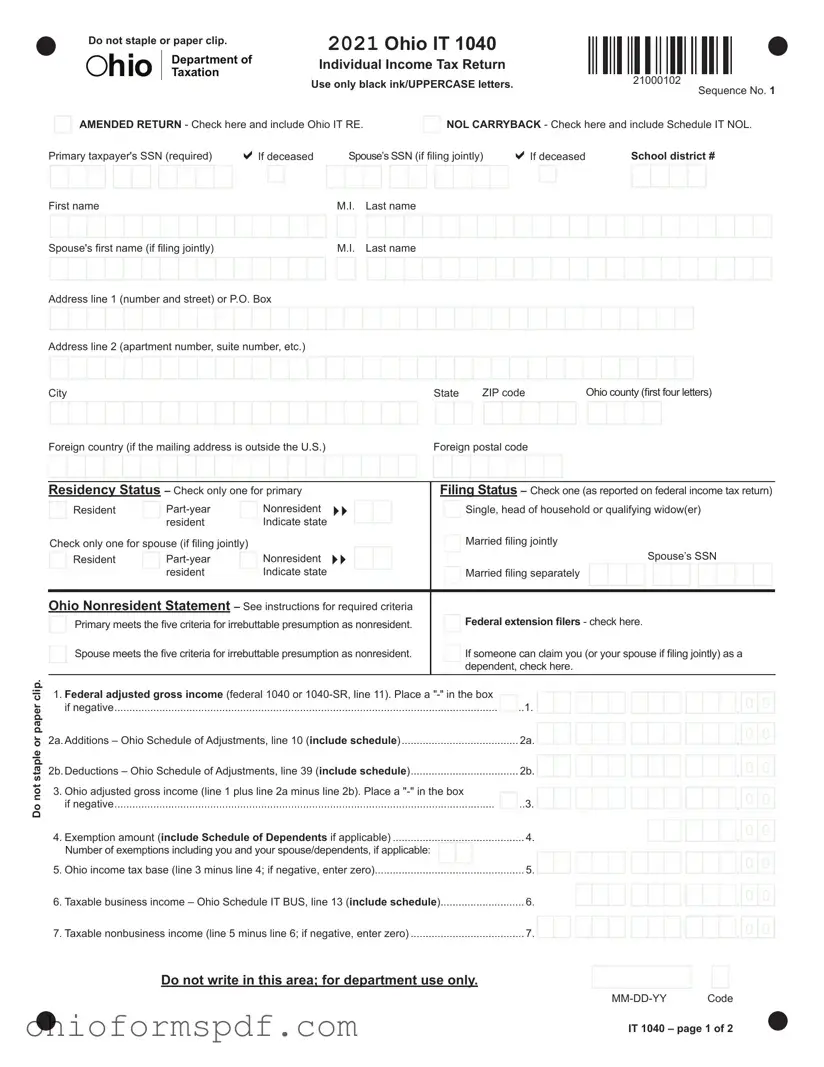

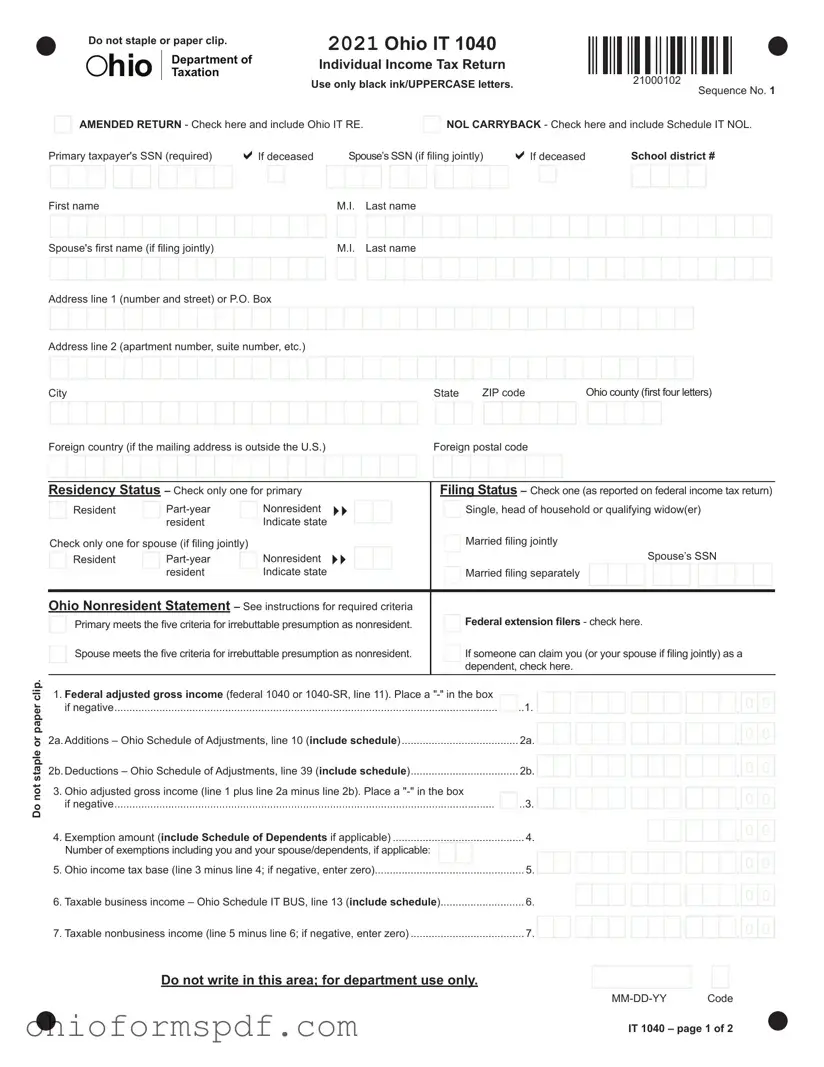

What is the purpose of the Ohio IT 1040 form?

The Ohio IT 1040 form is used by residents, part-year residents, and nonresidents to report and pay their annual state income tax to the Ohio Department of Taxation. This form helps calculate your total income tax based on earnings, adjustments, credits, and any taxes already paid or withheld.

Who needs to file the Ohio IT 1040 form?

Any individual who has earned income in Ohio during the tax year is required to file the Ohio IT 1040 form. This includes residents, part-year residents, and nonresidents who have Ohio-sourced income.

How do I know if I should file as a resident, part-year resident, or nonresident?

File as a resident if you lived in Ohio the entire year. If you moved into or out of Ohio during the tax year, you should file as a part-year resident. Nonresident filing applies if you lived outside Ohio but earned income from Ohio sources.

Can I file the Ohio IT 1040 form electronically?

Yes, Ohio encourages taxpayers to file electronically for faster processing and refunds. You can e-file through the Ohio Department of Taxation's website or through approved software.

What should I do if I need to amend a previously filed Ohio IT 1040?

If you need to amend a previously filed Ohio IT 1040, you should complete a new form and check the box indicating it's an amended return. Be sure to include the Ohio IT RE form with your amendment.

What are the deadlines for filing the Ohio IT 1040 form?

The Ohio IT 1040 is typically due on April 15th following the tax year. If the 15th falls on a weekend or holiday, the deadline is the next business day. If you filed an extension, your deadline to file is October 15th.

How do I claim dependents on my Ohio IT 1040 form?

To claim dependents on your Ohio IT 1040, you must complete and include Schedule J. This schedule helps determine the exemption amount for your dependents.

What if I owe money with my Ohio IT 1040 form?

If you owe additional taxes with your Ohio IT 1040, you can include a check or money order payable to the "Ohio Treasurer of State." Ensure to use the correct mailing address for returns with payments.

How can I receive my refund from the Ohio IT 1040 form?

Refunds from the Ohio IT 1040 are issued either by direct deposit or check. To receive your refund via direct deposit, provide your bank account information on the form. Otherwise, a check will be mailed to the address on your return.

What are the penalties for late filing or payment?

If you file or pay your Ohio IT 1040 after the deadline, you may be subject to penalties and interest. The specific amount depends on how late the return or payment is and how much you owe.

0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0

Check here to authorize your preparer to discuss this return with the Department.

Check here to authorize your preparer to discuss this return with the Department.