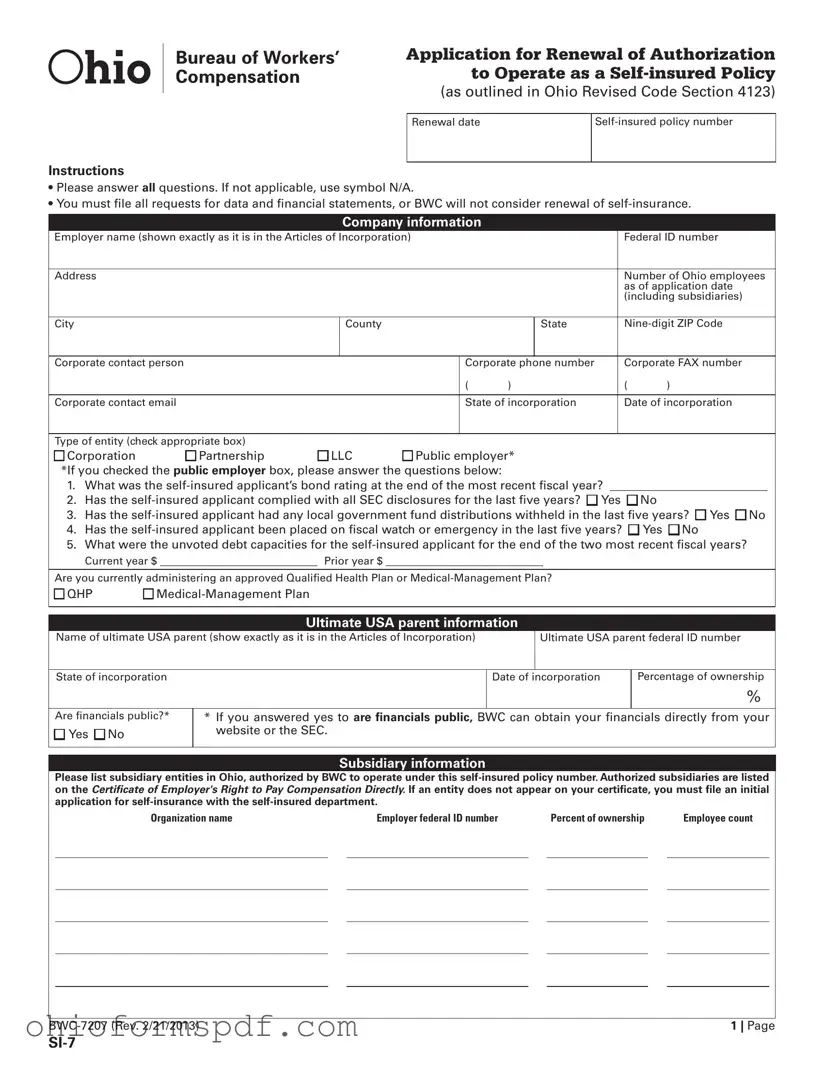

Application for Renewal of Authorization to Operate as a Self-insured Policy

(as outlined in Ohio Revised Code Section 4123)

Self-insured policy number

Instructions

•Please answer all questions. If not applicable, use symbol N/A.

•You must ile all requests for data and inancial statements, or BWC will not consider renewal of self-insurance.

Company information

Employer name (shown exactly as it is in the Articles of Incorporation) |

|

|

|

Federal ID number |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

Number of Ohio employees |

|

|

|

|

|

|

|

|

|

|

as of application date |

|

|

|

|

|

|

|

|

|

|

(including subsidiaries) |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

County |

|

|

|

State |

|

Nine-digit ZIP Code |

|

|

|

|

|

|

|

|

|

Corporate contact person |

|

|

|

|

Corporate phone number |

|

Corporate FAX number |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Corporate contact email |

|

|

|

|

State of incorporation |

|

Date of incorporation |

|

|

|

|

|

|

|

|

|

|

Type of entity (check appropriate box) |

|

|

|

|

|

|

|

|

|

n Corporation |

n Partnership |

n LLC |

n Public employer* |

|

|

*If you checked the public employer box, please answer the questions below: |

|

|

|

|

|

1. |

What was the self-insured applicant’s bond rating at the end of the most recent iscal year? __________________________ |

2. |

Has the self-insured applicant complied with all SEC disclosures for the last ive years? n Yes |

|

n No |

3. |

Has the self-insured applicant had any local government fund distributions withheld in the last ive years? n Yes n No |

4. |

Has the self-insured applicant been placed on iscal watch or emergency in the last ive years? n Yes n No |

5. What were the unvoted debt capacities for the self-insured applicant for the end of the two most recent iscal years? Current year $ __________________________ Prior year $ __________________________

Are you currently administering an approved Qualiied Health Plan or Medical-Management Plan?

n QHP |

n Medical-Management Plan |

Ultimate USA parent information

Name of ultimate USA parent (show exactly as it is in the Articles of Incorporation) |

|

Ultimate USA parent federal ID number |

|

|

|

|

|

State of incorporation |

|

Date of incorporation |

Percentage of ownership |

|

|

|

|

% |

|

|

|

|

|

Are inancials public?* |

* If you answered yes to are financials public, BWC can obtain your inancials directly from your |

n Yes n No |

website or the SEC. |

|

|

|

|

|

|

|

|

|

|

|

|

Subsidiary information

Please list subsidiary entities in Ohio, authorized by BWC to operate under this self-insured policy number. Authorized subsidiaries are listed on the Certificate of Employer's Right to Pay Compensation Directly. If an entity does not appear on your certificate, you must file an initial application for self-insurance with the self-insured department.

Organization name |

|

Employer federal ID number |

|

Percent of ownership |

|

Employee count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BWC-7207 (Rev. 2/21/2013) |

1 | Page |

Subsidiary information

|

Organization name |

|

Employer federal ID number |

|

Percent of ownership |

Employee count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BWC-7207 (Rev. 2/21/2013) |

2 | Page |

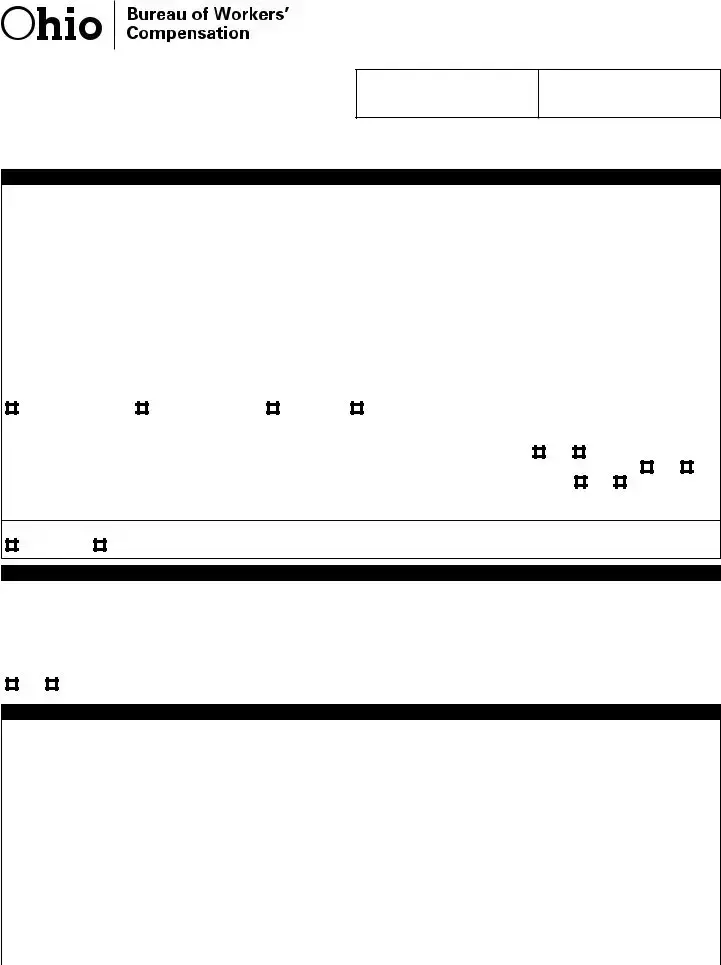

Ohio administrator’s phone number

( )

Corporate restructuring

Please note: For BWC to properly process the referenced revisions, please provide Ohio secretary of state papers and updated organizational chart.

Has your corporate name, structure or ultimate U.S. parent changed during the past year?

If yes, please provide detailed explanation: ____________________________________________________________________________________________

Ohio administrator information

Note:This administrator must be an employee of your company. It cannot be yourTPA.

Has your Ohio administrator changed in the last 12 months? n Yes n No

Does the Ohio administrator have one or more years of experience as a workers' compensation administrator for self-insured employers in Ohio? n Yes n No

Ohio administrator's name

Ohio administrator’s fax number

( )

Ohio administrator’s email address

Authorized representative

Has the authorized representative changed in the last 12 months? n Yes n No

Representative name

Representative identiication number |

Representative phone number |

|

( |

) |

Email address |

|

|

Excess workers' compensation insurance

Does your company carry excess workers' compensation insurance?* n Yes n No

*If you answered yes to does your company carry excess workers' compensation insurance, please submit a copy of the policies declaration page to SIINQ@bwc.state.oh.us

Name of carrier: _____________________________________________________________________________________________________________________

Name of agent: ______________________________________________________Telephone number: (________)____________________________________

Policy number: _______________________________________________________________________________________________________________________

Current policy period: From ______________________________________ to _________________________________________________________________

Self-insured retention: ________________________________________________________________________________________________________________

Is excess insurance paying claims?*

n Yes n No *If yes, please submit claim number(s) on a separate document to siinq@bwc.state.oh.us

Ohio assets and gross payroll information

Calendar and/or iscal year ending __________/__________/__________

MM DD YYYY

Ohio assets: $ ____________________________________________________

Ohio gross payroll: $ ______________________________________________

|

|

Certification |

|

(Notary seal) |

|

|

|

|

|

State of ______________________ County of _________________________ ss _______________________________ being duly sworn says that he/she |

|

is the ____________________________ of ____________________________ , the employer referred to in the foregoing is true to the best of their knowledge. |

|

Sworn to before me, this ________ day of ______________________ , 20_______ . |

|

|

|

|

|

|

|

Notary signature |

|

Corporate oficer signature |

|

|

|

|

|

|

BWC-7207 (Rev. 2/21/2013) |

|

|

3 | Page |

|

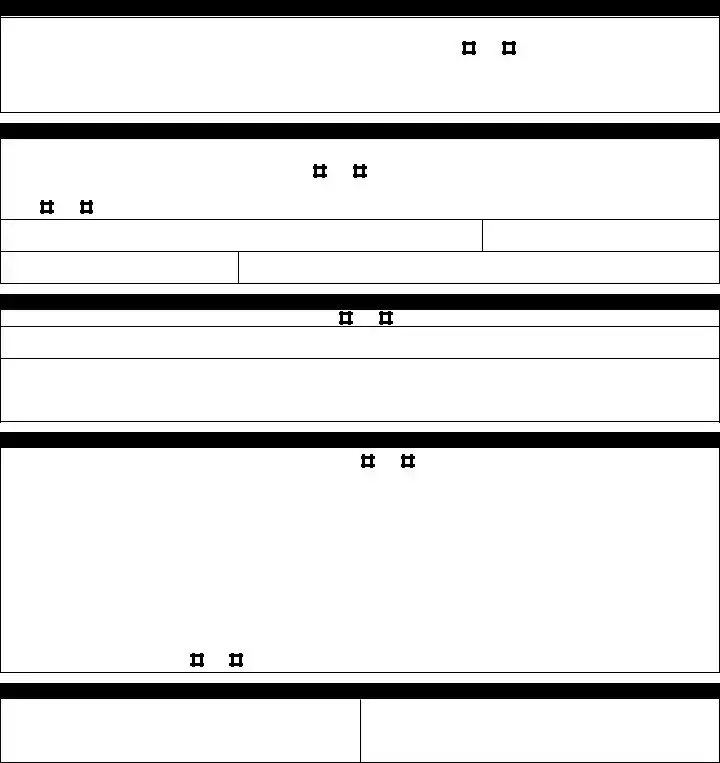

Claim File Housing Locations |

Instructions |

Self-insured policy number: ______________________ |

• Indicate all locations where you maintain claims records for auditing |

Company: ______________________________________ |

purposes (including authorized reps). |

This form completed by

Name and title

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

BWC-7207 (Rev. 2/21/2013) |

4 | Page |

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

BWC-7207 (Rev. 2/21/2013) |

5 | Page |

SI-7

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

Company/authorized representative: _________________________________________________________________________

Contact name: ______________________________________________________________________________________________

Telephone number: __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Email address: _________________________________________________________________________________________________

Date range of claims: _________________________________________________________________________________________

Approximate number of claims housed in this location? _______________________________________________________

BWC-7207 (Rev. 2/21/2013) |

6 | Page |

SI-7

|

Subsidiary Update Request |

Instructions |

Self-insured policy number: ________________________ |

• List all approved subsidiary entities, including address, |

|

contact, phone and email information. |

Company: _________________________________________ |

This form completed by

Name and title

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

BWC-7207 (Rev. 2/21/2013) |

7 | Page |

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

|

|

Subsidiary name: _________________________________________ |

|

|

Attention:_________________________________________________ |

|

|

Telephone number: _______________________________________ |

|

|

Address:__________________________________________________ |

The existing subsidiary has been |

|

Closed |

Sold |

__________________________________________________________ |

Check if there are no changes |

Email address: ____________________________________________ |

|

|

|

BWC-7207 (Rev. 2/21/2013) |

8 | Page |

SI-7