What is the Ohio IT 941 form?

The Ohio IT 941 form is a document required by the Ohio Department of Taxation. It serves as a report that employers need to file annually. This form details the total amount of income tax withheld from employees' wages throughout the tax year. The main purpose of the IT 941 form is to reconcile the amount of state income tax withheld from employees with the actual tax amount owed to the state.

Who needs to file the Ohio IT 941 form?

Any employer who withholds Ohio state income tax from their employees' wages must file the Ohio IT 941 form. This includes businesses operating within Ohio, as well as out-of-state employers who have withholding obligations for employees working in Ohio.

When is the Ohio IT 941 form due?

The Ohio IT 941 form is typically due by the last day of January following the end of the tax year. For example, for the tax year 2022, the form would be due by January 31, 2023. If the due date falls on a weekend or legal holiday, the deadline is extended to the next business day.

How do I file the Ohio IT 941 form?

Employers can file the Ohio IT 941 form electronically through the Ohio Business Gateway or by mailing a paper form to the Ohio Department of Taxation. Electronic filing is encouraged as it is faster and reduces the risk of errors.

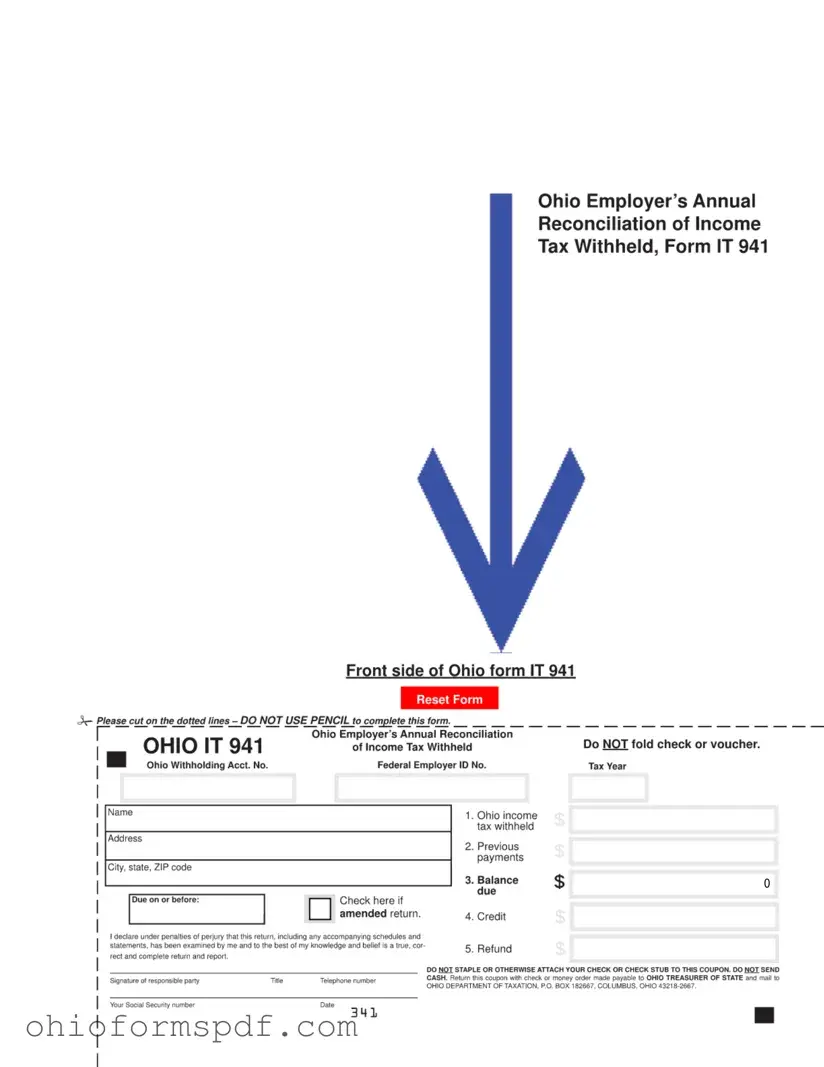

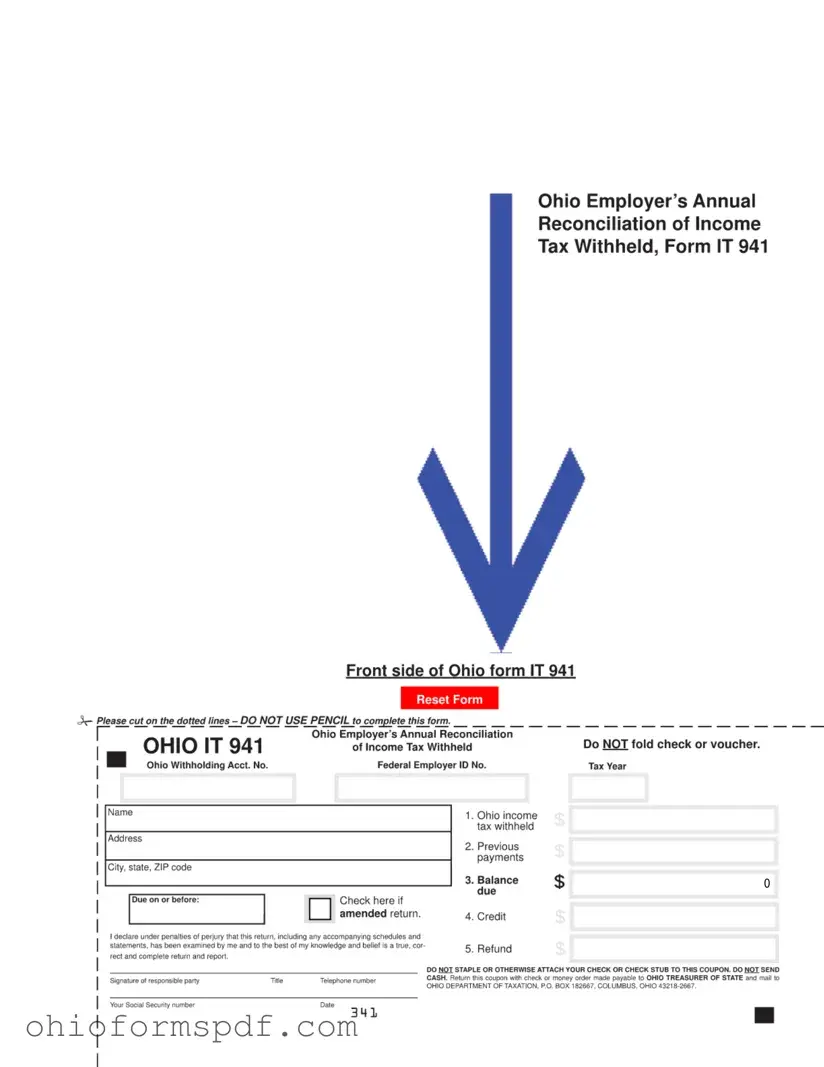

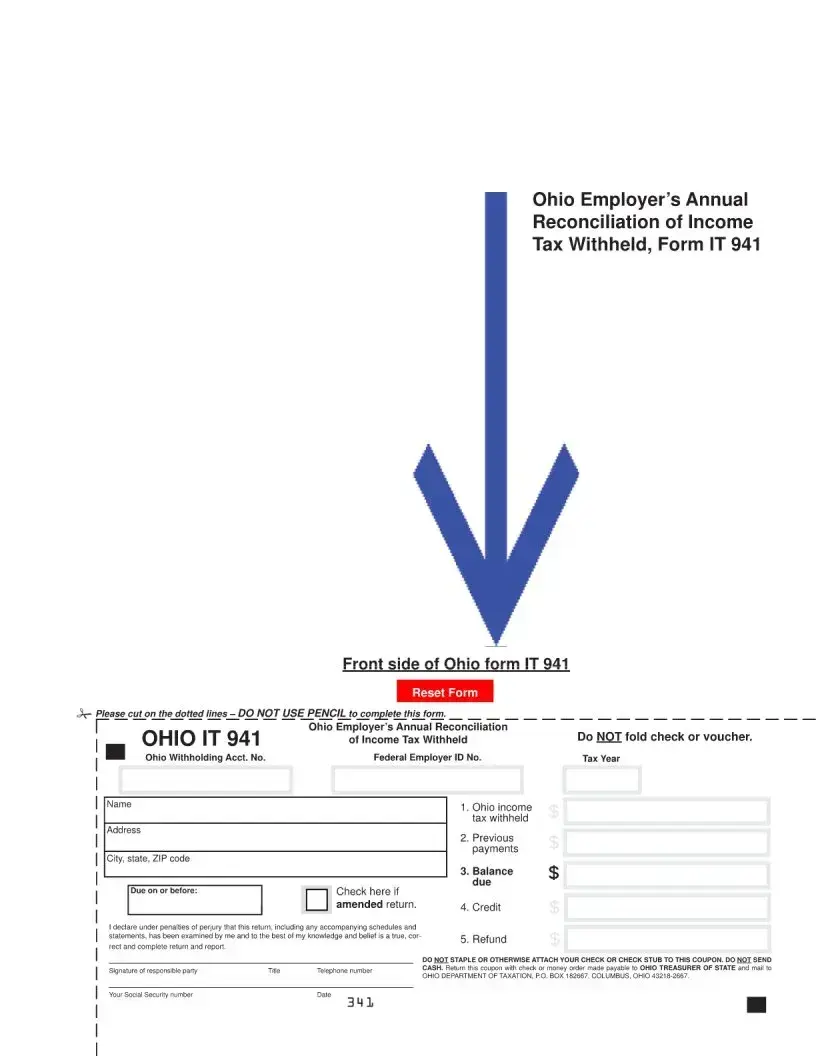

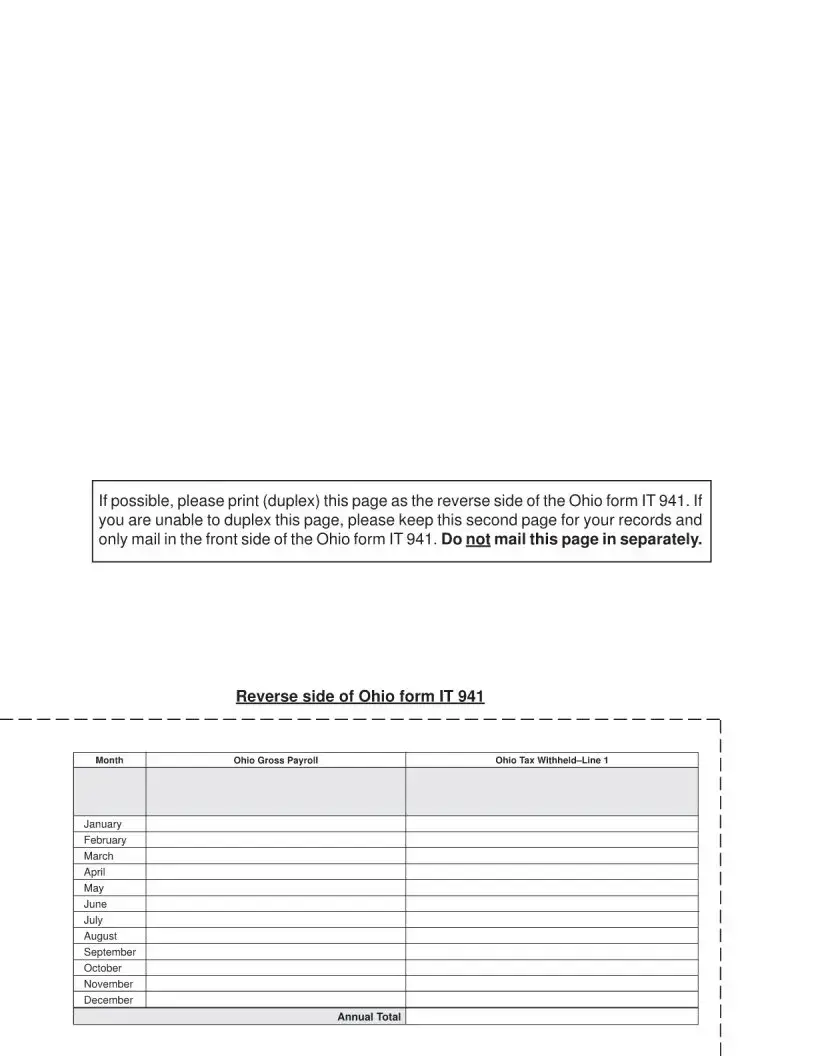

What information do I need to complete the Ohio IT 941 form?

To complete the IT 941 form, you will need detailed payroll records for the tax year. This includes the total amount of wages paid to employees, the amount of Ohio state income tax withheld from those wages, and any adjustments to withholdings, such as corrections or refunds processed during the year.

What if I made a mistake on my Ohio IT 941 form?

If you discover an error on your filed IT 941 form, you should correct the mistake by filing an amended return. The Ohio Department of Taxation provides specific guidelines on how to amend the IT 941, including marking the form as amended and detailing the corrected information.

Can I get an extension for filing the Ohio IT 941 form?

Extensions for filing the Ohio IT 941 form are not automatically granted. However, if you have a valid reason for needing more time to file, you can request an extension by contacting the Ohio Department of Taxation before the filing deadline. Keep in mind that an extension to file does not grant more time to pay any taxes due.

What happens if I don't file the Ohio IT 941 form?

Failing to file the Ohio IT 941 form can result in penalties and interest charges. The Ohio Department of Taxation may assess a failure-to-file penalty, and interest will accrane on any unpaid tax from the due date until the tax is paid in full. It's important to file the form on time, even if you cannot pay all the tax owed, to minimize penalties and interest.

Where can I find help with completing the Ohio IT 941 form?

Help with completing the Ohio IT 941 form is available from the Ohio Department of Taxation. Their website offers guides, FAQs, and contact information for taxpayer assistance. Additionally, professional tax advisors or accountants can provide expert assistance with preparing and filing the form.