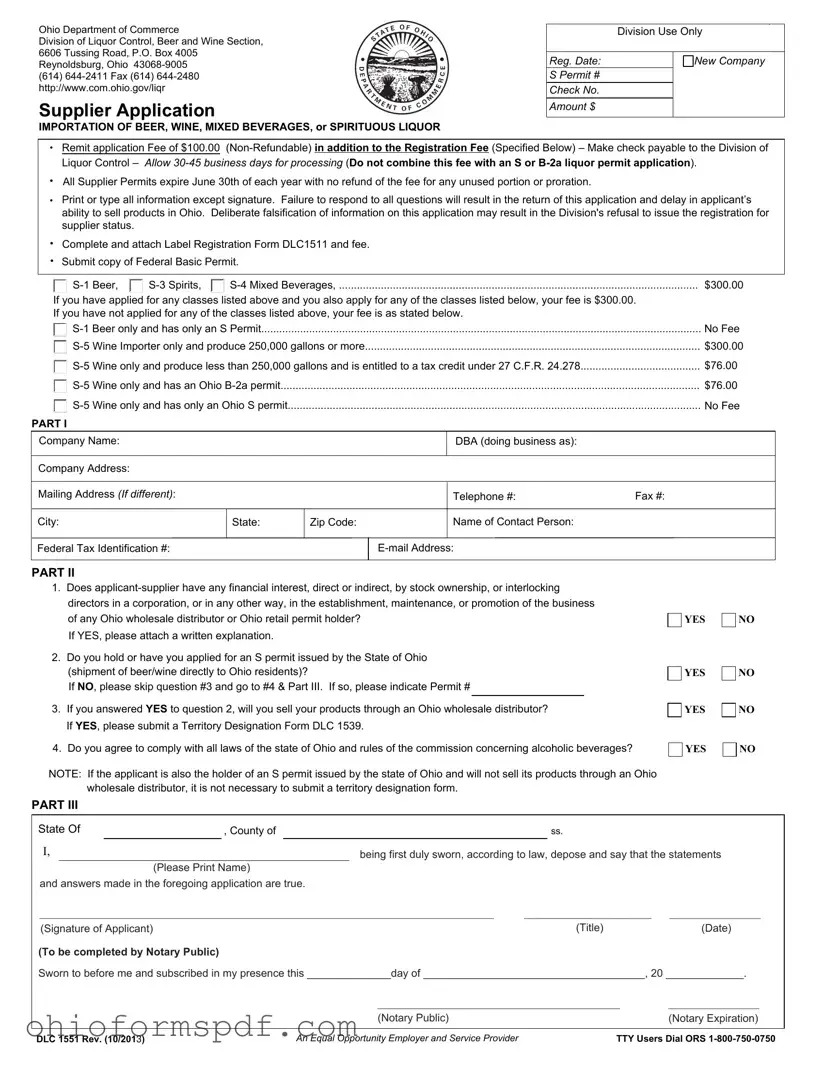

What is the Ohio DLC 1551 form used for?

The Ohio DLC 1551 form is an application for companies looking to import beer, wine, mixed beverages, or spirituous liquor into the state of Ohio. It's intended for use by suppliers to register with the Ohio Department of Commerce Division of Liquor Control. This process is crucial for ensuring that all alcoholic beverages entering Ohio comply with state regulations and laws.

How much does it cost to submit the Ohio DLC 1551 form?

The application fee for submitting the Ohio DLC 1551 form is $100.00, which is non-refundable. Additionally, depending on the type of permit you're applying for (S-1 Beer, S-3 Spirits, S-4 Mixed Beverages, etc.), there may be an additional registration fee. For example, registration fees range from no fee for certain S permit holders to $300.00 for others, with variations based on production size for wine importers.

Is the application fee refundable if my application is not approved?

No, the $100.00 application fee required when submitting the Ohio DLC 1551 form is non-refundable. This means that regardless of whether your application is approved or not, the fee will not be returned.

How long does it take to process the Ohio DLC 1551 form?

It typically takes 30-45 business days to process the Ohio DLC 1551 form once it has been received by the Division of Liquor Control. It’s essential to provide all the required information accurately to avoid delays in processing your application.

Do all supplier permits expire at the same time?

Yes, all supplier permits obtained through the Ohio DLC 1551 form expire on June 30th of each year. It's important to note that there is no refund available for any unused portion of the permit, and there is no proration of the fee.

What happens if I provide false information on the Ohio DLC 1551 form?

Deliberate falsification of information on the Ohio DLC 1551 form may result in the Division of Liquor Control refusing to issue the registration for supplier status. Honesty and accuracy in all responses are critical when completing the form.

Do I need to submit any additional forms with my Ohio DLC 1551 application?

Yes, in addition to the Ohio DLC 1551 form, you are required to complete and attach a Label Registration Form (DLC1511) and include the associated fee. Also, a copy of your Federal Basic Permit must be submitted with your application.

What if I already have an S permit issued by the State of Ohio?

If you already hold an S permit issued by the State of Ohio for the shipment of beer/wine directly to Ohio residents, this should be indicated when filling out the DLC 1551 form. An S permit may affect the fee structure and may eliminate the need for a territory designation form if you won't sell your products through an Ohio wholesale distributor.

How can I ensure my application is processed smoothly?

To ensure a smooth application process for the Ohio DLC 1551 form, make sure to read all instructions carefully, fill out all sections accurately, attach all required documents including the Label Registration Form and Federal Basic Permit, and submit the appropriate fees. Responding promptly to any inquiries from the Division of Liquor Control can also help avoid delays.