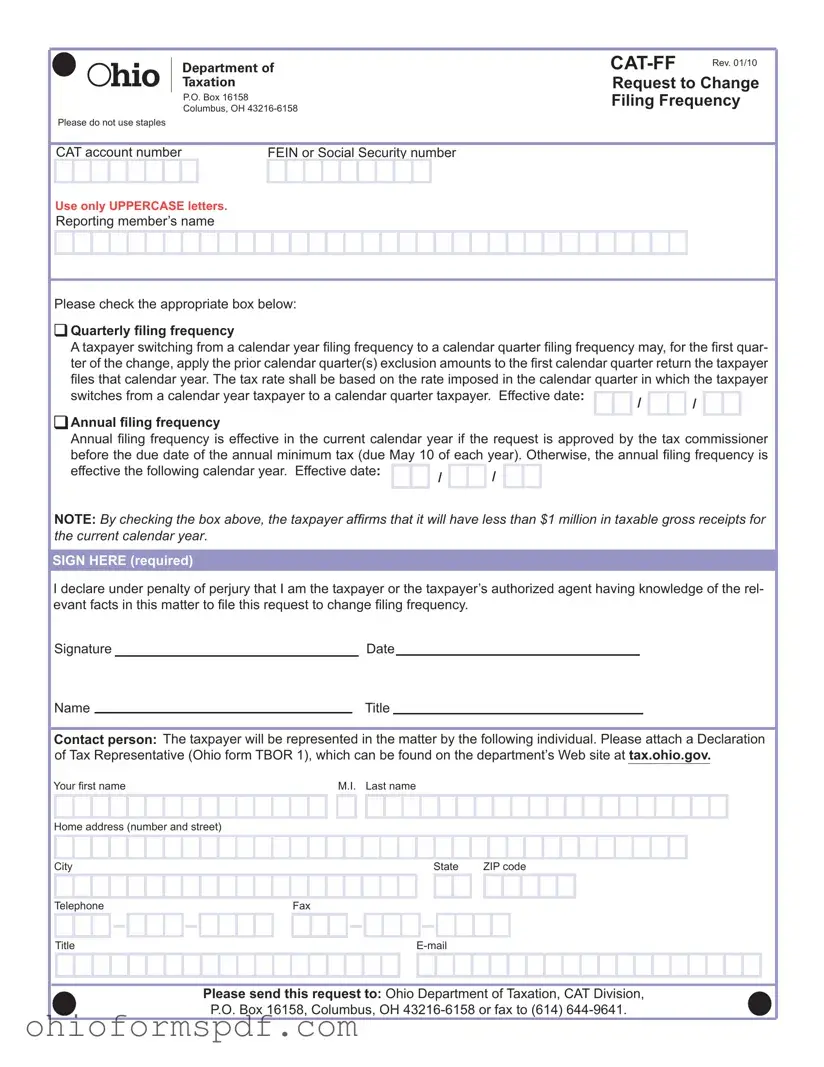

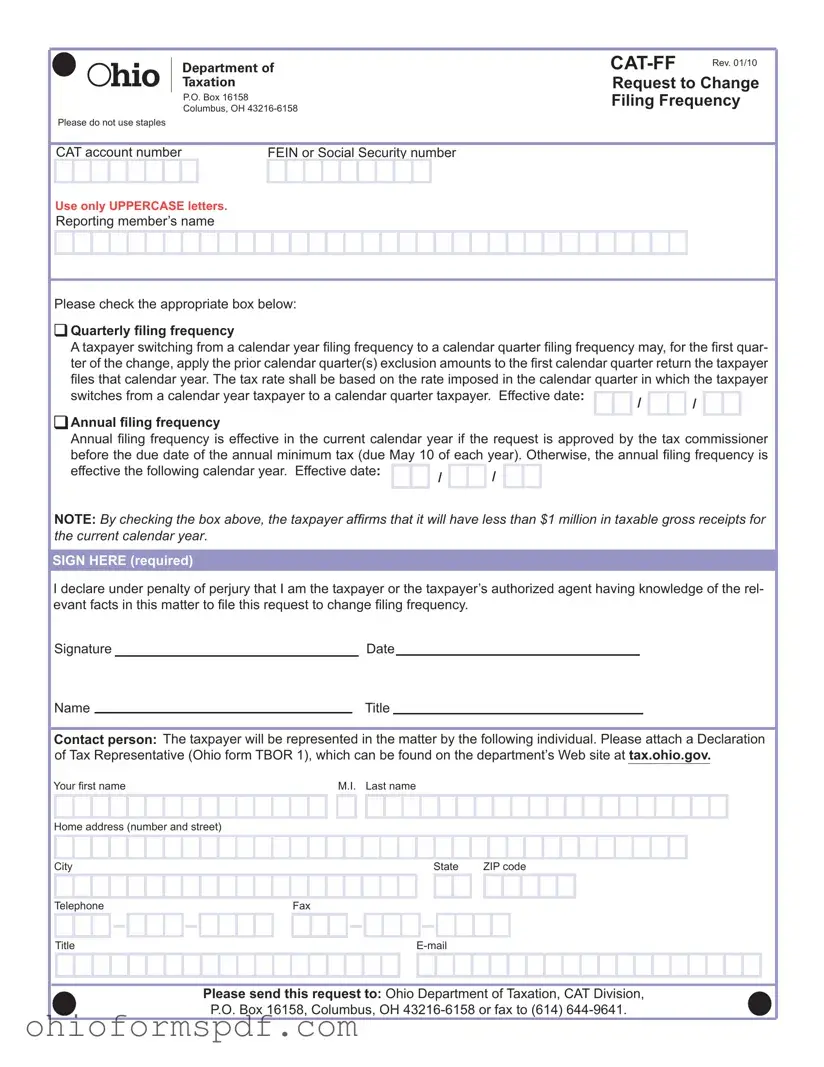

What is the Ohio CAT-FF form?

The Ohio CAT-FF form is an official document used by the Ohio Department of Taxation. It allows taxpayers to request a change in their filing frequency for the Commercial Activity Tax (CAT). Taxpayers can choose between quarterly and annual filing frequencies depending on their taxable gross receipts.

Who can file an Ohio CAT-FF form?

Any taxpayer subject to the Commercial Activity Tax in Ohio may file a CAT-FF form. This includes businesses and individuals with taxable gross receipts, wishing to change their filing frequency.

When should the Ohio CAT-FF form be submitted?

The form should be submitted when a taxpayer decides to change their filing frequency from annual to quarterly, or vice versa. For annual filing frequency, it must be submitted and approved by the tax commissioner before the annual minimum tax due date, which is May 10th each year. If this deadline is missed, the change will take effect in the following calendar year.

What information is required to complete the CAT-FF form?

To complete the CAT-FF form, taxpayers need to provide their CAT account number, Federal Employer Identification Number (FEIN) or Social Security number, reporting member's name, and choose their desired filing frequency. Additionally, information about the taxpayer or authorized agent, including a signature, the date of signature, contact details, and title, are necessary.

Can a taxpayer revert to their previous filing frequency after submitting the form?

While the form allows taxpayers to change their filing frequency, it does not specify the process for reverting back. Taxpayers wishing to revert to a previous filing frequency should contact the Ohio Department of Taxation directly to inquire about the procedure and possible implications.

Where should the Ohio CAT-FF form be sent?

The completed CAT-FF form should be sent to the Ohio Department of Taxation, CAT Division, at P.O. Box 16158, Columbus, OH 43216-6158. Alternatively, it can be faxed to (614) 644-9641.

What does checking the box for quarterly or annual filing frequency entail?

Checking the box for quarterly filing frequency indicates that the taxpayer wishes to file CAT returns on a quarterly basis, applying previous calendar quarter exclusion amounts for the first calendar quarter of change. Opting for annual filing frequency affirms that the taxpayer expects to have less than $1 million in taxable gross receipts for the current calendar year and that the change will be effective as outlined by the form's terms.

How do I know if my request to change filing frequency has been approved?

Approval of a request to change filing frequency is communicated by the Ohio Department of Taxation directly to the taxpayer. It is important to ensure that all contact information provided on the form is accurate to receive timely notification of the approval or if further information is required.

Is there a deadline for filing the CAT-FF form for annual filing frequency?

Yes, for the request to change to an annual filing frequency to be effective in the current calendar year, the form must be approved by the tax commissioner before the due date of the annual minimum tax, which is May 10. If the request is submitted and approved after this date, the change will be effective in the following calendar year.

Who can sign the Ohio CAT-FF form?

The form must be signed by the taxpayer or the taxpayer's authorized agent who has knowledge of the facts regarding the filing frequency change. If an agent is signing on behalf of the taxpayer, a Declaration of Tax Representative (Ohio form TBOR 1) must also be attached.

HIO

HIO