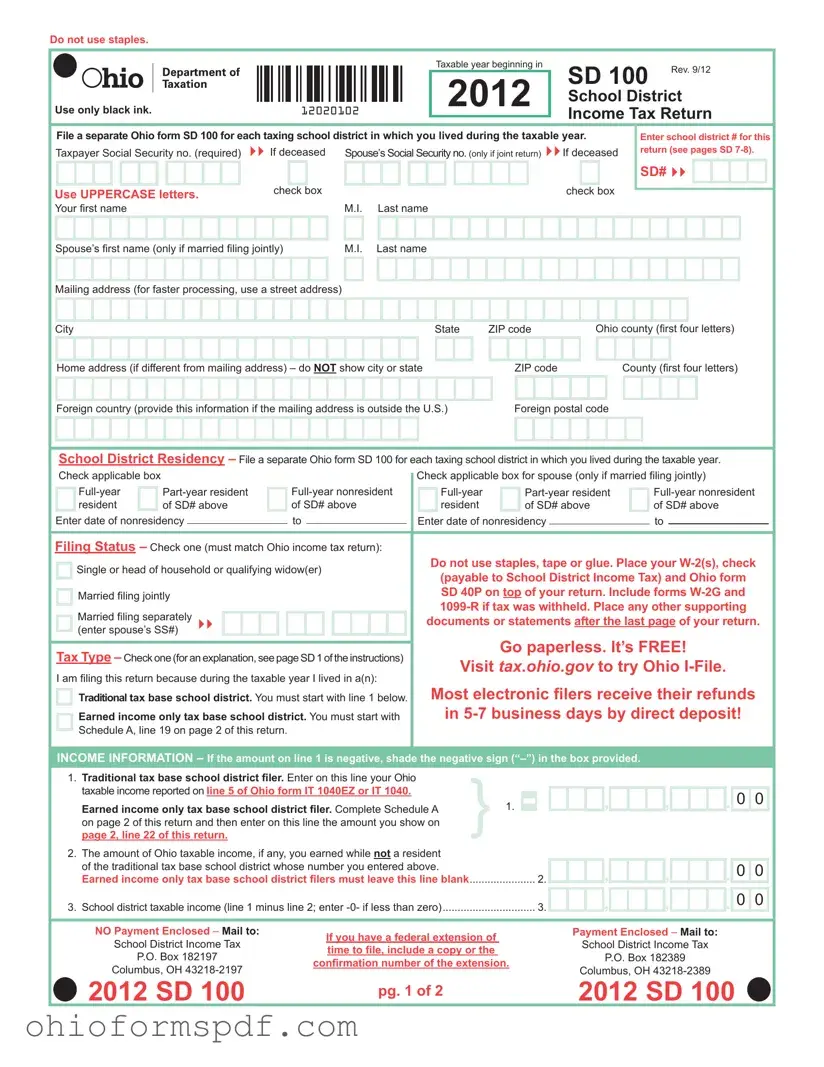

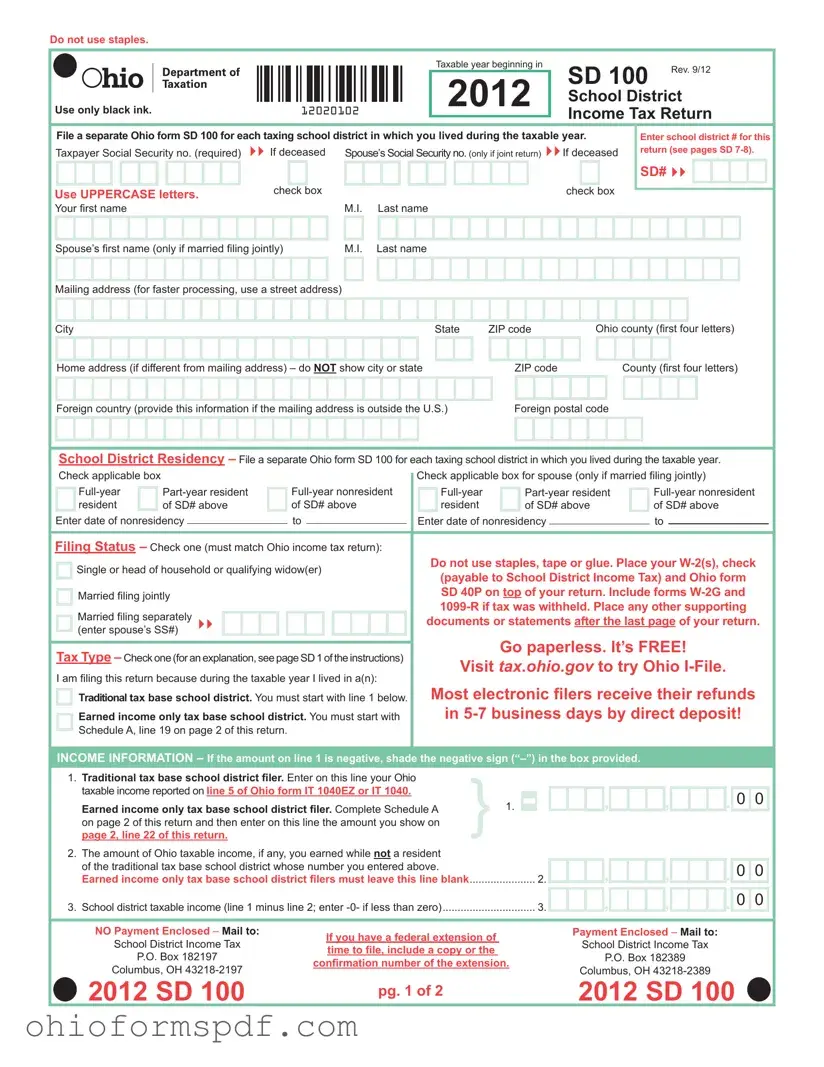

The Ohio Individual Income Tax Return (Form IT 1040) shares a significant similarity with the Ohio SD 100 form, as both are pivotal in reporting a taxpayer's income and determining the owed taxes to the state of Ohio. The Form IT 1040 is broader, focusing on state income tax, while the SD 100 is specifically for reporting income that contributes to school district funding. Both forms require taxpayers to disclose their income, calculate tax liability, and claim any eligible credits, making them complementary pieces in Ohio's tax structure.

Form W-2, Wage and Tax Statement, also bears resemblance to the Ohio SD 100 form. While the W-2 is a federal document employers provide to employees detailing the latter's annual wages and the amount of taxes withheld from their paycheck, the SD 100 form requires this information to accurately report earnings and calculate school district income tax. Both documents are integral in ensuring the proper reporting of income and taxes at different governmental levels.

Ohio Form SD 40P, Payment Voucher for School District Income Tax, is designed to accompany the Ohio SD 100 when payments are due for school district income taxes. Similar to the SD 100, which is used for reporting school district income tax liability, the SD 40P facilitates the actual payment of taxes owed. Taxpayers use both forms to fulfill their tax responsibilities regarding school district income tax, with the SD 40P specifically handling the remittance of payments.

The Federal Form 1040, U.S. Individual Income Tax Return, while serving a similar purpose at the federal level, shares core functions with the Ohio SD 100 form. Both are used by individuals to report their annual income, calculate taxes owed, and identify applicable credits and deductions. The main difference lies in their scope, with the Federal 1040 encompassing a wider array of income sources and taxes at the national level, and the SD 100 focusing on school district income taxes within Ohio.

Ohio Form SD 100ES, School District Estimated Income Tax Payment Voucher, is akin to the Ohio SD 100 in its focus on managing taxpayers' school district income tax obligations. However, the SD 100ES is specifically designed for estimated tax payments throughout the year, based on expected income, while the SD 100 reconciles actual income and taxes owed at year-end. Both forms ensure taxpayers can adequately budget for and meet their school district income tax liabilities on time.

The Ohio Business Income Tax Return (Form IT BUS) parallels the Ohio SD 100 in its objective to report taxable income, but it is tailored for business incomes. While the IT BUS captures the business entity's earnings and tax calculations within Ohio, the SD 100 focuses on individual and joint filers' income and their contributions to the school district's financial support. Each form caters to different filers but ultimately serves the state’s tax collection framework.

Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., relates to the Ohio SD 100 form in the aspect of income reporting. Recipients of retirement income use the 1099-R for federal tax purposes, and information from this form can also impact state school district income tax filings, particularly in districts with an earned income tax base. The SD 100 may require input from the 1099-R if such distributions are considered taxable income at the school district level.

Last, Ohio Form IT 1040EZ, the Ohio Individual Simplified Income Tax Return, shares similarities with the SD 100 form, providing a simpler alternative for taxpayers with straightforward tax situations. Like the SD 100, the IT 1040EZ is designed to streamline the tax reporting and payment process for Ohio residents, albeit on a broader scale. Both forms facilitate the efficient submission of required tax information, with the IT 1040EZ encompassing state income taxes and the SD 100 focusing on school district taxes.

2012 SD 100

2012 SD 100

,

,

,

,

.

.

,

,

,

,

.

.

,

,

Yes

Yes

No

No

,

,

,

,

2012 SD 100

2012 SD 100