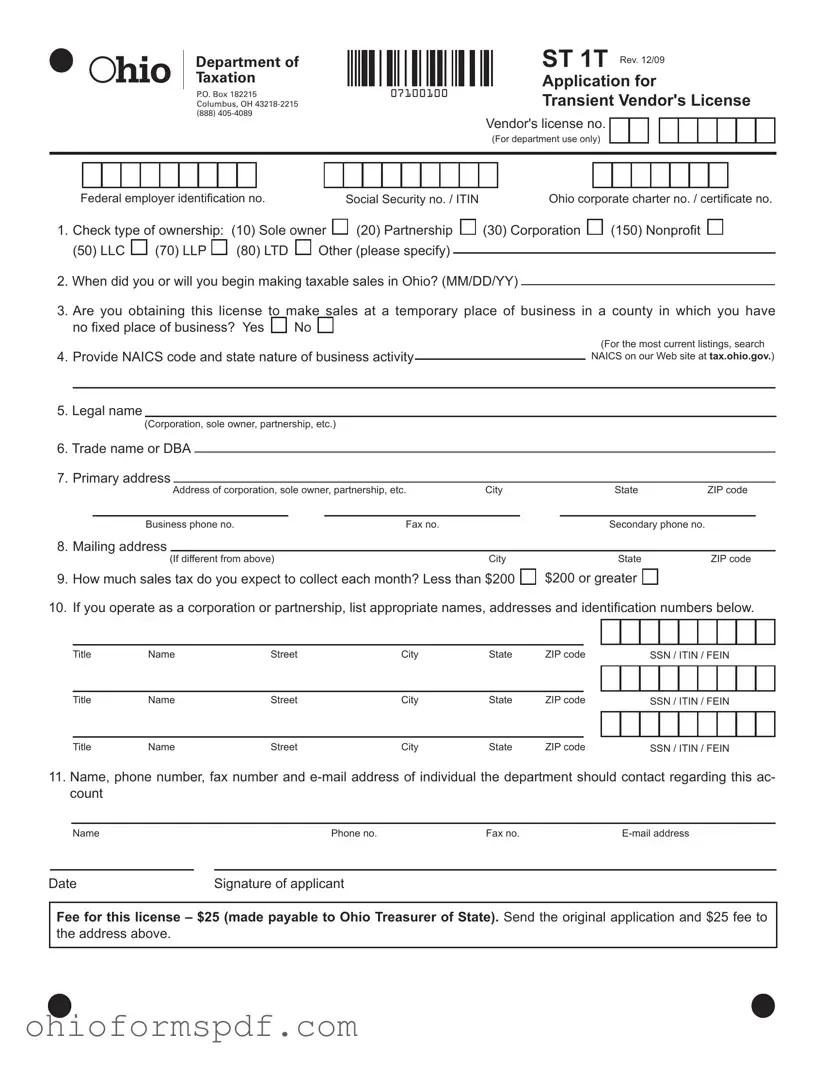

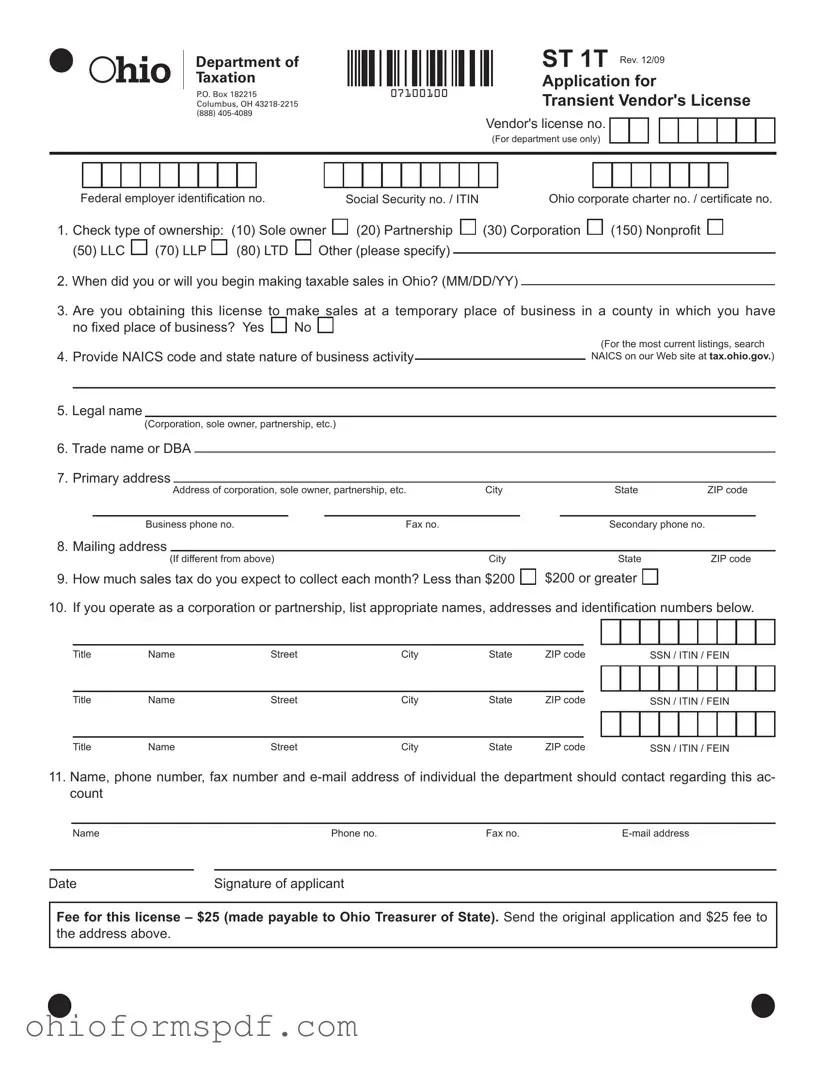

What is the Ohio St 1T form?

The Ohio St 1T form is an application used by businesses to obtain a Transient Vendor's License in Ohio. This license is required for vendors who plan to make sales at temporary locations within the state, in areas where they do not have a fixed place of business. The form collects basic information about the business, such as type of ownership, nature of business activity, and expected monthly sales tax collection, among other details.

Who needs to fill out the Ohio St 1T form?

Any vendor intending to sell goods or services at temporary locations in Ohio and does not have a permanent physical location in the county of those sales needs to complete the Ohio St 1T form. This includes sellers at fairs, festivals, trade shows, or similar events. Whether you're a sole proprietor, partnership, corporation, or operate under another business structure, if you’re conducting temporary sales in Ohio, this form applies to you.

What information do I need to provide on the Ohio St 1T form?

When completing the Ohio St 1T form, you will need to provide your business's legal name, trade name (if applicable), primary and mailing addresses, and contact information. Additionally, you must indicate your business structure (e.g., sole proprietorship, corporation), the date you began or will begin making taxable sales in Ohio, and your North American Industry Classification System (NAICS) code that reflects your main business activity. Information about expected monthly sales tax and names and personal details of corporate officers or partners, if applicable, are also required.

How much does it cost to apply for a Transient Vendor's License in Ohio?

The application fee for a Transient Vendor's License in Ohio is $25. Payments must be made payable to the Ohio Treasurer of State. This fee must accompany your completed Ohio St 1T form when submitting your application to the Department of Taxation. Remember, the licensing fee is for processing your application and is required for each transient vendor's license you apply for.

Where do I send the Ohio St 1T form and fee?

Once you have completed the Ohio St 1T form and attached the $25 application fee, you should send these documents to the Ohio Department of Taxation at the following address: P.O. BOX 182215, COLUMBUS, OH 43218-2215. Make sure all information provided is accurate and that the application fee is included to avoid any delays in processing your Transient Vendor's License.

HIO

HIO

(20) Partnership

(20) Partnership

(30) Corporation

(30) Corporation

(150) Nonprofi t

(150) Nonprofi t

(50) LLC

(50) LLC  (70) LLP

(70) LLP  (80) LTD

(80) LTD  Other (please specify)

Other (please specify)