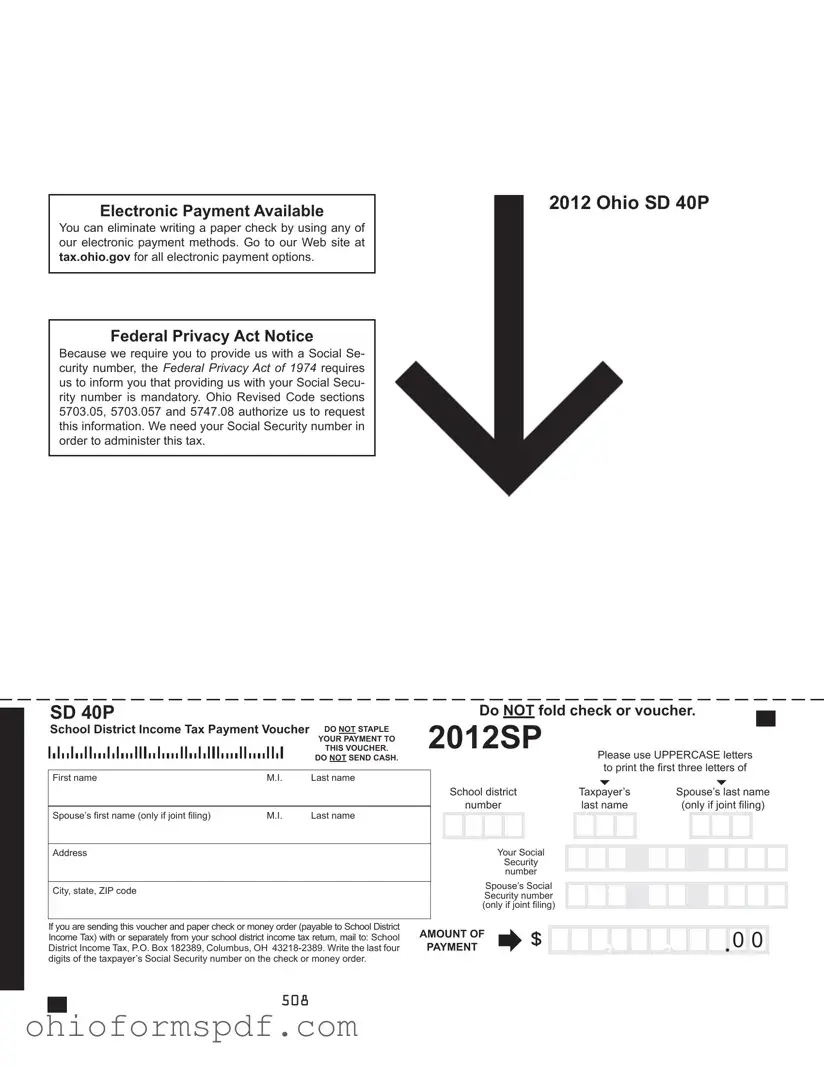

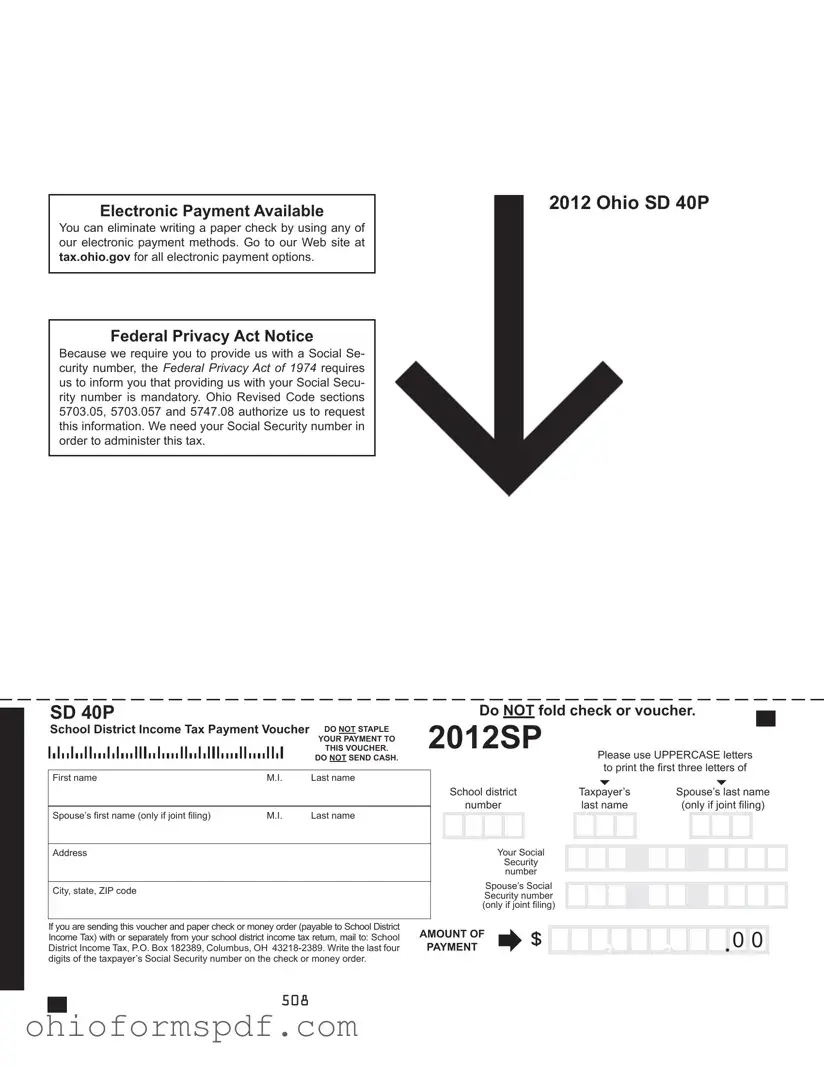

The Ohio Sd 40P form shares similarities with the IRS Form 1040-V, the Payment Voucher for Income Tax. Both forms serve as payment vouchers for taxpayers to submit their payments to the respective tax authority. The 1040-V is used for federal income tax payments, while the Sd 40P is specific to Ohio's school district income tax. Each form requires the taxpayer's Social Security number, payment amount, and advises against sending cash, recommending electronic payment options instead.

Another document mirroring the Sd 40P form is the IRS Form 941-V, Payment Voucher, which is used by employers to submit their quarterly federal tax return payments. Similar to the Sd 40P, this form includes a section for the taxpayer’s information and the payment amount, ensuring the payment is correctly applied to the taxpayer’s account. Both forms underscore the importance of including the taxpayer’s identification number to facilitate correct processing.

The Ohio IT 40P, Income Tax Payment Voucher, is closely related to the Sd 40P form for individuals paying state income taxes in Ohio. Like the Sd 40P, the IT 40P includes spaces for personal identification information, payment amount, and instructions not to send cash. Both forms are tailored to specific Ohio tax payments, distinguishing state income tax from school district income tax responsibilities.

State tax departments in other states have their versions of payment vouchers, akin to Ohio's Sd 40P form, like California's Form 540-V. This voucher is part of the income tax filing process for Californians, requiring similar information to ensure payments are attributed to the correct taxpayer account. Despite the difference in state governance, the underlying purpose and structure of the forms are consistent, facilitating taxpayer compliance.

Form W-2V, Voluntary Withholding Request, although primarily a withholding document, shares some features with the Sd 40P. It concerns tax payments, but from the angle of requesting withholding from social security benefits. Like the Sd 40P, it collects taxpayer identification details and emphasizes security concerns, particularly around Social Security numbers.

The Ohio CAT 12, Payment Voucher for Commercial Activity Tax, is aligned with the Sd 40P in its function as a payment voucher for a specific Ohio tax. Both documents are essential for correctly applying payments to taxpayer accounts, requiring detailed identification and payment information. Each form caters to a distinct tax but operates within Ohio's broader tax system framework, emphasizing electronic payment options.

Federal Form 2290-V, Payment Voucher, part of the Heavy Highway Vehicle Use Tax Return, serves a payment facilitation role similar to the Sd 40P. It is designed for specialized tax obligations at the federal level, needing taxpayer identification and payment details to correctly process the tax associated with heavy vehicle use. The concept of pairing a payment with a voucher for proper crediting runs parallel in both documents.

The Ohio Estate Tax Payment Voucher is analogous to the Sd 40P in that it is designed for settling specific tax liabilities within Ohio—this time, estate taxes. It mirrors the structure and intent of the Sd 40P, by including essential taxpayer information, payment details, and instructions for securely submitting payments, underlining the adaptability of the voucher system across different tax types.