What is the purpose of the Ohio New Hire Reporting form?

The Ohio New Hire Reporting form serves a crucial role in helping the Ohio Department of Job and Family Services keep track of all contractors and newly hired employees in the state. By collecting this information, the state can effectively administer child support enforcement measures. Employers, both public and private, are required by law to report new hires and contractors within 20 days of their contract or hire date.

Who is required to report new hires and contractors in Ohio?

Every employer operating within Ohio, regardless of the size of their business or organization, public or private, must report new hires and contractors to the state. This requirement ensures that the Ohio Department of Job and Family Services can maintain accurate and up-to-date employment records essential for multiple state functions, including but not limited to child support enforcement.

How can Ohio employers submit the New Hire Reporting form?

Ohio employers have multiple options for submitting the New Hire Reporting form. They can mail the completed forms to the Ohio New Hire Reporting Center, or use fax services (both standard and toll-free fax numbers are available). Additionally, for added convenience, online reporting options are provided through the official website: www.oh-newhire.com.

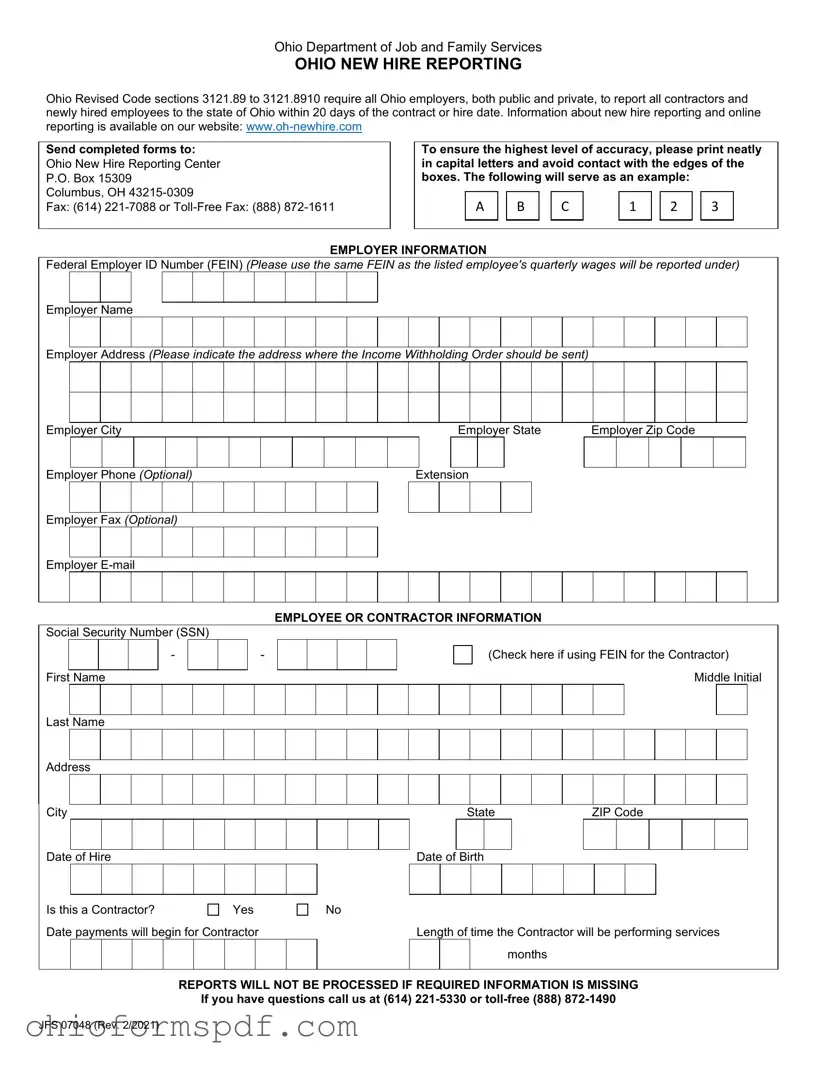

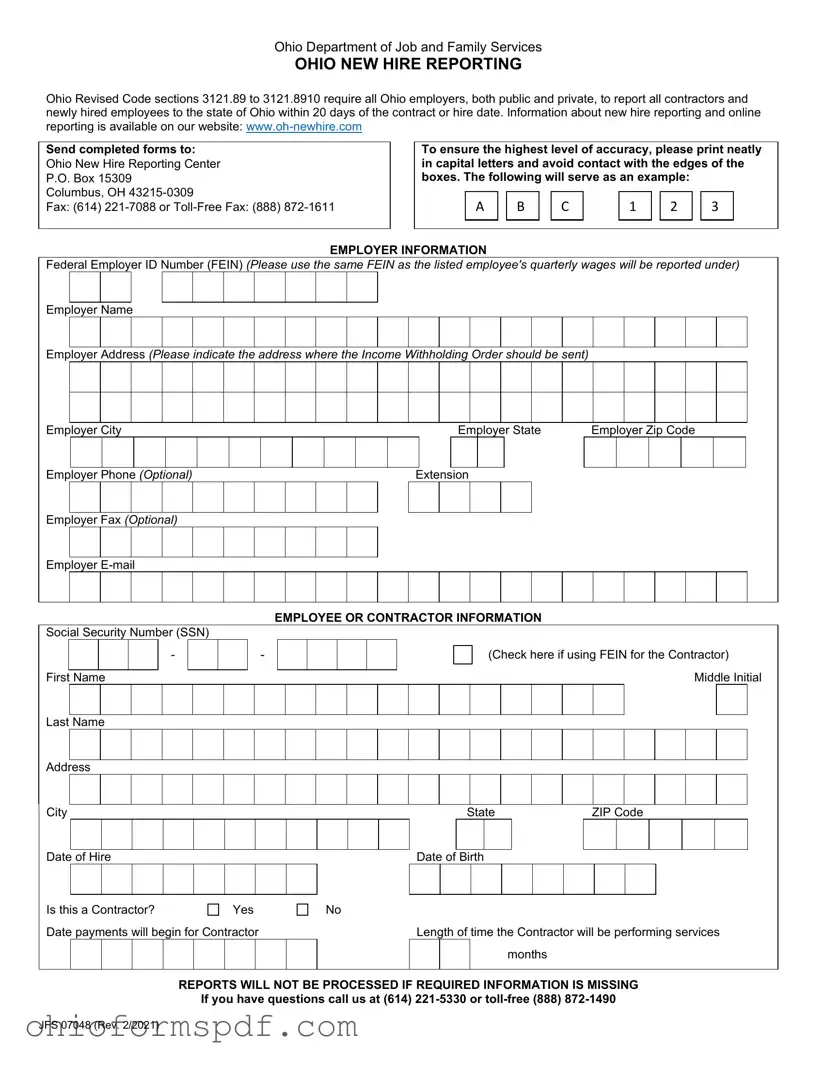

What information is required on the Ohio New Hire Reporting form?

The form requires detailed information about both the employer and the new hire or contractor. For employers, this includes the Federal Employer ID Number (FEIN), name, address, and contact details. For the new hire or contractor, it demands personal details such as Social Security Number (or FEIN for contractors), full name, address, date of hire or contract start, date of birth (for employees), and details regarding the contract's length and start for contractors.

What happens if the required information is missing from the report?

Accuracy and completeness are essential for the New Hire Reporting process. Reports missing required information will not be processed. This can lead to delays in the registration of new hires or contractors, potentially resulting in non-compliance with state laws for the employers.

Is there a deadline for submitting the New Hire Reporting form in Ohio?

Yes, there is a strict deadline. Employers must submit the New Hire Reporting form within 20 days of a new employee's hire date or the start date of a contractor's agreement. Timely submission ensures compliance with Ohio's laws and aids in efficient state administrative processes.

Can employers submit reports for multiple new hires simultaneously?

Employers who need to report multiple new hires or contractors have the option of submitting their information in batches. This can be especially handy when using the online reporting system, which is designed to handle multiple entries efficiently, streamlining the process for employers with several new hires or contractors.

What are the penalties for failing to report new hires in Ohio?

Employers who neglect their duty to report new hires and contractors may face penalties. Although specific penalties can vary, the essence of the requirement underscores its importance to state functions, particularly in enforcing child support obligations. Employers are encouraged to adhere to reporting deadlines to avoid any legal or financial repercussions.

Is the employer's phone number and email address required on the form?

While providing an employer's phone number and email address on the New Hire Reporting form is optional, including this information can improve communications. If any issues arise or additional information is needed, having direct contact information allows for a quicker resolution.

How does new hire reporting benefit the state of Ohio?

By requiring the reporting of all new hires and contractors, the state of Ohio ensures a robust mechanism for enforcing child support orders, among other obligations. This system helps in locating non-custodial parents who have child support obligations and assists in preventing fraud within state benefit programs. Ultimately, it contributes to the welfare of Ohio's children and families while supporting the integrity of state-run assistance programs.