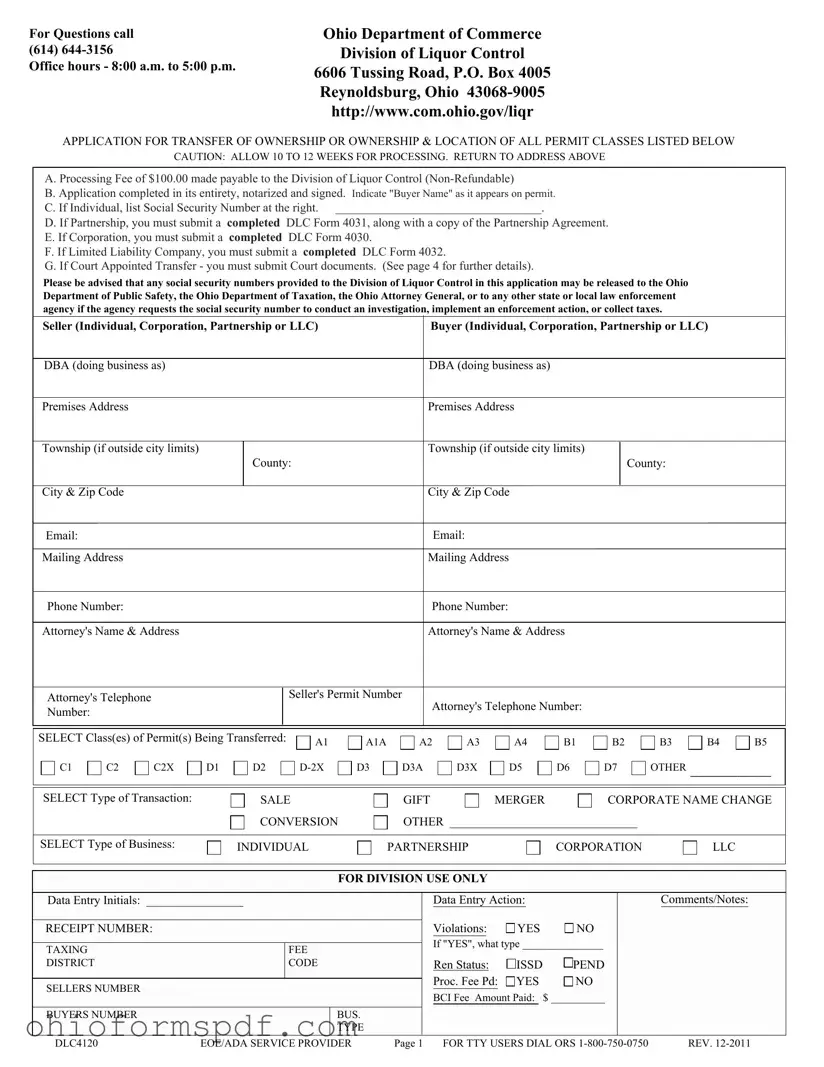

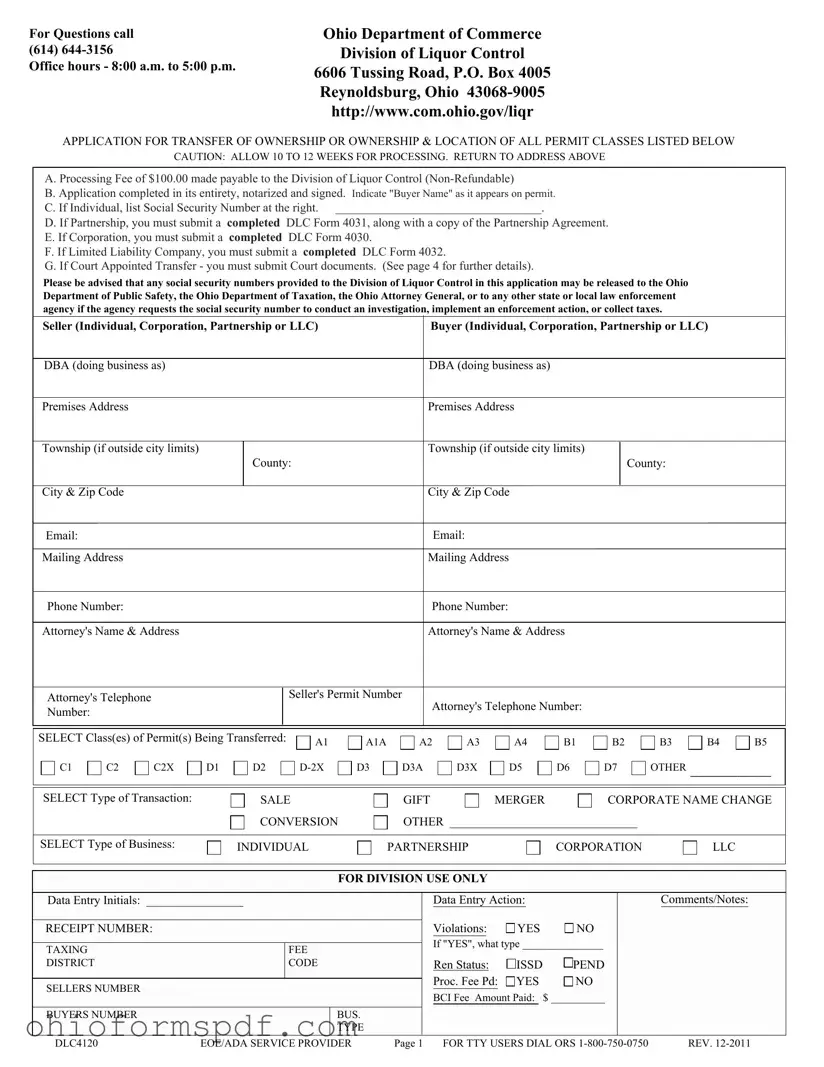

What is the Ohio DLC4120 form?

The Ohio DLC4120 form is an application required for the transfer of ownership or ownership & location of all listed permit classes in the state of Ohio. This form must be filled out by anyone seeking to transfer a liquor permit, whether through sale, gift, merger, or other means. The Ohio Department of Commerce Division of Liquor Control processes these forms.

How long does it take to process the DLC4120 form?

Applicants should allow 10 to 12 weeks for the processing of the Ohio DLC4120 form. This time frame is necessary for the Division of Liquor Control to review the application, perform necessary background checks, and complete other procedural requirements.

What is the processing fee for the DLC4120 form?

A non-refundable processing fee of $100.00, made payable to the Division of Liquor Control, is required when submitting the DLC4120 form.

Who needs to complete the DLC4120 form?

The DLC4120 form must be completed by the prospective buyer in its entirety. It requires detailed information about the buyer and the seller, the type of business, and the specific permits being transferred. Notarization of the form is also required.

Are there different requirements for different types of business entities?

Yes, depending on the type of business entity, additional documentation is required:

- Individuals: Social Security Number listed on the form.

- Partnerships: A completed DLC Form 4031 and a copy of the Partnership Agreement.

- Corporations: A completed DLC Form 4030.

- Limited Liability Companies: A completed DLC Form 4032.

- Court Appointed Transfers: Relevant court documents.

What happens if there are violations or outstanding taxes?

If there are any violations or if the seller has outstanding taxes, the Division of Liquor Control will be unable to transfer the permit until these issues are resolved. Buyers are encouraged to request a sales tax release certificate from the seller to avoid assuming any liability for unpaid taxes.

How can I check the status of my application?

To minimize inquiries regarding the status of an application, the Division of Liquor Control outlines the processing steps in the DLC4120 form instructions. However, applicants can call the Division at (614) 644-3156 during office hours for updates.

What other documents may be required with my DLC4120 form?

Depending on the specifics of the transfer, additional documents such as a lease or tenancy agreement, financial verification of the transaction, or certified copies of court appointments for court-appointed transfers may be required. A detailed checklist is provided with the form instructions.

Can I submit the DLC4120 form online?

The current instructions do not specify an online submission process for the DLC4120 form. Applicants are advised to return the completed, notarized form along with all required documentation and the processing fee to the specified mailing address of the Ohio Department of Commerce Division of Liquor Control.

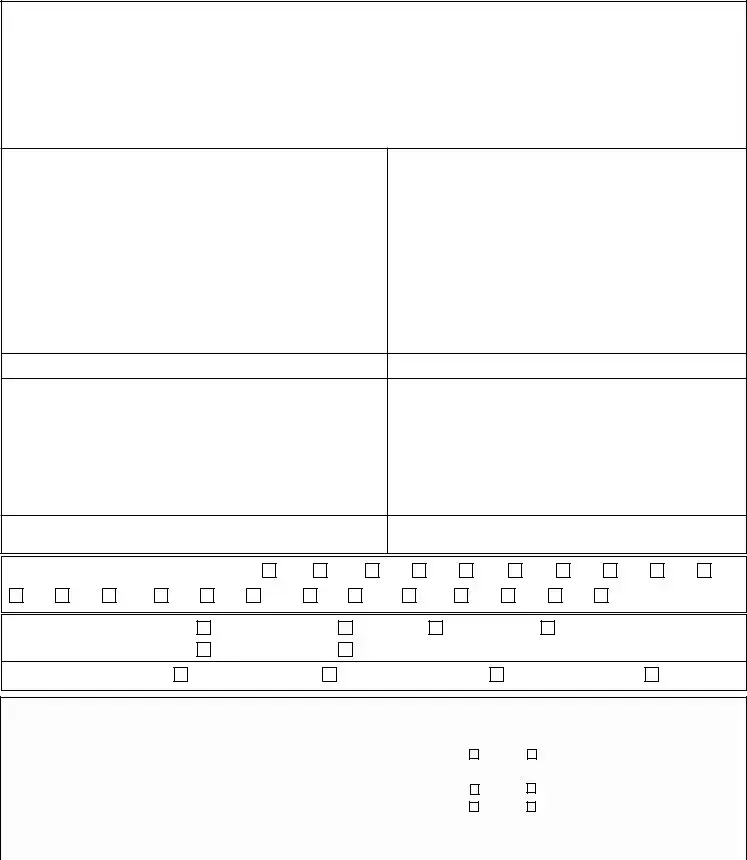

all items as you complete them, to submit with the application packet

all items as you complete them, to submit with the application packet