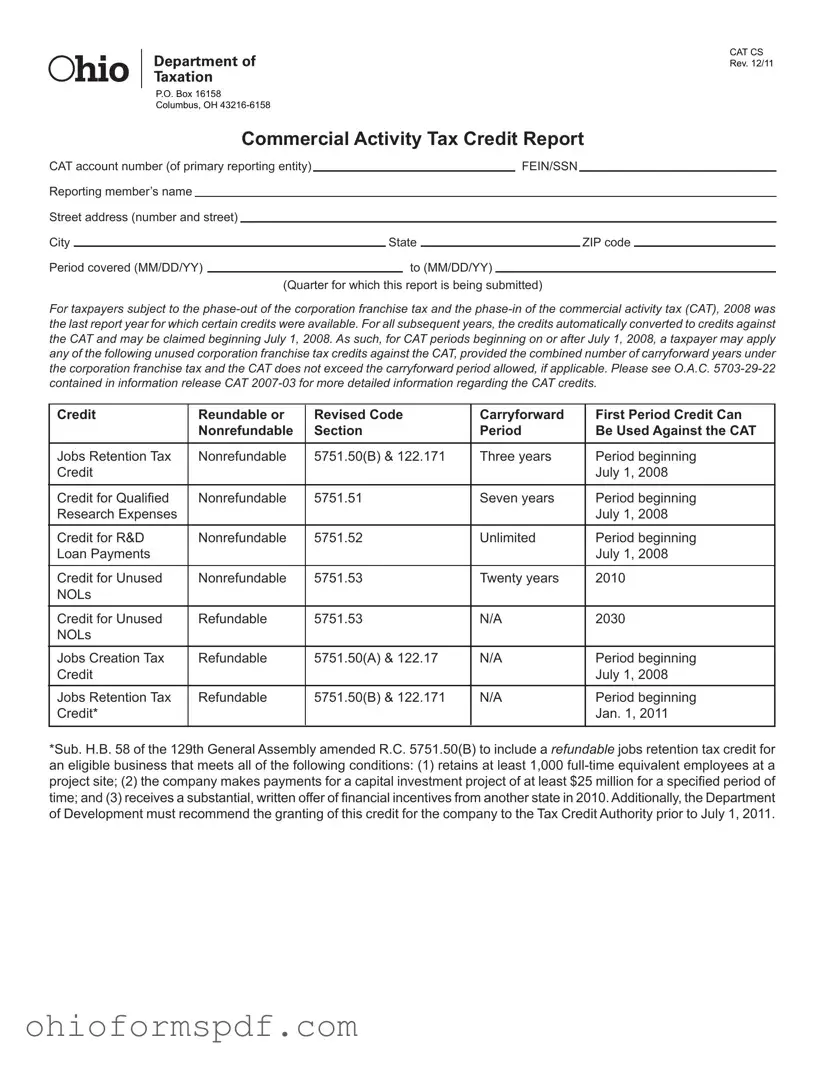

The Ohio Cat Cs form is closely related to the Federal Income Tax Credit form in terms of its structure and purpose. Both forms allow taxpayers, whether individuals or businesses, to report specific tax credits that can reduce their taxable income or tax liability. Just like the Ohio Cat Cs form enables businesses to claim credits for activities such as job retention and research expenses, the Federal Income Tax Credit form includes provisions for credits related to energy efficiency, education, and investment in low-income housing, among others. Each credit outlined is subject to specific qualifying criteria, carryforward periods, and rules about whether the credit is refundable or nonrefundable.

Another document resembling the Ohio Cat Cs form is the State Income Tax Return form found in states that impose an income tax. These state forms also include sections where taxpayers can report and claim various credits against their taxable income. Credits might relate to property taxes paid, education expenses, or investments in renewable energy. The structure of these forms requires detailed information about eligible credits, similar to how the Ohio Cat Cs form requires specific details about credits against the Commercial Activity Tax.

The General Business Credit (Form 3800) used in federal tax filings shares similarities with the Ohio Cat Cs form. It's designed for businesses to aggregate and claim various smaller credits into one larger credit against their income tax. This form encompasses a range of credits, including those for increasing research activities, which is also a feature of the Ohio Cat Cs form. Both forms act as aggregators for different credits and have the underlying aim of encouraging and rewarding certain business behaviors, such as innovation or retaining jobs.

The Research & Development Tax Credit forms, both at the federal and state levels, where applicable, bear resemblance to sections of the Ohio Cat Cs form that pertain to credits for qualified research expenses and R&D loan payments. These forms are dedicated to encouraging businesses to invest in research and development by offering a reduction in tax liability in return. They require detailed reporting of qualifying expenses, mirroring the Ohio form’s structure in the way credits are documented and claimed.

Similarly, the Job Creation Tax Credit forms found in various states are analogous to the Job Creation and Retention sections of the Ohio Cat Cs form. These documents are specifically designed to incentivize businesses to create new jobs or retain existing ones within a state. They outline the eligibility criteria, benefit periods, and sometimes the mechanism for claiming the credit, whether it is refundable or not, closely following the Ohio document's approach to fostering employment growth through tax incentives.

The New Markets Tax Credit (NMTC) application forms, catering to investments in economically disadvantaged areas, share a conceptual parallel with the Ohio Cat Cs form. While the NMTC primarily focuses on encouraging investments that spur economic growth and job creation in low-income communities, it's akin to the Ohio form in its goal of using tax credits as an economic development tool. Applicants must provide detailed information about their investments, similar to how businesses report their qualifying activities for credits on the Ohio form.

The Energy Investment Tax Credit (ITC) forms, which provide credits for investments in energy property, also share similarities with the Ohio Cat Cs form. These forms cater to businesses investing in renewable energy sources, offering them a way to reduce their tax burden in recognition of their contributions to environmental sustainability. The detailed eligibility requirements, claim process, and the distinction between refundable and nonrefundable credits reflect the structure seen in the Ohio Cat Cs form.

Last, the Foreign Tax Credit forms, used by businesses and individuals who have paid or accrued tax to a foreign government, and wish to avoid double taxation, resemble the Ohio Cat Cs form in their purpose to ensure taxpayers are not penalized for operating across borders. Both sets of documents serve to alleviate the tax burden, though in different contexts, by providing a mechanism to claim credits for taxes already paid elsewhere, ensuring that businesses can operate more freely without the hindrance of excessive taxation.