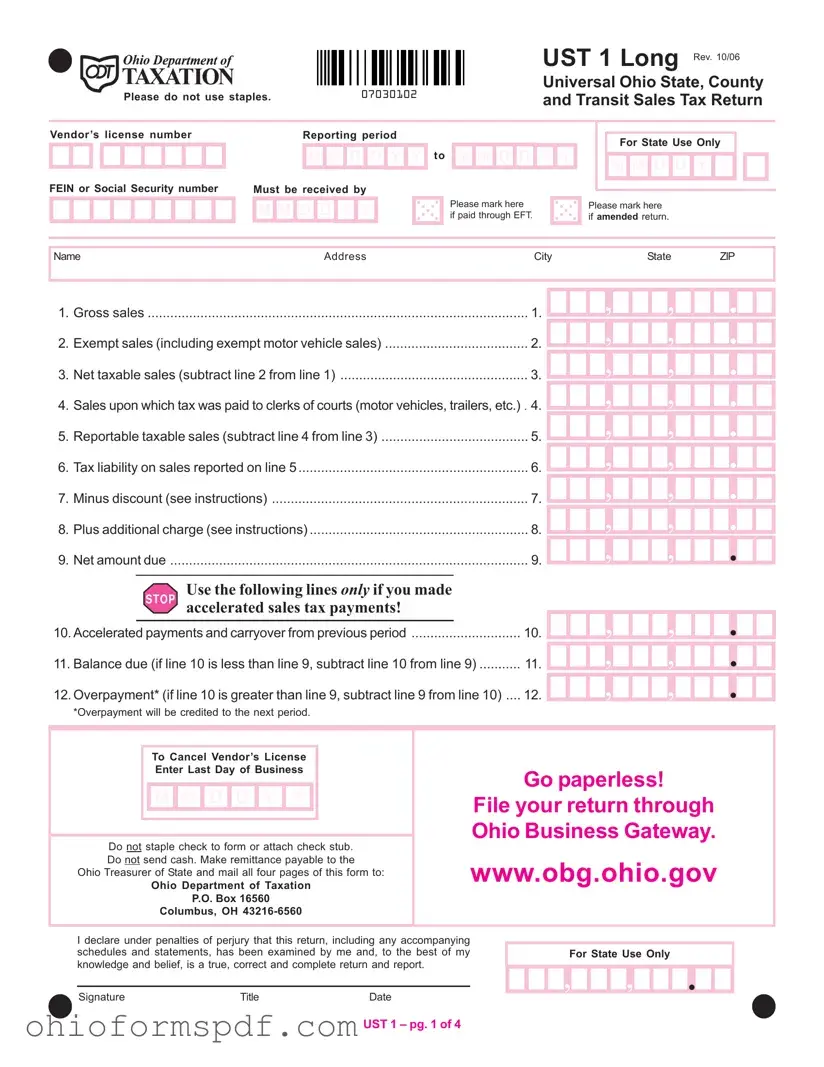

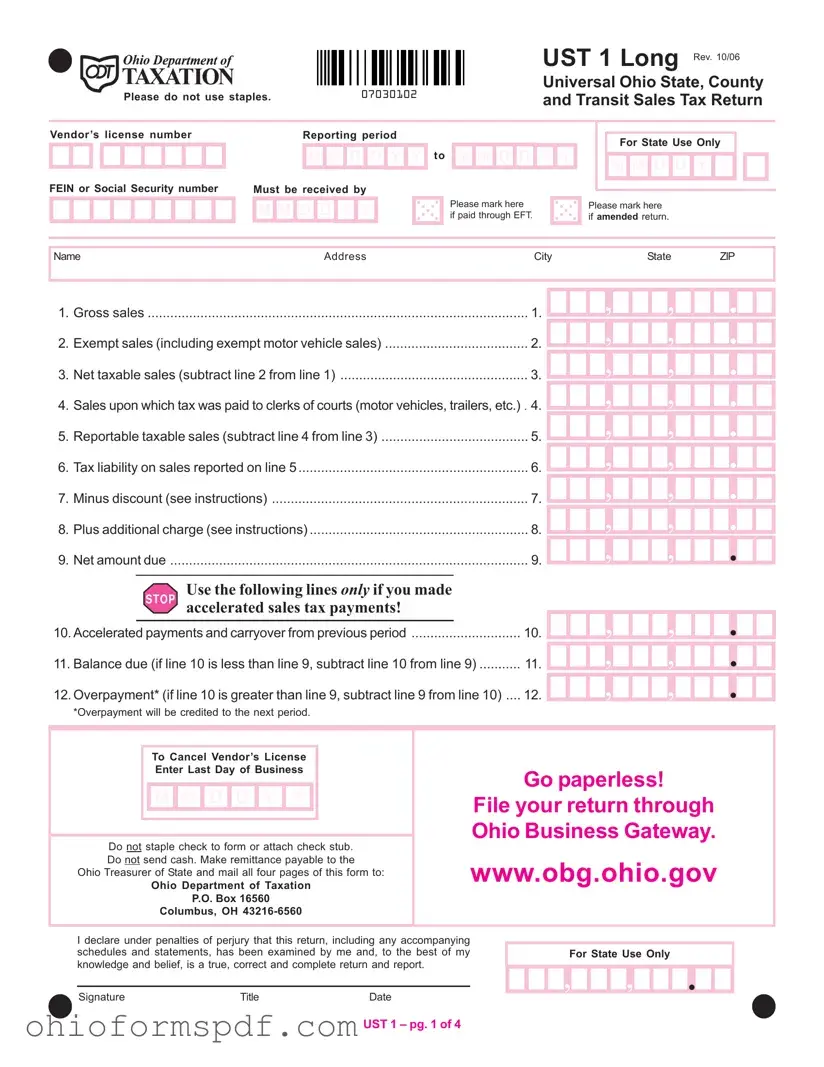

The Ohio UST 1 form, dedicated to reporting state, county, and transit sales tax, has remarkable similarities with other tax forms used across various jurisdictions and tax domains, although each form has its distinct focus and application. One such form is the California Sales and Use Tax Return, which similarly requires businesses to report the total sales, exempt sales, and taxable sales within a specific period. Both forms play crucial roles in their respective states, ensuring that the tax collected on sales and services is accurately reported and paid to the state department of taxation.

Another document that shares a common purpose with the Ohio UST 1 form is the New York Quarterly Sales and Use Tax Return. This form requires New York businesses to detail their sales activities and calculate the sales tax due to the state, closely mirroring the Ohio form's purpose of capturing and taxing economic activities within the state but tailored to New York's tax codes and rates.

The Texas Sales and Use Tax Return is also analogous to the Ohio UST 1 form in that it necessitates businesses in Texas to report gross receipts, subtract exempt sales, and calculate the net taxable sales and the tax due. Both forms serve as vital tools for their respective states in enforcing sales tax laws and regulations, ensuring that the right amount of sales tax is collected from businesses and remitted to the government.

Federal forms, such as the IRS Form 941, Employer's Quarterly Federal Tax Return, though focused on reporting employee wages, federal income tax withheld, and both employee and employer portions of Social Security and Medicare taxes, shares the cyclic reporting nature with the Ohio UST 1 form. Both are instrumental in periodic tax assessments and collections, albeit for different types of taxes and at different levels of governance.

Form VAT 100, used in the United Kingdom for Value Added Tax (VAT) reporting, is similar to the Ohio UST 1 form concerning its role in collecting tax on goods and services. Whilst the VAT system is different from the U.S. sales tax regime, both forms are essential in calculating and reporting the tax levied on the sale of goods and services and ensuring compliance with tax laws.

The General Excise Tax (GET) Return in Hawaii, though specific to Hawaii's unique tax system which applies broadly to business activities, resembles the Ohio UST 1 in its function of tax reporting. Businesses must report their total income and calculate the tax due based on their activities, reflecting the Ohio form's purpose of sales tax reporting but under Hawaii's distinct GET system.

Canada’s GST/HST Return highlights international similarities, requiring Canadian businesses to report gross sales, calculate the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) payable, or claim refunds. This reflects the Ohio UST 1’s essential role in a different national context, ensuring the accurate reporting and remittance of sales-related taxes.

Lastly, the European Union’s VAT Return, applicable across member states, mandates businesses to report their sales and purchases to calculate VAT owed or reclaimable. Despite the differences in tax framework and governance, both the EU VAT Return and the Ohio UST 1 form underscore the necessity of transparent, periodic tax reporting to support fiscal and economic policies.

Through these comparisons, it's evident that while tax forms like the Ohio UST 1 serve specific jurisdictions and taxes, their core functions—collecting data on taxable activities, ensuring compliance, and facilitating the accurate calculation and remittance of taxes—are universally fundamental across different tax systems globally.

M

M D

D  D

D  Y

Y  Y

Y M

M  D

D  D

D  Y

Y  Y

Y

M

M D

D  D

D  Y

Y  Y

Y M

M  D

D  D

D  Y

Y  Y

Y

,

,

,

,