The Internal Revenue Service (IRS) W-2 form is notably similar to the Ohio IT 3 form in its fundamental purpose, which is to report wages, tips, and other compensation paid to employees, along with the taxes withheld from these wages. Much like the Ohio IT 3, the W-2 form must be submitted by employers annually. Both forms cater to a similar audience—employers—and serve as critical components in the compliance with tax reporting obligations, facilitating the accurate reporting of employee income and tax withholdings to respective tax authorities.

The IRS 1099-R form, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc., also shares similarities with the Ohio IT 3 form. Both forms are integral to tax reporting and compliance, especially concerning the documentation of income beyond wages. The Ohio IT 3 mentions the 1099-R explicitly, as it encompasses the transmittal of 1099-R statements, indicating a direct relevance and conjunction in their use for reporting purposes.

Form 941, also known by the IRS, is employed by employers to report federal withholdings from employee wages, including social security and Medicare taxes. This form's submission frequency and its role in reporting crucial tax deduction information make it akin to the Ohio IT 3 form. While the IT 3 focusses on state-level income and school district tax liabilities, Form 941 addresses federal tax obligations, highlighting the interconnected nature of tax reporting across different government levels.

The Bureau of Labor Statistics' (BLS) Quarterly Census of Employment and Wages (QCEW) program uses federal and state data to compile a comprehensive report on employment and wage trends across the U.S. Though not a direct form like the Ohio IT 3, the QCEW's data collection process is reminiscent of the IT 3's role in aggregating employment income and tax information, contributing to a broader understanding of labor market dynamics at the state and national levels.

The Ohio Employer's Quarterly Unemployment Tax Return (form JFS 20125) mirrors the Ohio IT 3 in its quarterly reporting requirement, albeit focusing on unemployment tax contributions rather than wage and tax statements. Both forms are pivotal for employers in Ohio, ensuring compliance with state tax laws and supporting the administration of employment-related tax programs.

The Ohio SD 101 form serves as the School District Income Tax Withholding Payment Voucher, which is similar to the Ohio IT 3 form in its focus on school district tax considerations. While the IT 3 includes the total Ohio school district tax liability, the SD 101 concentrates on the remittance of withheld school district income taxes, showcasing another layer of tax responsibility for Ohio employers.

The IRS form 940, used for the Federal Unemployment Tax Act (FUTA) tax reporting, parallels the Ohio IT 3 form somewhat. The form 940 involves reporting on taxes paid into the federal unemployment tax system, reflecting an employer's annual financial obligations towards this scheme. This form, similar to the IT 3, demonstrates the importance of employer contributions to federal and state tax and employment programs, ensuring that unemployment insurance systems are adequately funded.

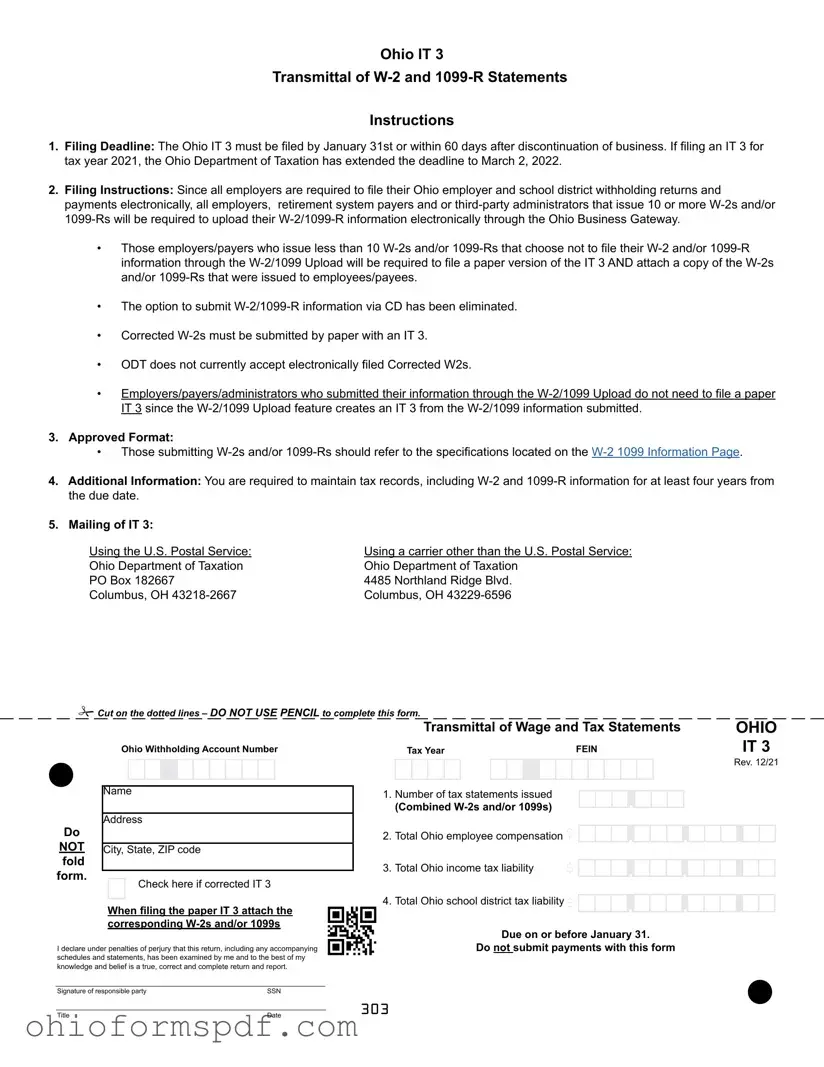

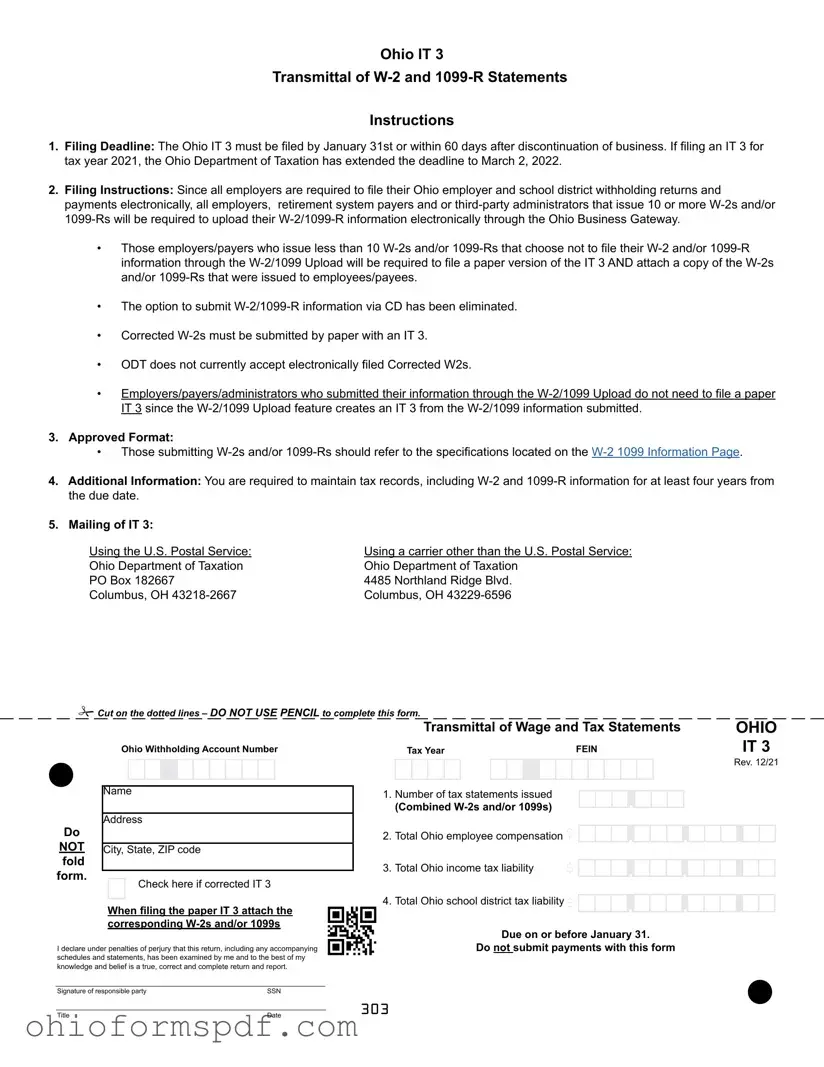

Another IRS form, W-3, the Transmittal of Wage and Tax Statements, is closely related to the Ohio IT 3 form. The W-3 is utilized to submit all W-2 forms for a business to the Social Security Administration. The purpose aligns with that of the IT 3 in aggregating and transmitting employee wage and tax information, although the W-3 serves as a federal conduit, further emphasizing the synergy between state and federal tax reporting practices.

The Employer's Annual Federal Tax Return (form 944) is designed for smaller employers to report their employees' withheld federal income tax and the employer's portion of Social Security and Medicare taxes. Although aimed at a narrower audience, the parallels with the Ohio IT 3 form's goals of tax reporting and compliance remain evident, underscoring the broader framework of employer reporting obligations across various tax domains.

Lastly, the Ohio IT 1040 form, which is the Individual Income Tax Return form for Ohio residents, indirectly correlates with the information contained within the Ohio IT 3 form. While the IT 3 deals with the collection and reporting of employment taxes at the employer level, the IT 1040 form represents the culmination of an individual's state tax reporting process. Together, they encapsulate the cycle of tax documentation from earnings reporting to personal tax submission in the state of Ohio.