What is the Ohio ET 2 form used for?

The Ohio ET 2 form is an estate tax return required for estates of decedents with dates of death on or after January 1, 2002, whose gross value exceeds $338,333. It's designed to calculate the estate tax owed to the state of Ohio, by considering the total gross estate and allowable deductions, to determine the net taxable estate and the ensuing tax liability.

Who needs to file the Ohio ET 2 form?

Estate executors or administrators managing estates with the decedent’s date of death on or after January 1, 2002, and whose gross estate value is more than $338,333 are required to file the Ohio ET 2 form. In cases where the estate's value is less than the specified amount, filing this form is not necessary.

Where can one obtain the Ohio ET 2 form and its instructions?

The Ohio ET 2 form along with detailed instructions can be obtained from the Ohio Department of Taxation's official website at tax.ohio.gov. Additionally, these documents can be requested by contacting the Ohio Department of Taxation directly to ensure you have the most updated forms and information.

What information is required when completing the Ohio ET 2 form?

To complete the Ohio ET 2 form, you will need comprehensive information regarding the decedent's estate. This includes the total gross estate value, deductions (like debts and administrative expenses, charitable bequests, and marital deduction), tax computation, and personal information about the decedent such as their social security number and date of death. Additionally, details about the executor or administrator, as well as the attorney representing the estate if applicable, are required.

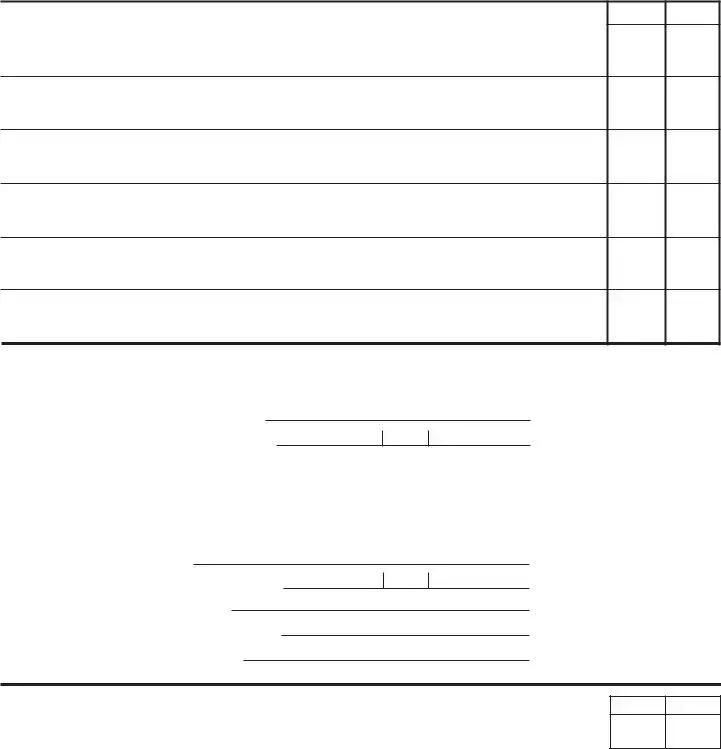

Are there any specific elections that need to be made on the Ohio ET 2 form?

Yes, the Ohio ET 2 form requires executors to make specific elections regarding the valuation of the estate. These include decisions on alternate valuation, qualified farm property valuation, claiming a marital deduction for qualified terminable interest property (QTIP), and electing to claim a deduction for a qualified family-owned business interest. Each election must be made carefully, as they can significantly impact the estate's tax liability.

Where and how is the completed Ohio ET 2 form filed?

The completed Ohio ET 2 form must be filed in duplicate with the probate court located in the county where the estate is being administered. It is critical to check local probate court requirements, as additional documentation may be necessary. The form and any accompanying payments also need to be processed in accordance with the Ohio Department of Taxation's guidelines, which can be found in the General Information section of the form's instructions.