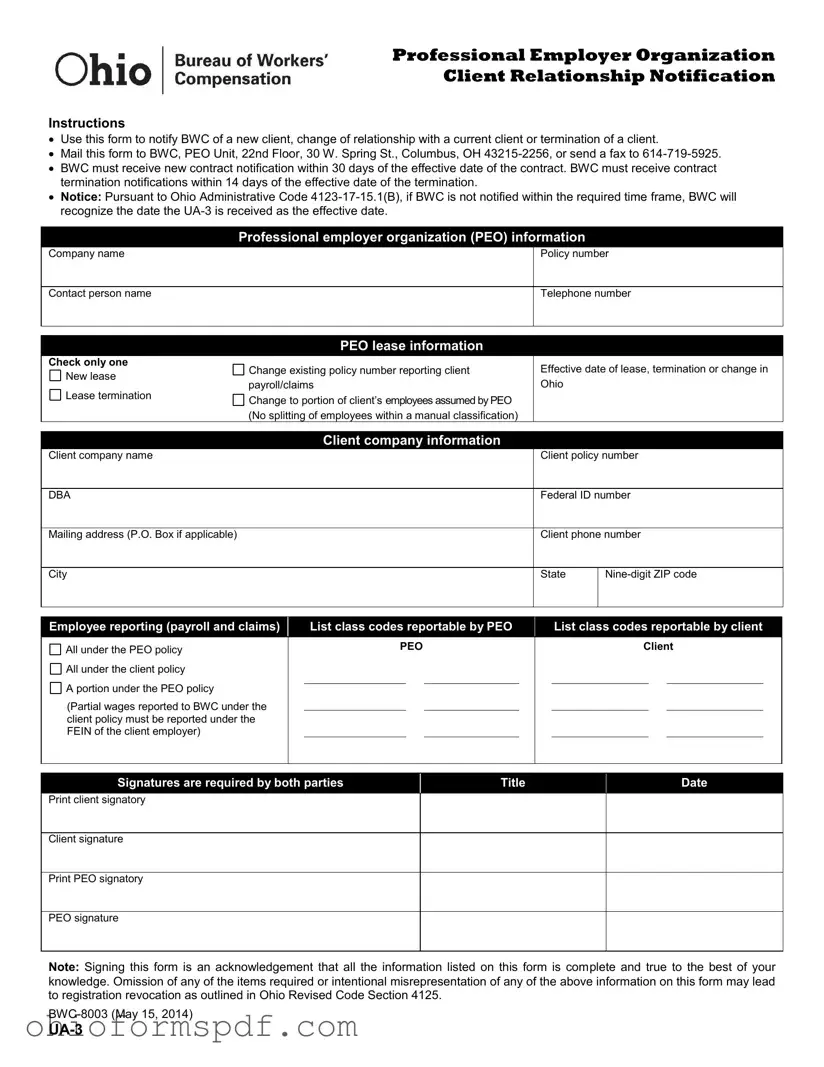

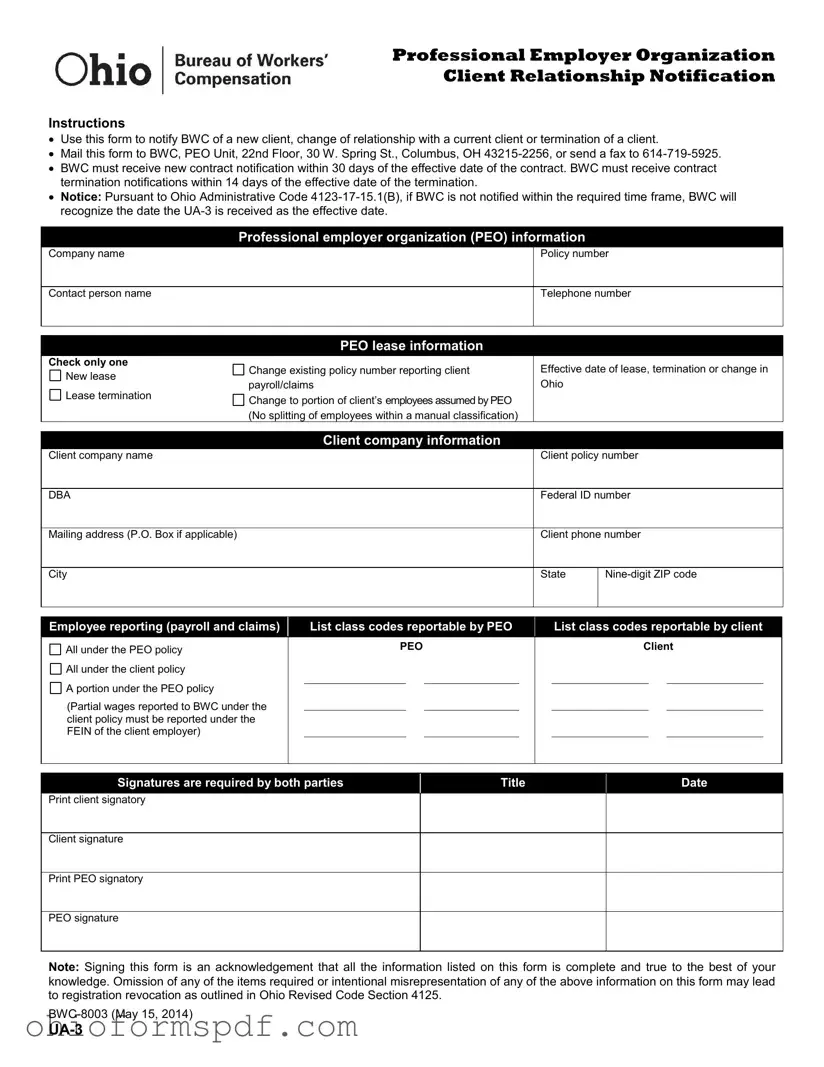

What is the Ohio UA-3 form, and when is it used?

The Ohio UA-3 form is utilized for notifying the Bureau of Workers' Compensation (BWC) about the commencement, alteration, or termination of a relationship between a Professional Employer Organization (PEO) and its client. This form plays a crucial role in ensuring that workers' compensation coverage is correctly administered and attributed to either the PEO or the client company, depending on the specifics of their contract. It must be submitted to BWC when a new client relationship is established, when there's a change in the nature of an existing relationship, or when a client relationship is terminated.

How and where should the Ohio UA-3 form be submitted?

The completed Ohio UA-3 form should be mailed to the PEO Unit, on the 22nd Floor, at 30 W. Spring St., Columbus, OH 43215-2256. Alternatively, it can be faxed to 614-719-5925. This procedure ensures that the BWC is informed promptly of any changes in professional employer organization client relationships, enabling the BWC to maintain accurate records for workers' compensation insurance purposes.

What are the deadlines for submitting the Ohio UA-3 form?

There are specific deadlines for submitting the Ohio UA-3 form to the BWC. For new contract notifications, the form must be received within 30 days of the contract's effective date. In the case of contract termination notifications, the form must be submitted within 14 days of the contract termination date. Adhering to these deadlines is critical to avoid potential issues or penalties related to workers' compensation coverage.

What happens if the Ohio UA-3 form is not submitted within the required time frame?

Failure to submit the Ohio UA-3 form within the mandated timelines can lead to the Bureau of Workers' Compensation recognizing the submission date of the UA-3 as the effective date of the contract or termination. This may result in discrepancies in coverage dates and could potentially affect the accuracy of workers' compensation insurance records. To avoid such complications, it is essential to ensure timely submission of this form.

What information is required on the Ohio UA-3 form?

The Ohio UA-3 form requires comprehensive information about the PEO and client relationship, including company names, policy numbers, and contact details of both parties. It also necessitates details on the type of change being reported—whether it's a new lease, termination of the lease, or a change in the portion of the client's employees assumed by the PEO. Additionally, the form asks for employee reporting details, such as class codes reportable by the PEO and the client, and signatures from both parties as acknowledgement of the completeness and truthfulness of the information provided. Omitting any required item or intentionally misrepresenting information may lead to serious consequences, including registration revocation, as outlined in the Ohio Revised Code Section 4125.