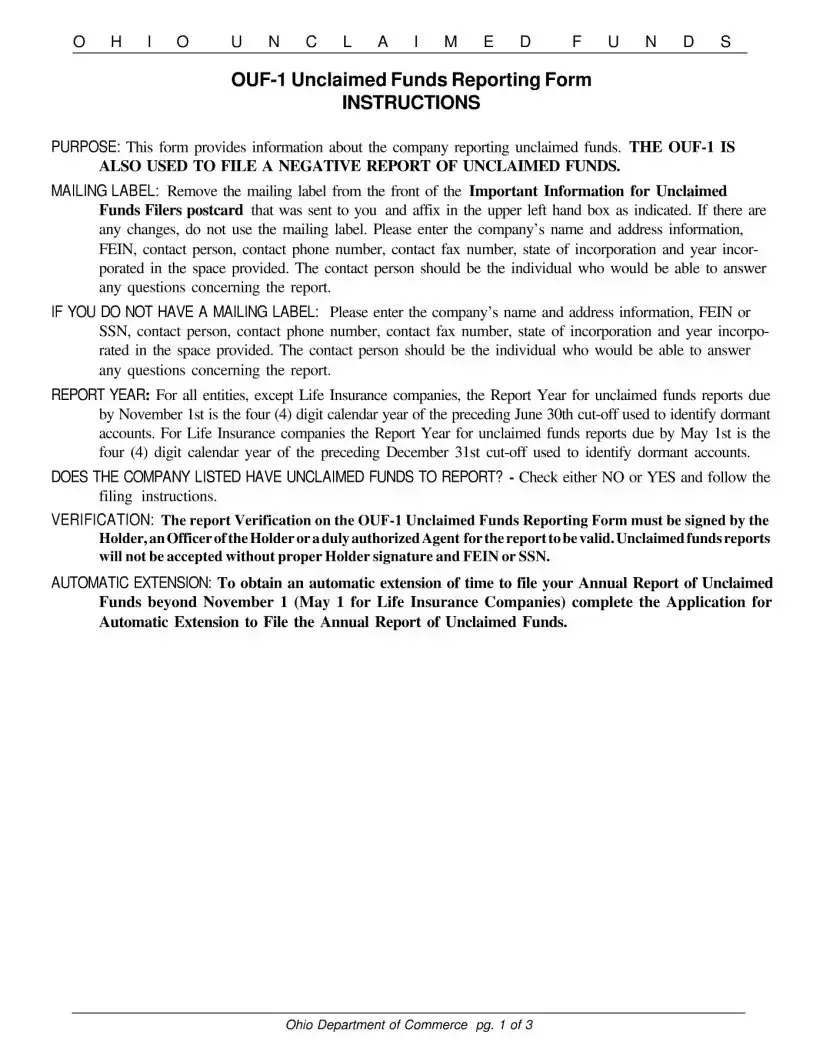

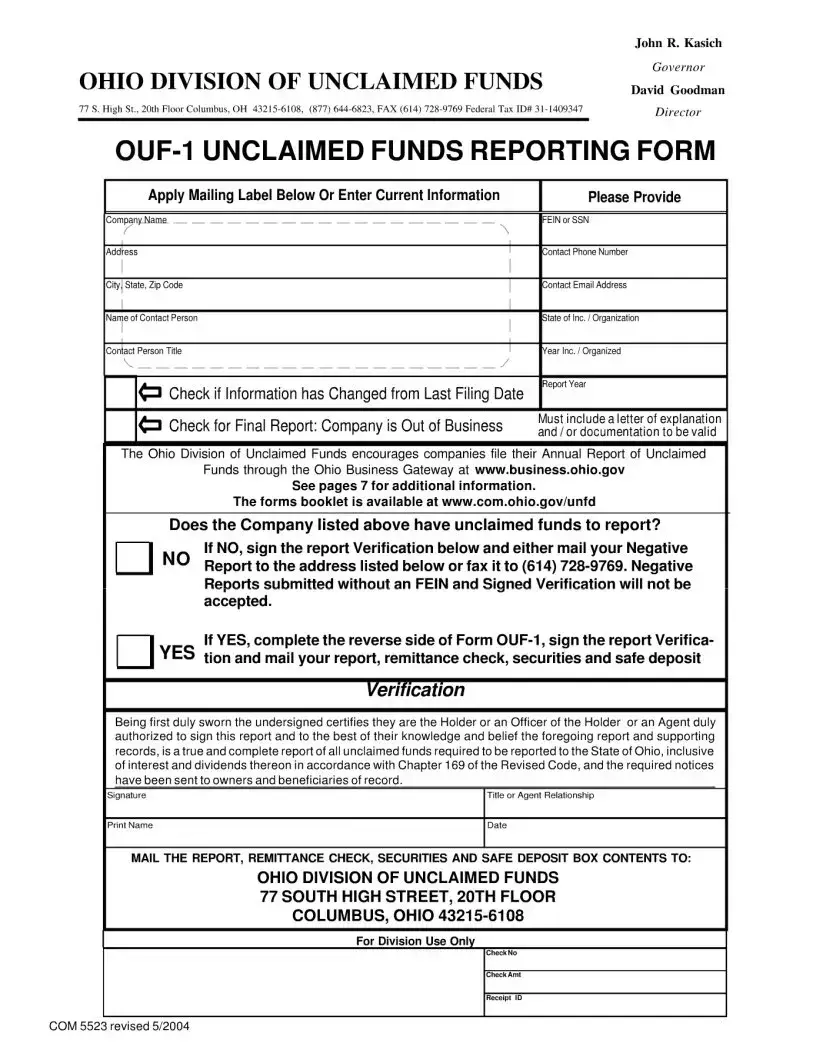

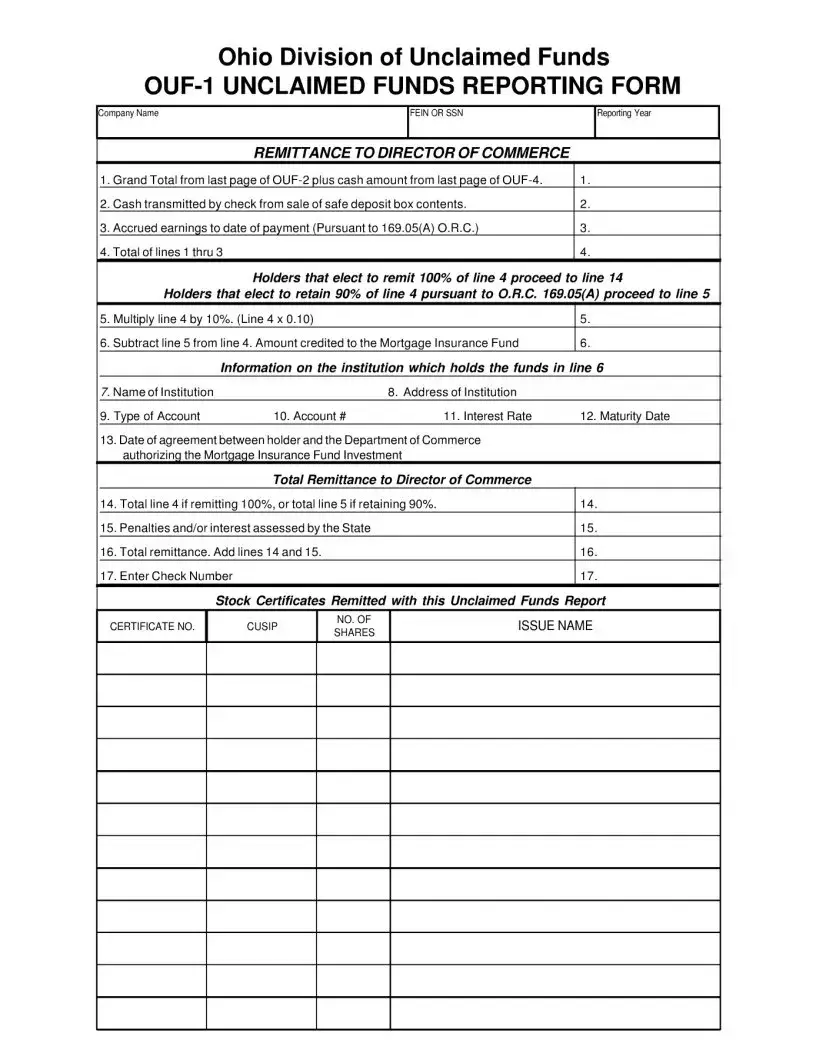

Blank Ohio Unclaimed Template

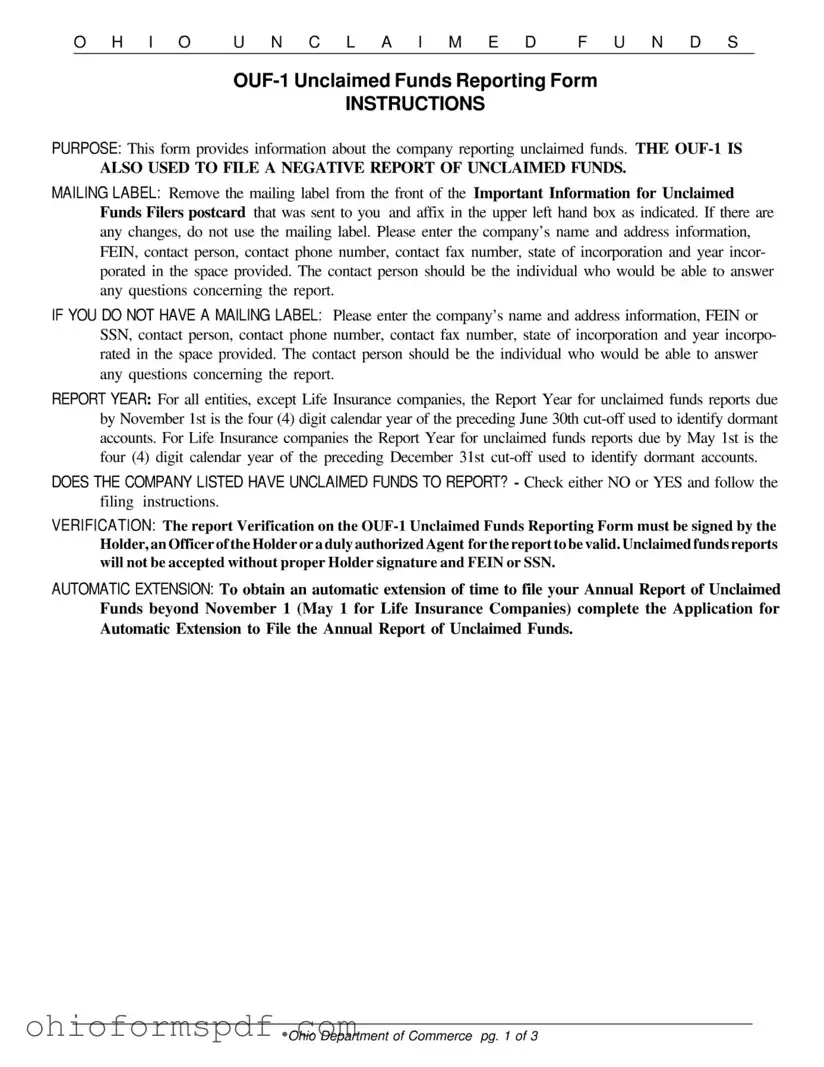

The Ohio Unclaimed form is a document that allows residents to claim funds or property held by the state that has not been claimed by its rightful owner within a certain period. It serves as a bridge between the state's treasury and individuals aiming to retrieve assets that are rightfully theirs but have been forgotten or left behind. This system ensures that these assets are securely held until they can be claimed by their owners or the owners' heirs.

Prepare Form

Blank Ohio Unclaimed Template

Prepare Form

Prepare Form

or

⇩ Ohio Unclaimed PDF

You’re in the middle of the form

Complete Ohio Unclaimed online — edit, save, and download smoothly.