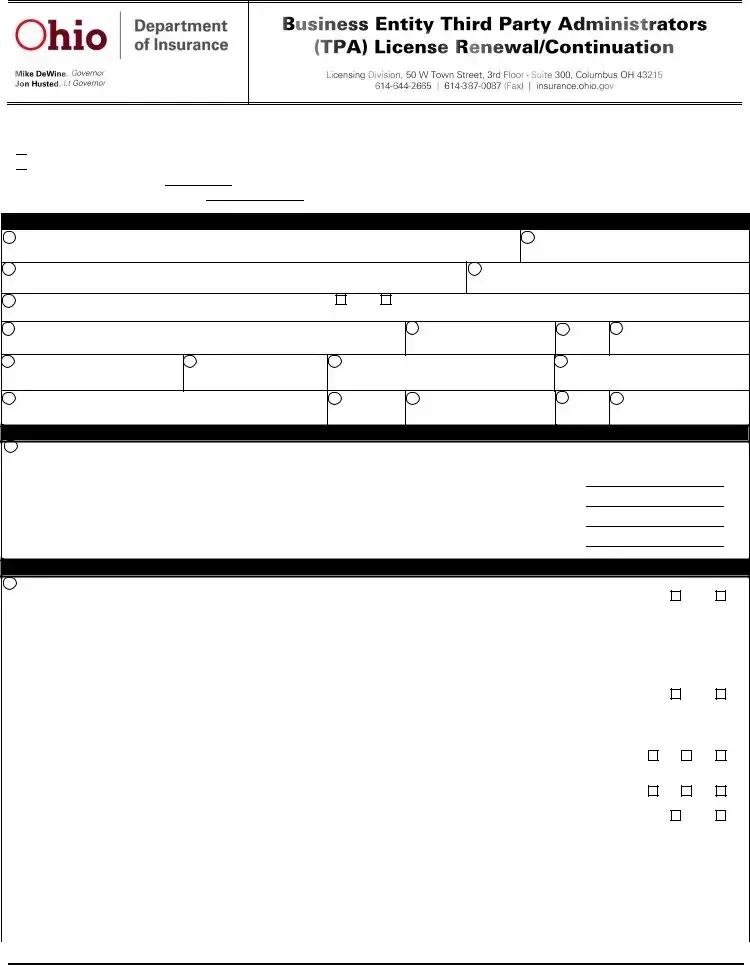

Ohio Department of InsuranceBUSINESS ENTITY TPA LICENSE RENEWAL/CONTINUATION

Background Questions (continued)

|

12. |

Does the applicant understand that the TPA may not commingle among its personal assets, or draw against for its own purposes, any |

Yes |

No |

|

|

monies or contributions of a plan sponsor or plan participant according to OAC 3901-8-05 (H)(1)? |

|

|

|

13. |

Have there been any changes of officers, directors, partners, members or trustees, or any change of shareholders or other owners or |

Yes |

No |

|

|

members holding 5% or more ownership in the TPA or change of business address that has not been previously reported to the Department |

|

|

|

|

as required by OAC 3901-8-05(D)(5)? |

|

|

|

|

If “Yes”, include the Department’s document for business entity changes. |

|

|

|

14. |

Is the TPA operating as a Pharmacy Benefit Manager (PBM)? |

Yes |

No |

|

|

|

|

|

|

|

|

Applicant’s Certification and Attestation

21

On behalf of the business entity or limited liability company, the undersigned owner, partner, officer or director of the business entity, or member or manager of a limited liability company, hereby certifies, under penalty of perjury, that:

1.All of the information submitted in this application and attachments is true and complete and I am aware that submitting false information or omitting pertinent or material information in connection with this application is grounds for license or registration revocation and may subject me and the business entity or limited liability company to civil or criminal penalties.

2.Unless provided otherwise by law or regulation of the jurisdiction, the business entity or limited liability company hereby designate the Commissioner, Director or Superintendent of Insurance, or other appropriate party in each jurisdiction for which this application is made to be its agent for service of process regarding all insurance matters in the respective jurisdiction and agree that service upon the Commissioner, Director or Superintendent of Insurance, or other appropriate party of that jurisdiction is of the same legal force and validity as personal service upon the business entity.

3.The business entity or limited liability company grants permission to the Commissioner, Director or Superintendent of Insurance, or other appropriate party in each jurisdiction for which this application is made to verify information with any federal, state or local government agency, current or former employer, or insurance company.

4.Every owner, partner, officer or director of the business entity, or member or manager of a limited liability company, either (a) does not have a current child-support obligation, or (b) has a child-support obligation and is currently in compliance with that obligation.

5.I authorize the jurisdictions to give any information concerning me, as permitted by law, to any federal, state or municipal agency, or any other organization and I release the jurisdictions and any person acting on their behalf from any and all liability of whatever nature by reason of furnishing such information.

6.I acknowledge that I understand and will comply with the insurance laws and regulations of the jurisdictions to which I am applying for licensure/registration.

7.For Non-Resident License Applications, I certify that I am licensed and in good standing in my home state/resident state for the lines of authority requested from the non-resident state.

8.I hereby certify that upon request, I will furnish the jurisdiction(s) to which I am applying, certified copies of any documents attached to this application or requested by the jurisdiction(s).

Must be signed by an officer, director, or partner of the business entity, or member or manager if a limited liability company who has authority to act on behalf of the business entity:

Application Attachments

22The following attachments must accompany the application; otherwise the application may be returned unprocessed or considered deficient.

1.Non-refundable fee (check or money order) made payable to the “State of Ohio Treasurer” in the amount of $300.00;

2.Provide proof of fidelity bond or other comparable insurance policy coverage for all employees as required by R.C. 3959.11 and OAC 3901-8-05 (D)(5). (Documentation must include the name of the carrier, policy number and effective dates.)

3.Provide proof of professional liability insurance coverage and/or E&O insurance as required by ERISA. (Documentation must include the name of the carrier, policy number and effective dates.); and

4.If necessary, any required supporting details or documents.

Requirements for Licensure

23

1.All business entity TPA applicants must be registered with the Ohio Secretary of State.

2.Non-Resident TPA applicants must be registered with the home state Secretary of State.

Resident License

Resident License