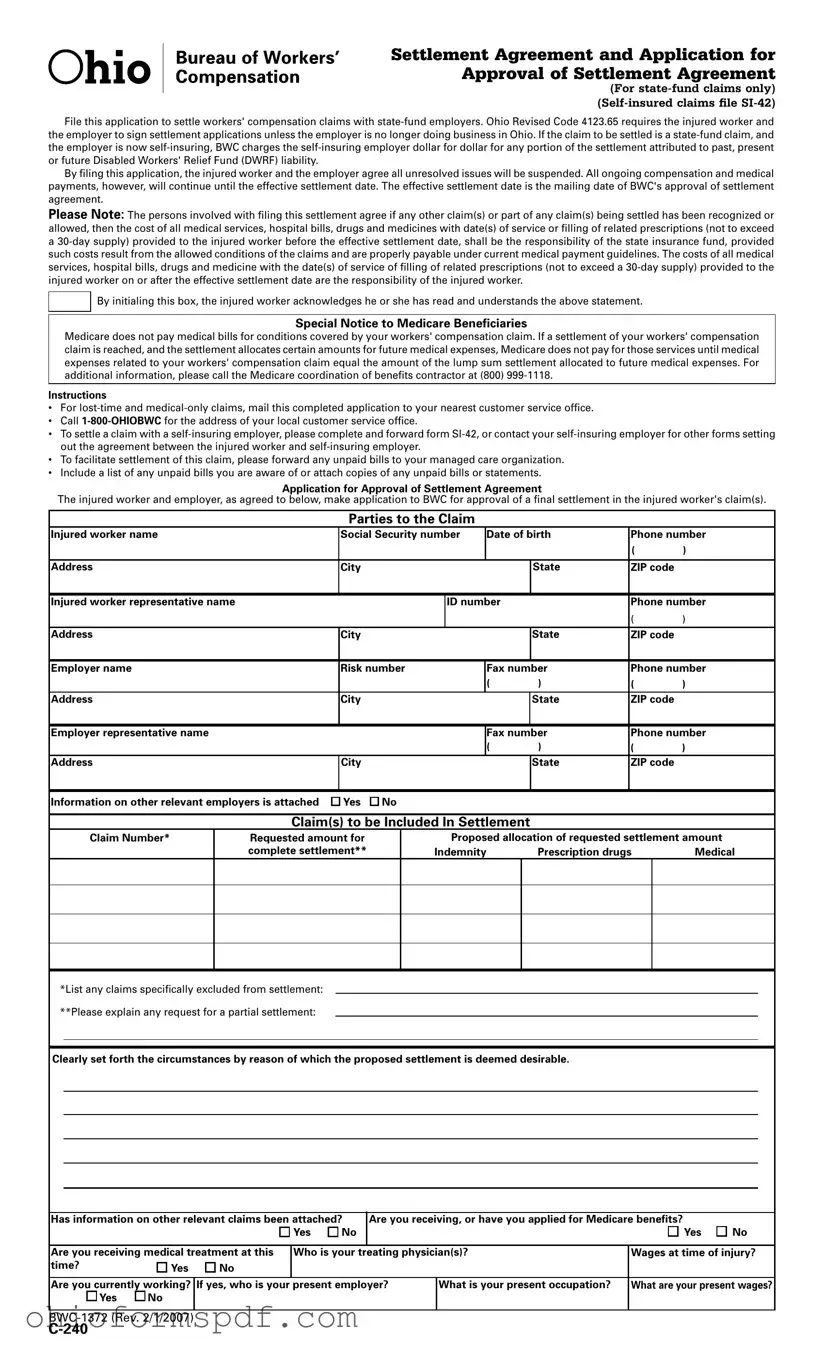

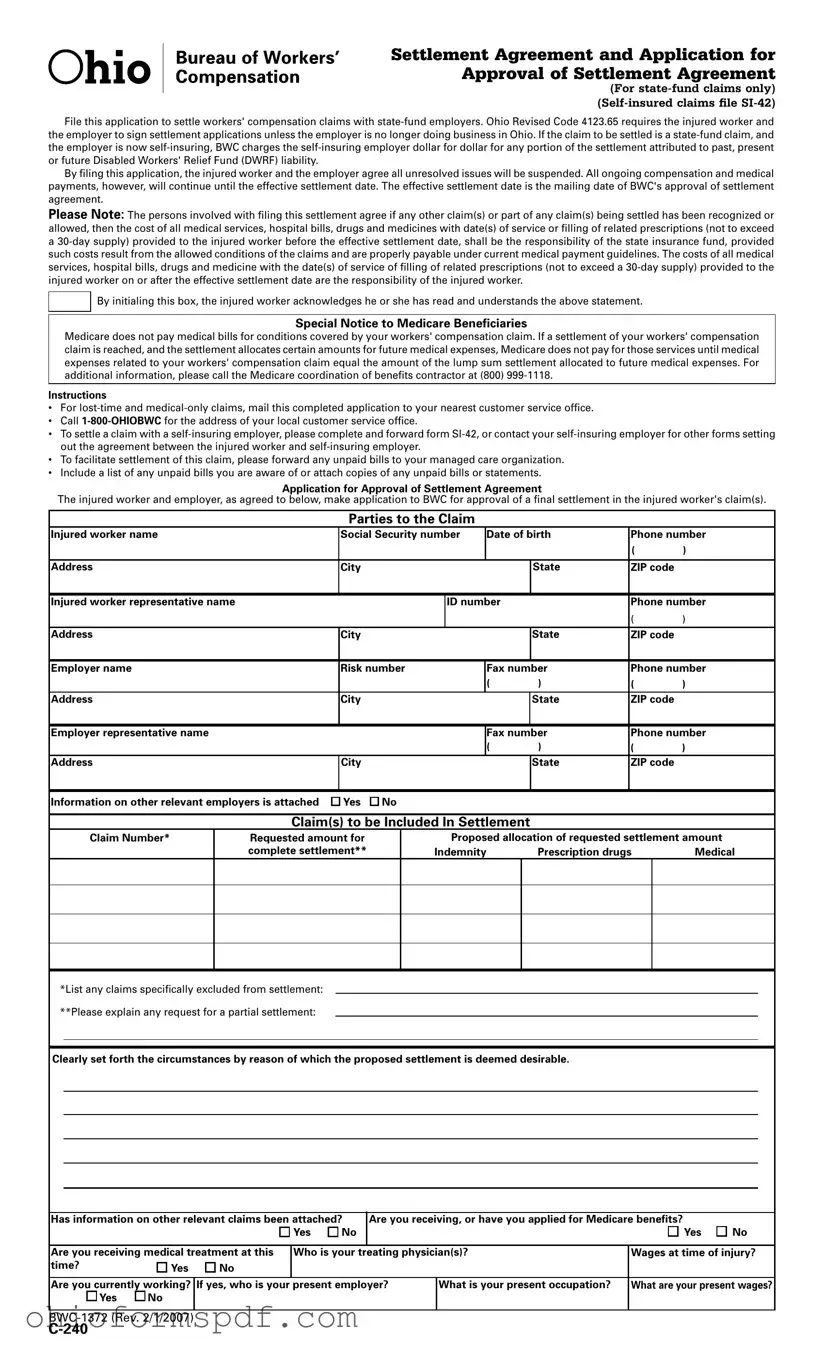

By initialing this box, the injured worker acknowledges he or she has read and understands the above statement.

By initialing this box, the injured worker acknowledges he or she has read and understands the above statement.