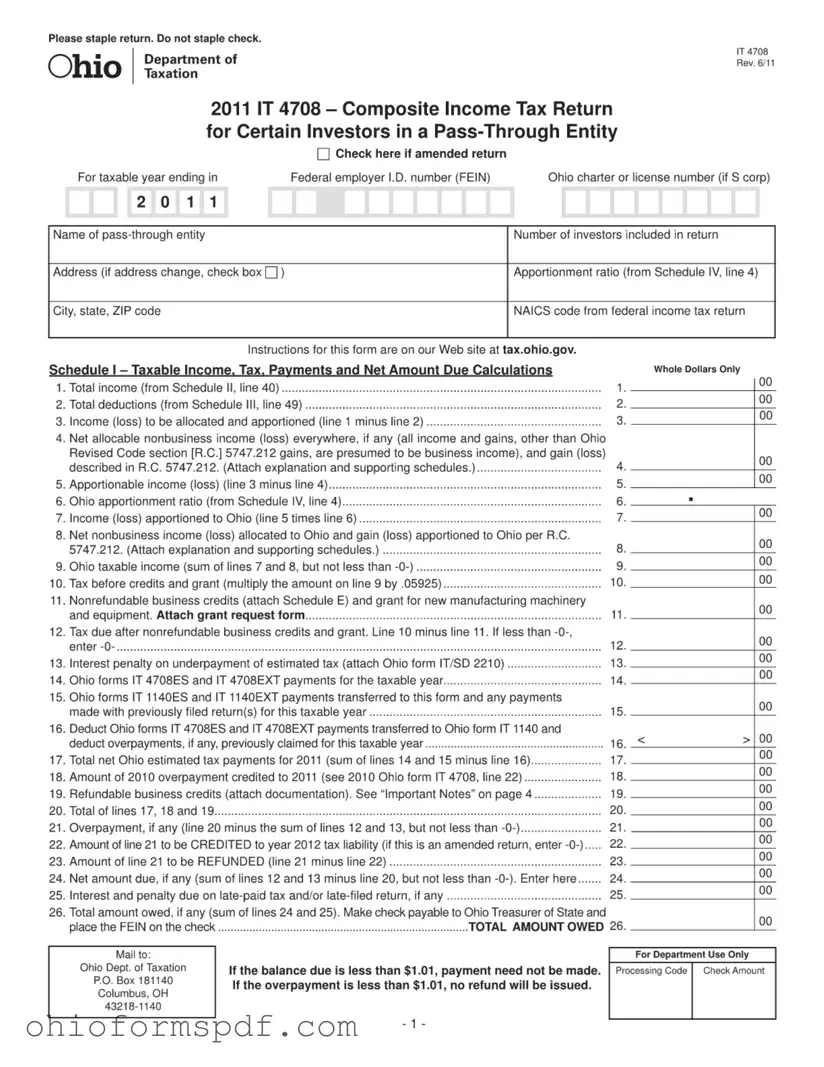

What is the Ohio IT 4708 form?

The Ohio IT 4708 form is a tax document specifically designed for pass-through entities, such as partnerships or S corporations, that have investors or owners needing to report their share of the income or losses from Ohio sources. It enables the entity to file a composite return on behalf of certain investors or owners who are non-residents of Ohio.

Who needs to file the Ohio IT 4708 form?

Any pass-through entity that has income from Ohio sources and has one or more investors or owners who are non-residents of Ohio must file the IT 4708 form. This requirement holds unless all non-resident owners have signed an agreement to file their own individual Ohio tax returns.

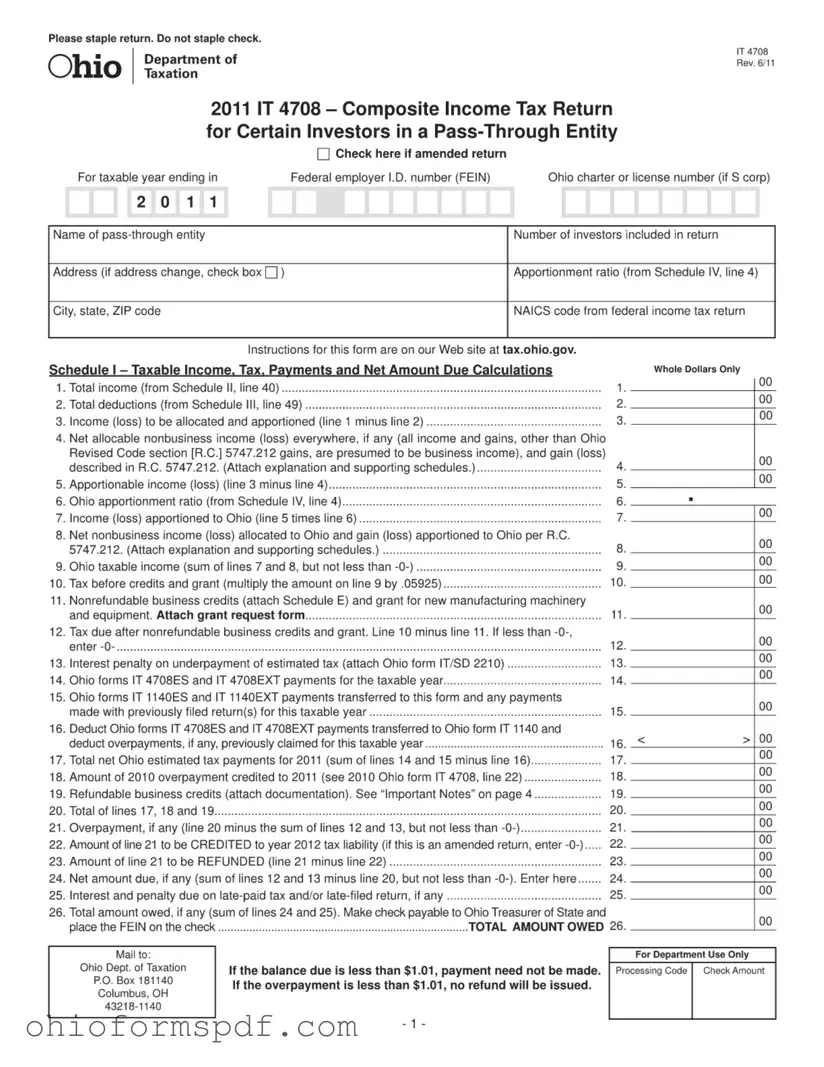

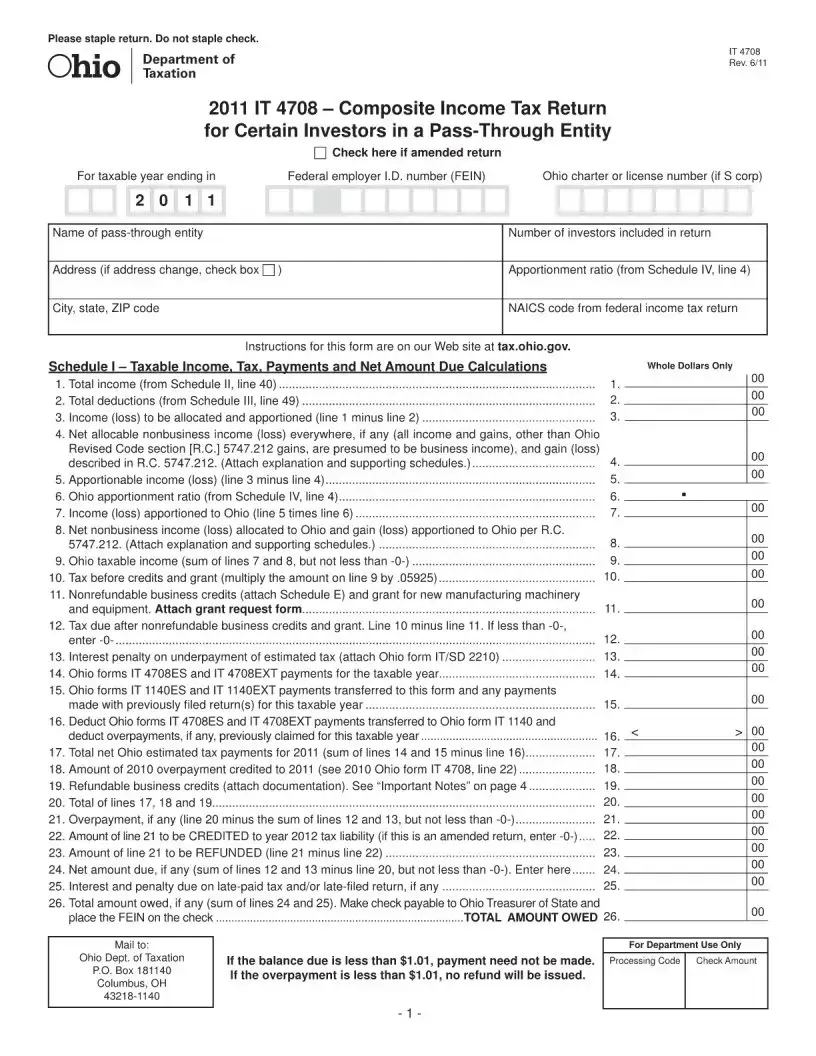

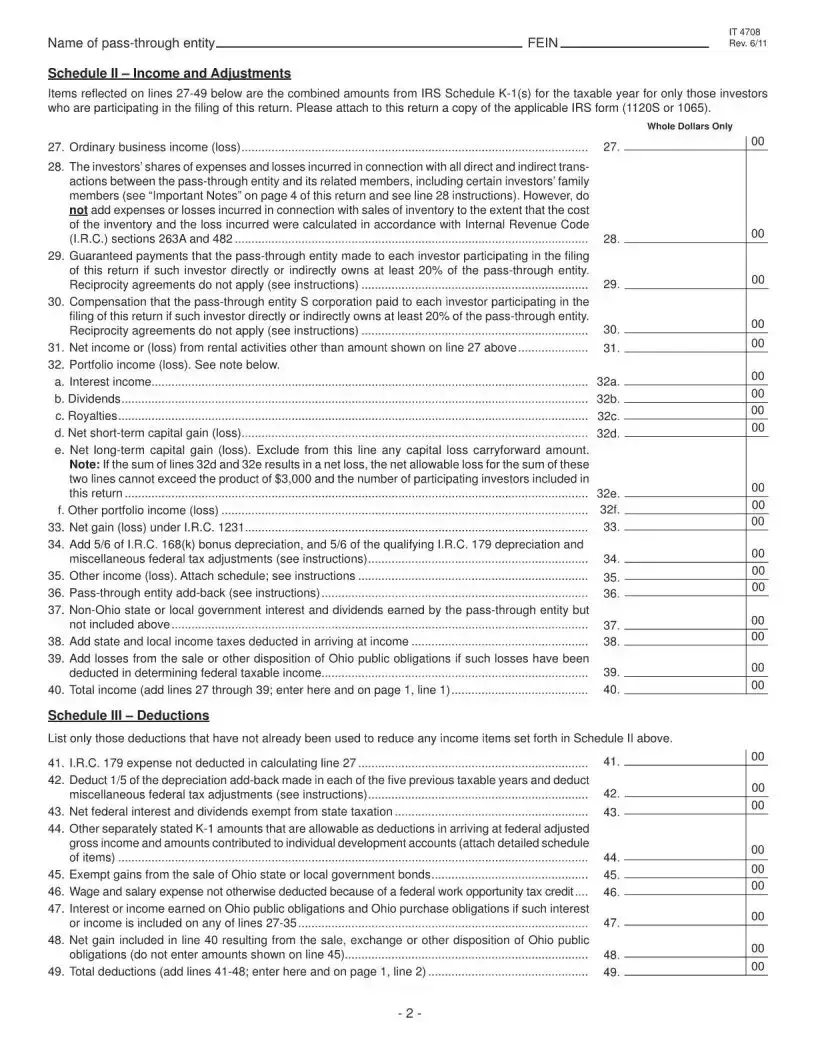

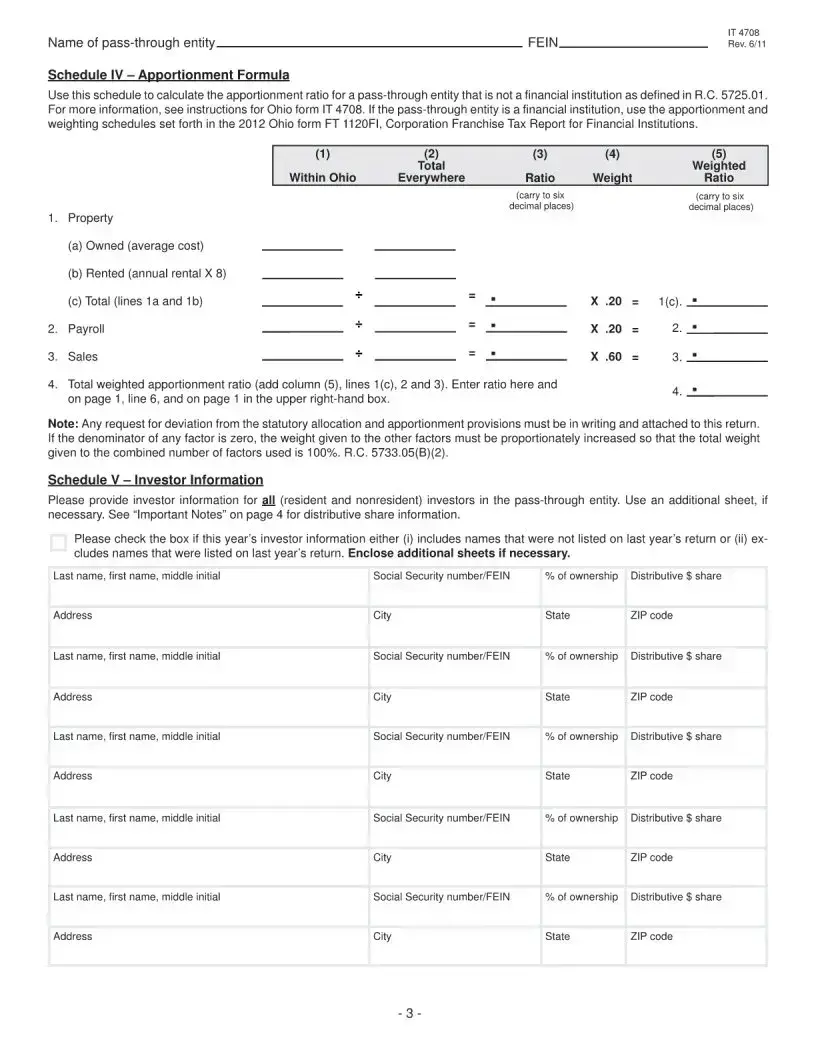

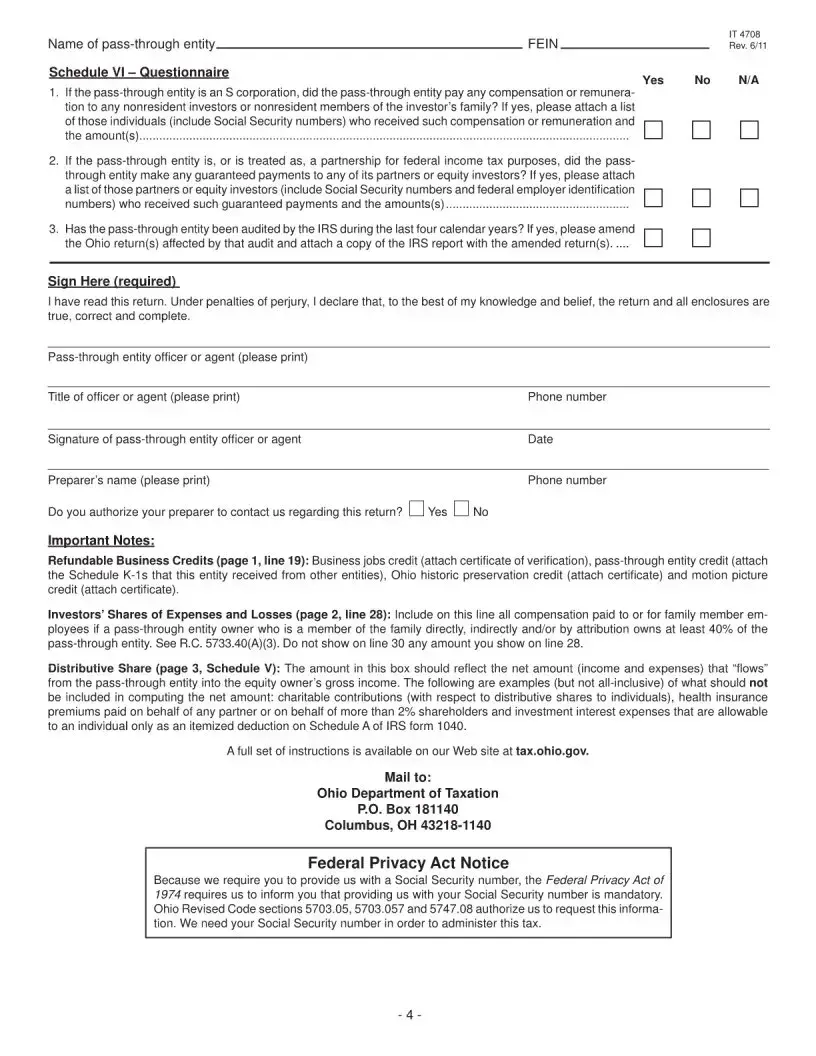

What information is required on the IT 4708 form?

The form requires detailed information about the pass-through entity's income from Ohio sources, distributions to each non-resident owner, and the total tax due. It also requires the identification of each participating non-resident owner, including their name, Social Security Number (or Federal Identification Number), and the share of income or loss attributed to them.

When is the IT 4708 form due?

The IT 4708 is due on the 15th day of the fourth month following the end of the taxable year for the pass-through entity. For most entities operating on a calendar year, this means the deadline is April 15th of the following year.

How is the tax calculated on the IT 4708 form?

Tax is calculated based on the total adjusted income of the pass-through entity from Ohio sources allocated to all participating non-resident owners at the applicable individual or corporate tax rate, depending on the nature of the income. Specific credits, deductions, and payment of estimated taxes can also impact the final tax due.

What if some non-resident owners file their own Ohio tax returns?

If some non-resident owners choose to file their own Ohio tax returns, the pass-through entity should not include their share of the income or taxes due for those individuals on the IT 4708 form. These owners must provide a written consent, using Form IT 4708UP, indicating their agreement to file their own return and their understanding that they are separately responsible for their Ohio tax obligations.

Are there penalties for late filing or payment?

Yes, Ohio may impose penalties for both late filing of the IT 4708 form and late payment of any taxes due. These penalties are calculated as a percentage of the unpaid tax and increase the longer the delay. Additionally, interest may accrite on any unpaid tax from the due date until the tax is fully paid.

Can the IT 4708 form be filed electronically?

Yes, Ohio supports electronic filing for the IT 4708 form, offering a more convenient and faster processing option than paper filing. Electronic filing can also help reduce errors, ensuring a smoother handling of your tax obligations.