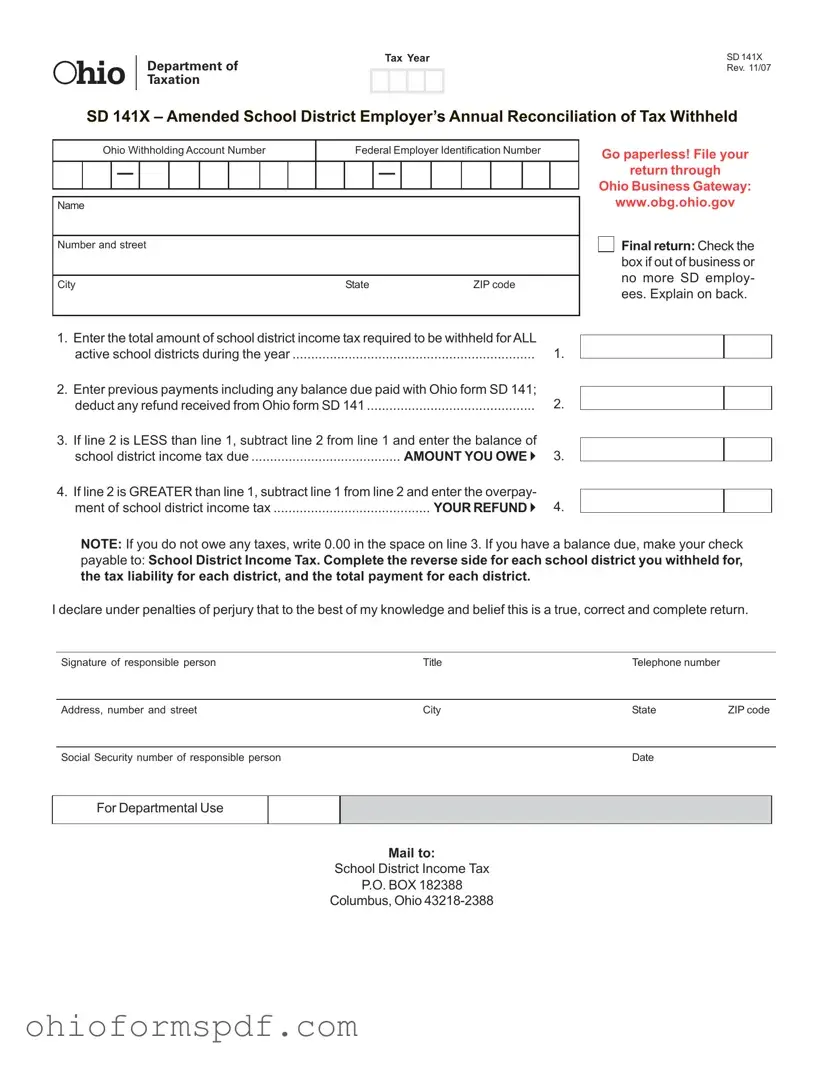

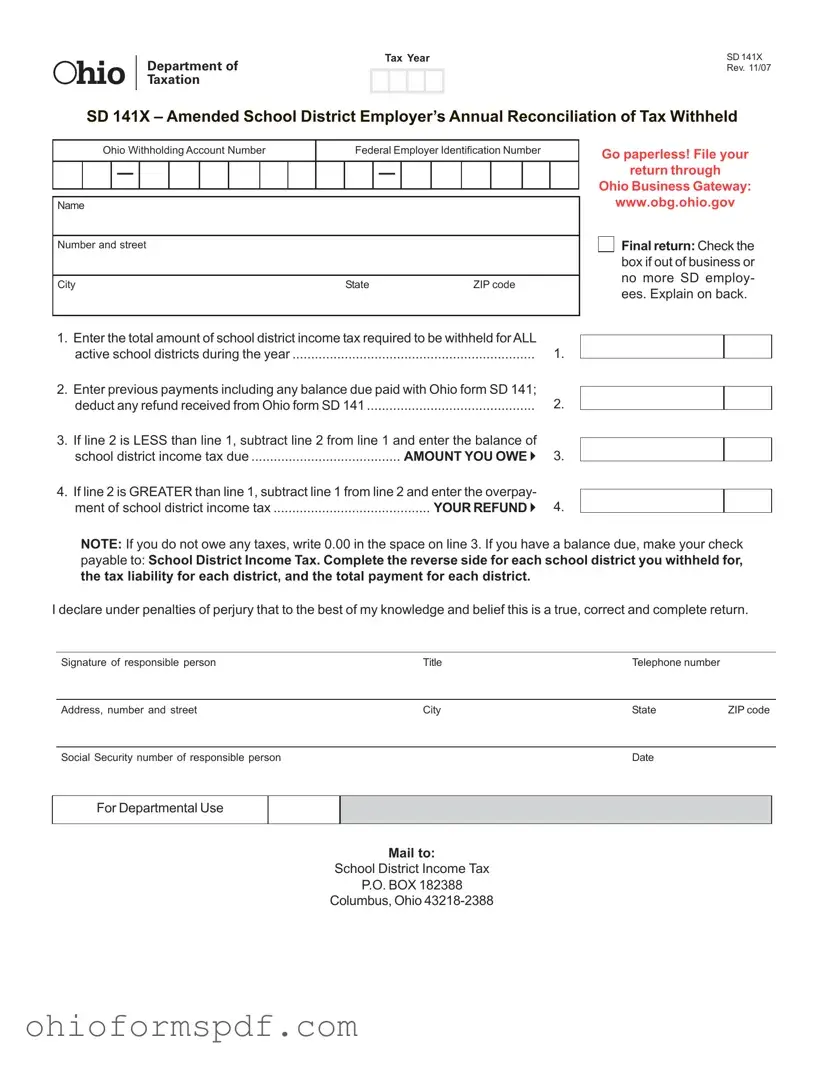

What is the Ohio SD 141X form?

The Ohio SD 141X form is known as the Amended School District Employer’s Annual Reconciliation of Tax Withheld. It is a document that employers need to fill out if they need to make corrections to the initially reported school district income tax withholdings. This can be due to reporting errors, adjustments or any other modifications to the taxes that were withheld for the benefit of school districts in Ohio during a particular tax year.

Who needs to file the Ohio SD 141X form?

Employers who have previously submitted the Ohio form SD 141 and need to amend the amount of school district income tax withheld for their employees must file the Ohio SD 141X form. This requirement is applicable if the employer discovers any errors or changes that affect the reported withheld tax amount for any of the school districts they have withheld taxes for.

What information is required to complete the SD 141X form?

To accurately fill out the SD 141X form, employers must provide their Ohio Withholding Account Number, Federal Employer Identification Number, and the complete address of the business. Additionally, the form requires the total amount of school district income tax that was required to be withheld, any previous payments including balance due paid or refunds received, and calculations to determine either the amount owed or refund due based on the adjusted withholdings.

How does one calculate the amended amount due or refund on this form?

Calculations on the SD 141X form involve comparing the total amount of school district income tax that was required to be withheld against the sum of any previous payments made or refunds received. If the corrected total required withholding exceeds what has already been paid, this difference represents the additional amount owed. Conversely, if initial payments exceed the corrected total required withholding, this overpayment amount is eligible for a refund to the employer.

Can this form be filed electronically?

Yes, the Ohio Department of Taxation encourages employers to file the SD 141X form electronically through the Ohio Business Gateway at www.obg.ohio.gov. This digital option offers a faster and more efficient filing process, reducing paperwork and expediting the processing time.

What happens if you discover an error after filing?

If an employer discovers an error in their school district income tax withholding after submitting the SD 141X form, they should file another amended return using the same form to correct any additional inaccuracies, ensuring that their tax obligations are accurately met.

Is there a deadline for filing the SD 141X form?

While the SD 141X form does not have a specific annual filing deadline, it should be submitted as soon as the employer identifies errors or the need for adjustments in previously filed withholding amounts. Prompt correction ensures compliance with Ohio's tax regulations and may prevent possible penalties or interest due to underpayment.

Where should the completed SD 141X form be mailed?

Once completed, the SD 141X form should be mailed to the School District Income Tax office at the address provided on the form: P.O. BOX 182388, Columbus, Ohio, 43218-2388. This ensures that the form is processed by the appropriate department for corrections to be made.

Who can I contact for help or more information about this form?

For assistance or more details on the SD 141X form, employers can reach out to the Ohio Department of Taxation directly. They offer help through their website, or you can contact them via phone. Their knowledgeable staff can provide guidance and answer any specific questions regarding the filing and correction process for school district income tax withholdings.

HIO

HIO