What is the Ohio IT 1040EZ form, and who should use it?

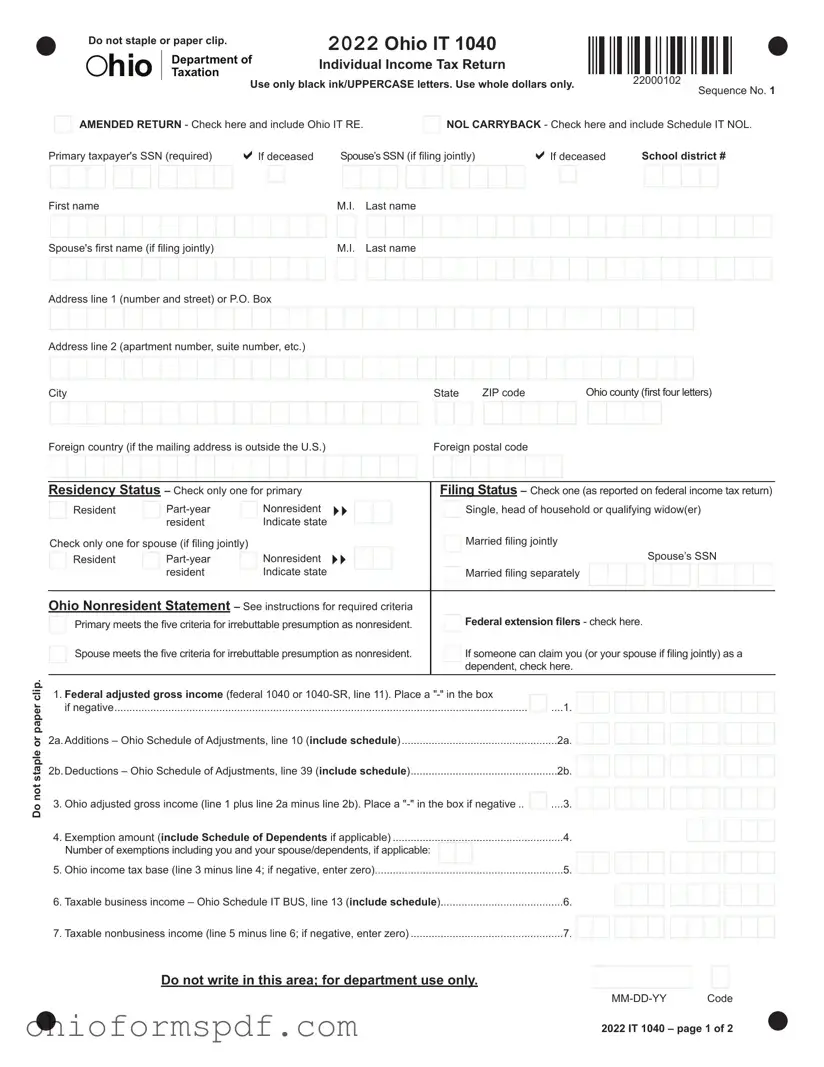

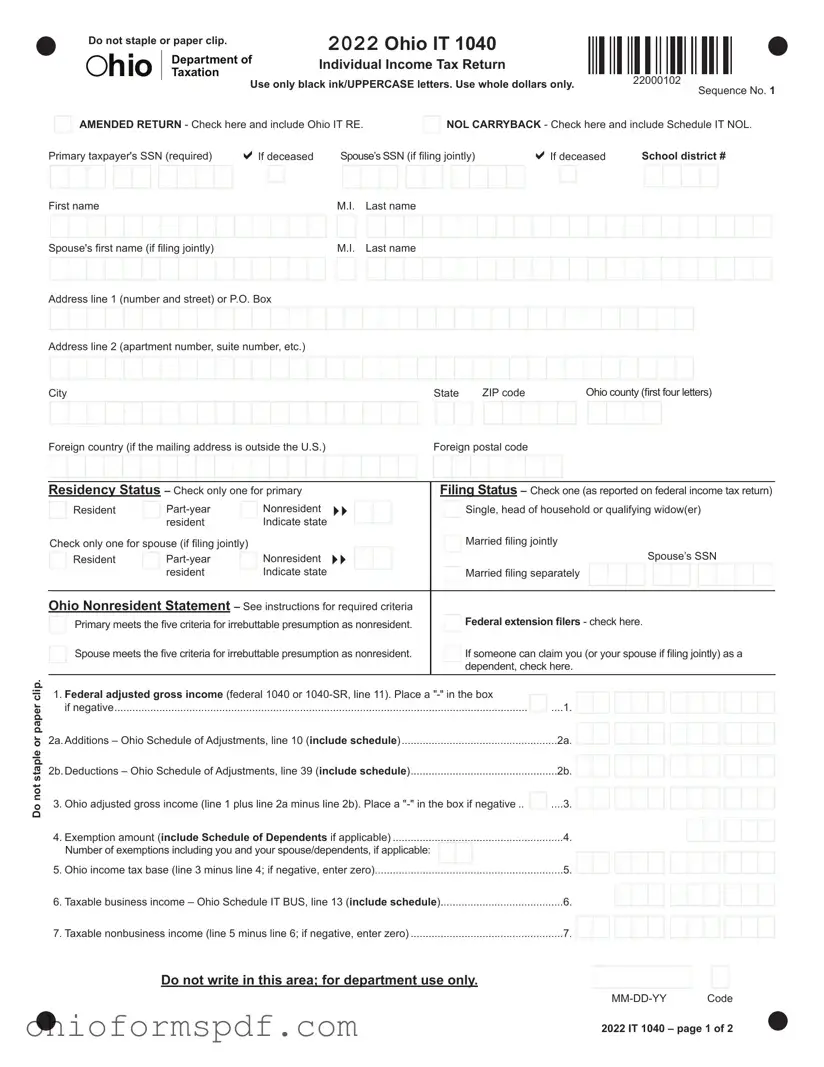

The Ohio IT 1040EZ form is a simplified individual income tax return for Ohio residents. It is designed for taxpayers with straightforward tax situations, such as those who only have income from wages, salaries, tips, and Ohio unemployment compensation. Those eligible to file this form typically do not itemize deductions or have complex tax scenarios involving credits, adjustments, or non-business income. If your tax situation is more complicated, you may need to use the standard Ohio IT 1040 form instead.

Can I file the Ohio IT 1040EZ form electronically?

Yes, taxpayers have the option to file the Ohio IT 1040EZ form electronically through the Ohio Department of Taxation’s website or through approved tax software. Electronic filing (e-filing) is encouraged because it is faster, more secure, and provides immediate confirmation that the return has been received.

What information do I need to complete the Ohio IT 1040EZ form?

To complete the Ohio IT 1040EZ form, you will need your Social Security number, federal adjusted gross income from your federal tax return, and information about any additions or deductions to your Ohio income. Additionally, if you're claiming dependents, you'll need their Social Security numbers and the total number of exemptions. You'll also need your Ohio withholdings or estimated payments if applicable.

How do I determine my filing status on the Ohio IT 1040EZ form?

Your filing status on the Ohio IT 1040EZ form should match the status you reported on your federal income tax return. Options include single, head of household, qualifying widow(er), married filing jointly, or married filing separately. Choose the status that applies to your situation for the tax year being filed.

What if I need to amend a previously filed Ohio IT 1040EZ?

If you need to amend a previously filed Ohio IT 1040EZ, you should check the "AMENDED RETURN" box at the top of the form and include a completed Ohio IT RE form with your amended return. The IT RE form is required to explain the changes being made. Remember to correct any information and adjust your tax calculations as necessary.

Is there a deadline for filing the Ohio IT 1040EZ form?

The deadline for filing the Ohio IT 1040EZ form is typically April 15th, following the end of the tax year. If April 15th falls on a weekend or holiday, the deadline is extended to the next business day. For taxpayers who have been granted a federal extension, Ohio automatically extends the filing deadline, but you must check the "Federal extension filers" box on the form and attach a copy of the federal extension when filing your Ohio return.

hio

hio