Ohio Historical Society |

Page ____ of ____ |

|

State Archives of Ohio

Local Government Records Program

800E. 17th Avenue Columbus, Ohio 43211-2497

Section A: Local Government Unit

Include the name of the municipality, county, township, school, library, or special taxing district (local government entity) for which the form is being submitted.

Include the unit (department, agency, office), if applicable.

The departmental official directly responsible for the records must sign and date the form.

Section B: Records Commission

Complete the phone number and mailing address for the Records Commission, including the county.

To have this form returned to the Records Commission electronically, include an email address. It is the responsibility of the Records Commission to forward an electronic or paper copy of the approved form to the appropriate department.

The Records Commission Chairperson must sign the certification statement before it can be reviewed and signed at the Ohio Historical Society by the Local Government Records representative, and approved by the Auditor of State’s Office.

Section C: Ohio Historical Society – State Archives

The reviewing agent from Ohio Historical Society Local Government Records Program (OHS-LGRP) will indicate on your RC-2 which records series will require a Certificate of Records Disposal (RC-3) prior to disposal.

They will sign the form and forward it to the Auditor of State’s Office.

Section D: Auditor of State

The approving agent at the Auditor of State’s office will sign the form and return it to the OHS-LGRP.

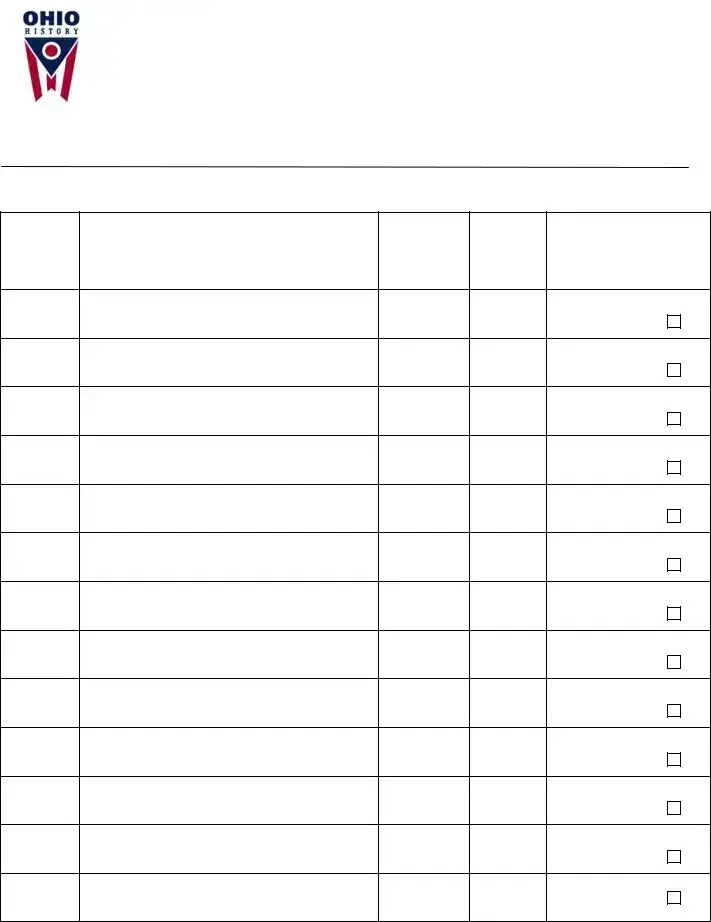

Section E: Records Retention Schedule

1)Schedule numbers can be expressed by a year and item numbering scheme for each records series being scheduled, for example, 09-1 and 09-2. Another option is to include a unique abbreviated identifier for each office, for example, Eng. [Engineer] 1, Eng. 2, etc. The numbering schema is your choice, and it will be used later on your Certificate of Records Disposal (RC-3).

2)Include the title of the records series and a brief description of each series. Please provide information about the content and use of the records series.

3)Articulate a retention period for the record in terms of time (exp. six years), an action (exp. until audited), or both (six years after audit).

4)Include the formats of the record (paper, electronic, microfilm, etc.)

5)For use by the Auditor of State or the OHS-LGRP. OHS-LGRP will mark the records series that will need an RC-3 prior to disposal.

GENERAL INSTRUCTIONS:

---For questions related to records scheduling and disposition, OHS-LGRP: (614) 297-2553 or at localrecs@ohiohistory.org

---After completing sections A and E, submit the form to your records commission so it can be approved in an open meeting pursuant to Section 121.22 ORC. See Ohio Revised Code Section 149.38 (counties), 149.39 (municipalities), 149.41 (school districts), 149.411 (libraries), 149.412 (special taxing districts) and 149.42 (townships) for the composition of your records commission. Your records commission completes section B and sends the form to OHS-LGRP at:

localrecs@ohiohistory.org OR |

The Ohio Historical Society |

|

State Archives of Ohio |

|

Local Government Records Archivist |

|

800 E. 17th Avenue |

|

Columbus, OH 43211-2497 |

---The OHS-LGRP will review this RC-2 and forward it to the Auditor of State’s Records Officer, Columbus.

---This RC-2 is in effect when all signatures have been affixed to it. OHS-LGRP will return a copy of the approved form to the Records Commission. The local records commission and the originating office should retain permanent copies of the form to document legal disposal of public records.

---Remember, at least 15 Business days before you intend to dispose of records, submit a Certificate of Records Disposal (RC-3) to the OHS-LGRP. Copies of RC-3s will not be returned.