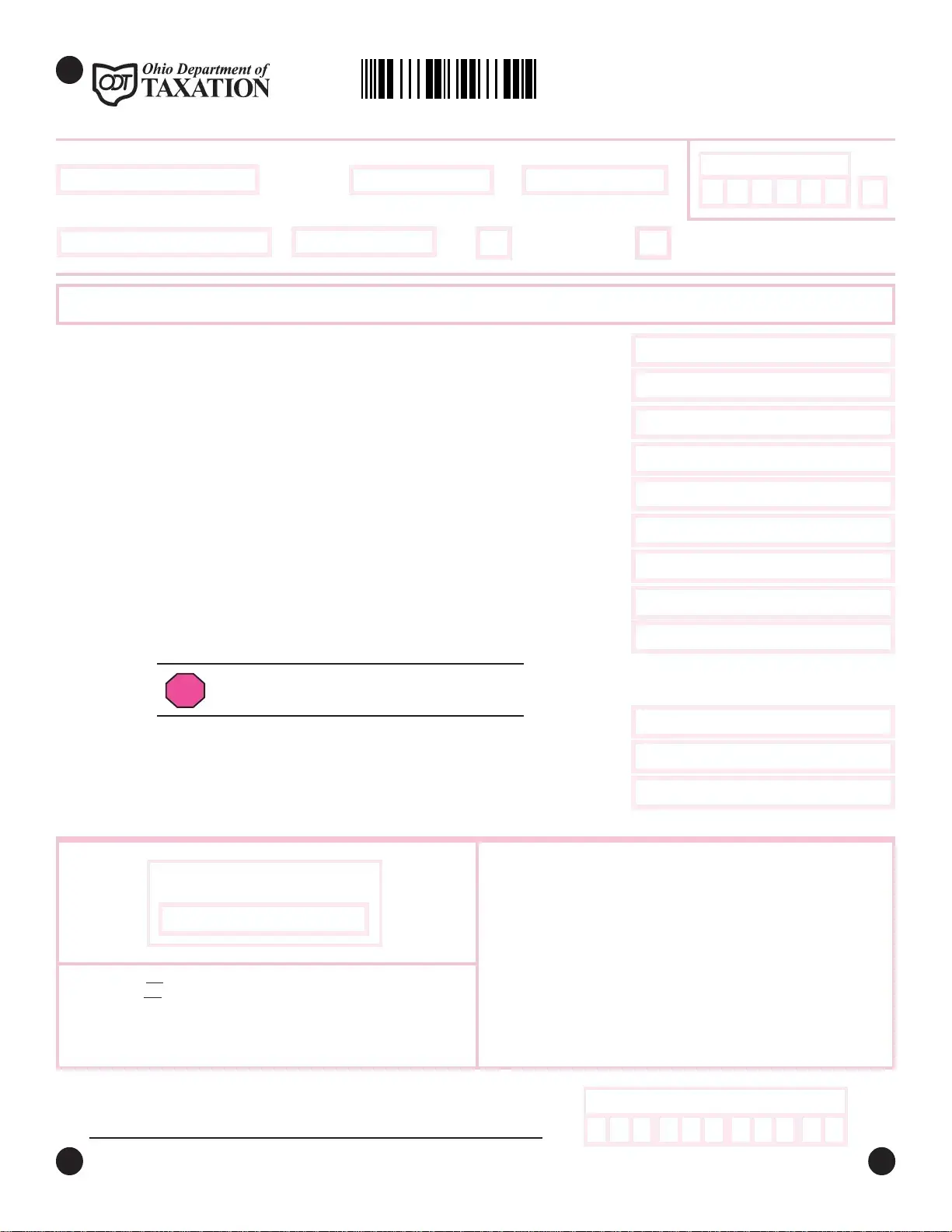

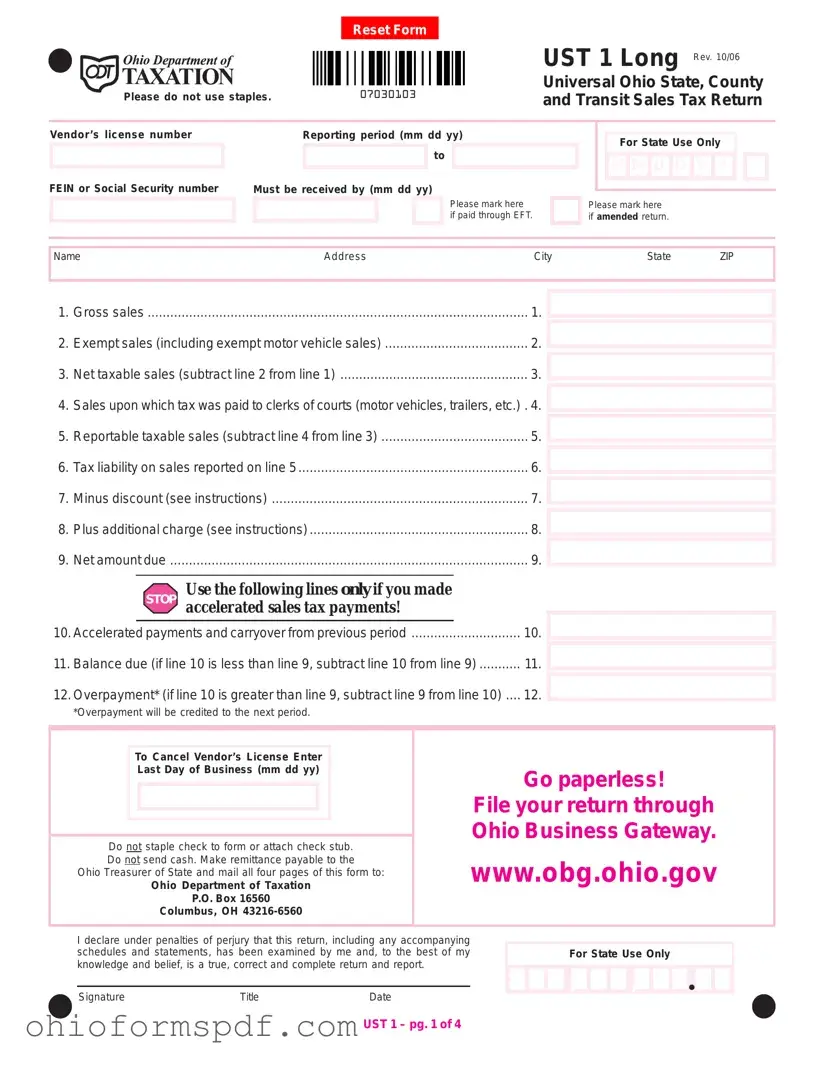

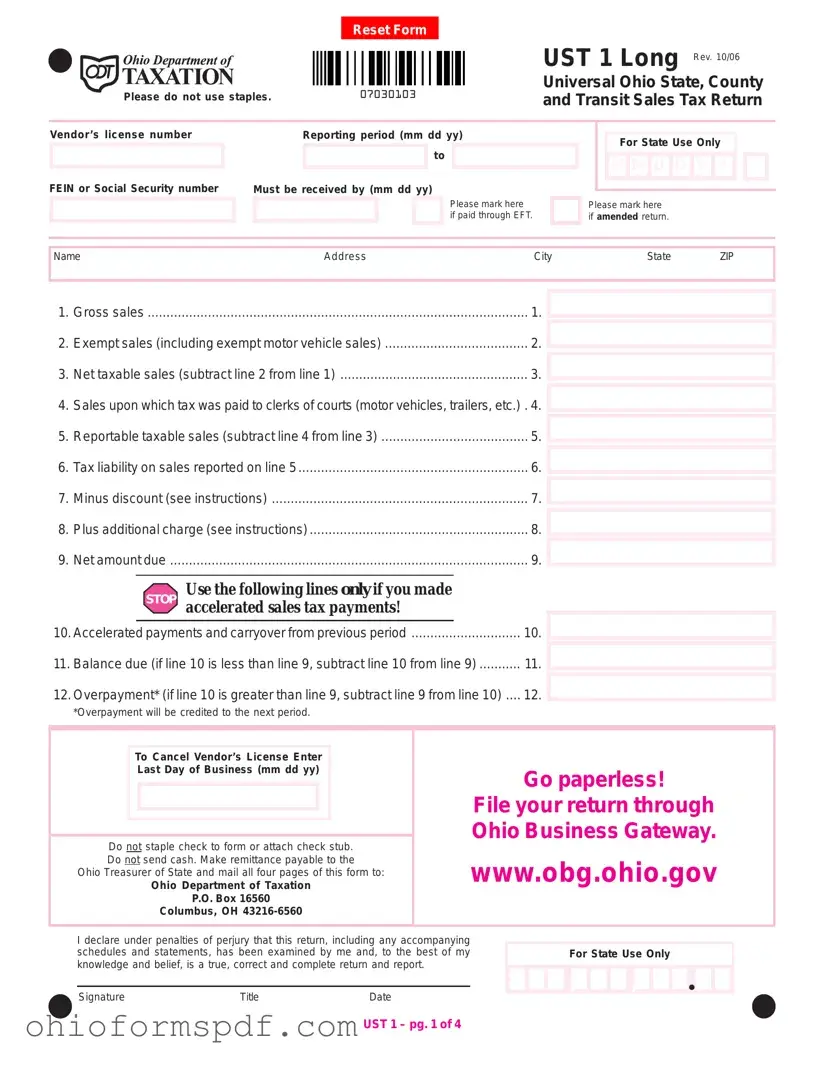

Blank Ohio Sales Tax Ust 1 Template

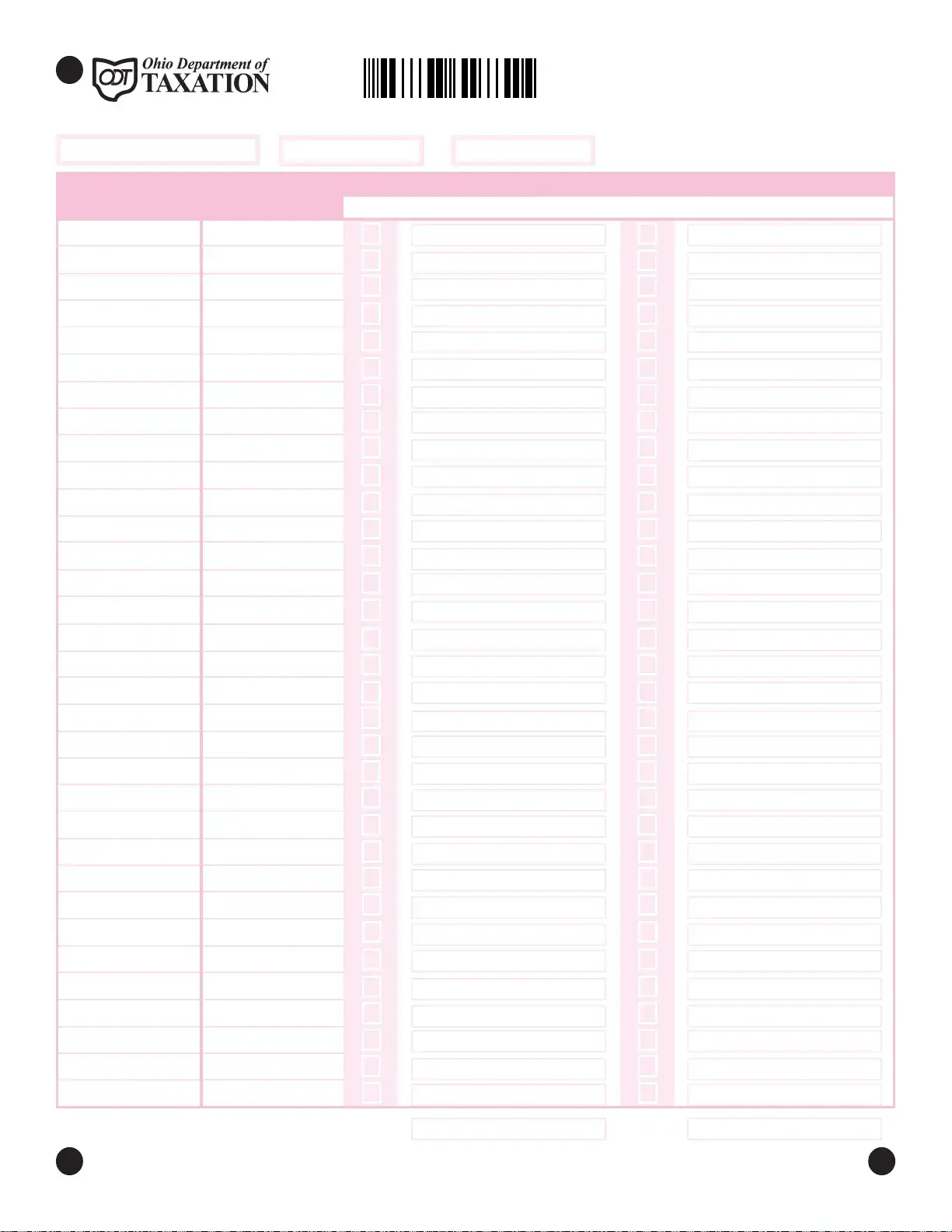

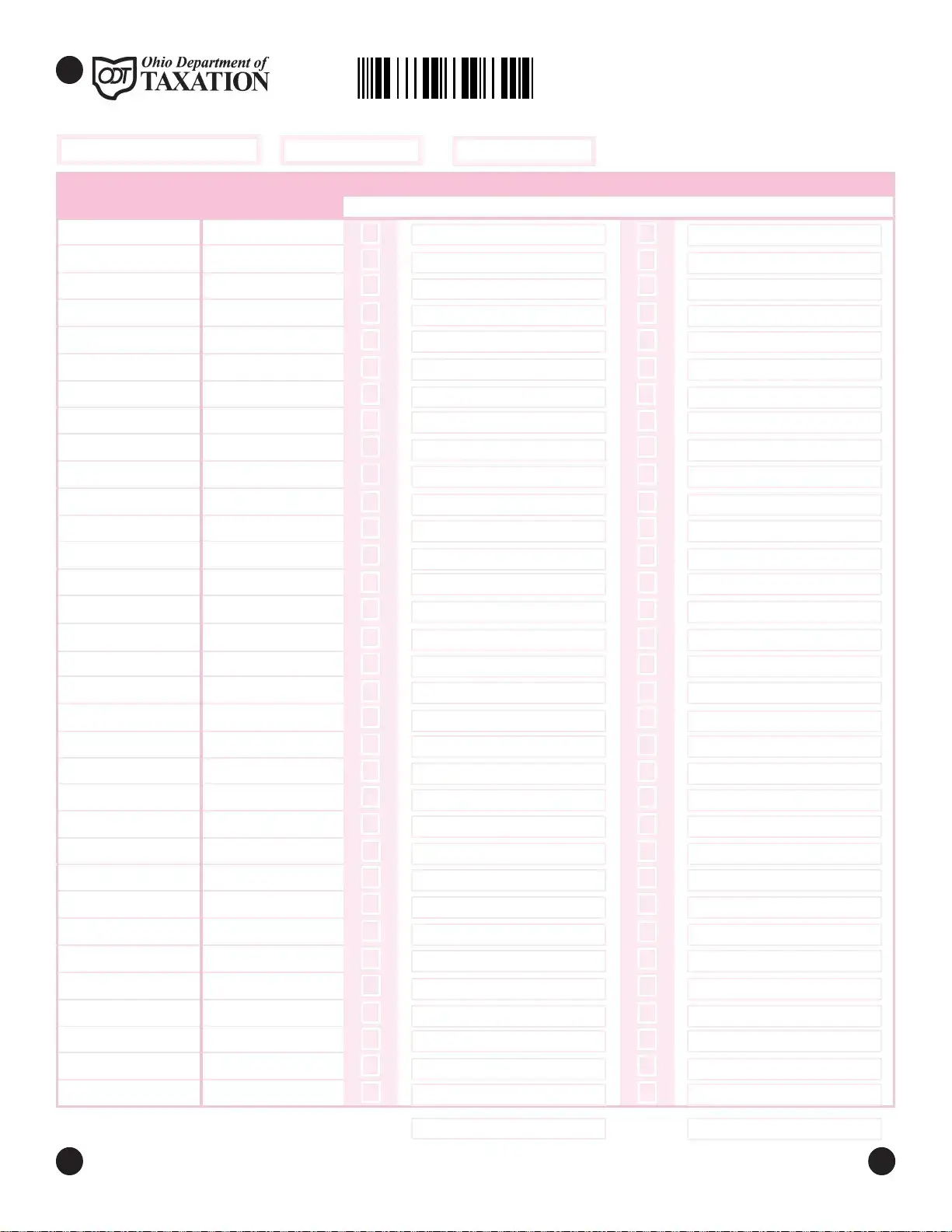

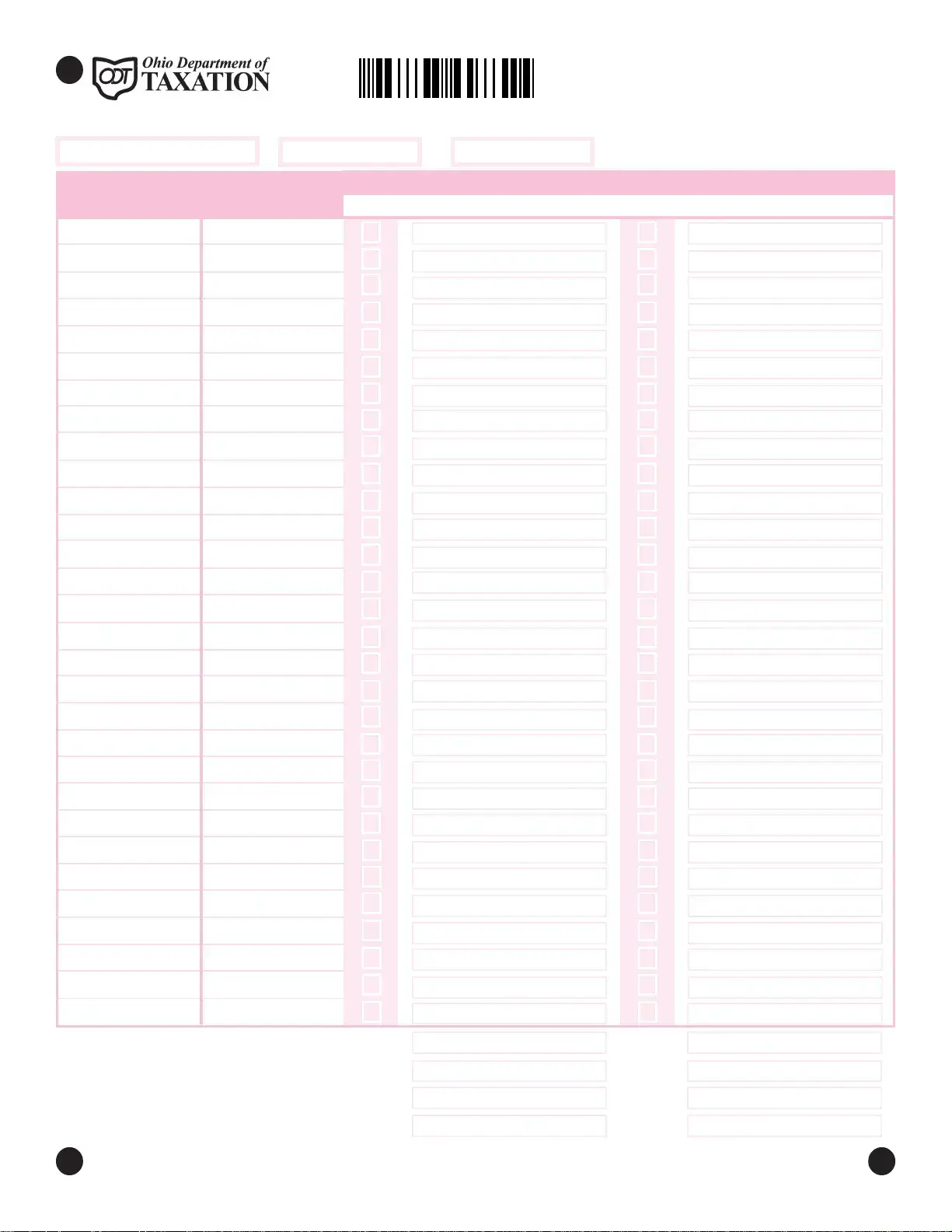

The Ohio Sales Tax UST 1 Form serves as a comprehensive return document through which businesses report and pay state, county, and transit sales taxes to the Ohio Department of Taxation. It requires detailed information about gross sales, taxable sales, exemptions, and net tax due, including a breakdown by county for accurate allocation of tax liabilities. Designed to ensure tax compliance, this form plays a crucial role in the state's tax administration, offering options for electronic filing and payment to streamline the process for vendors.

Prepare Form

Blank Ohio Sales Tax Ust 1 Template

Prepare Form

Prepare Form

or

⇩ Ohio Sales Tax Ust 1 PDF

You’re in the middle of the form

Complete Ohio Sales Tax Ust 1 online — edit, save, and download smoothly.