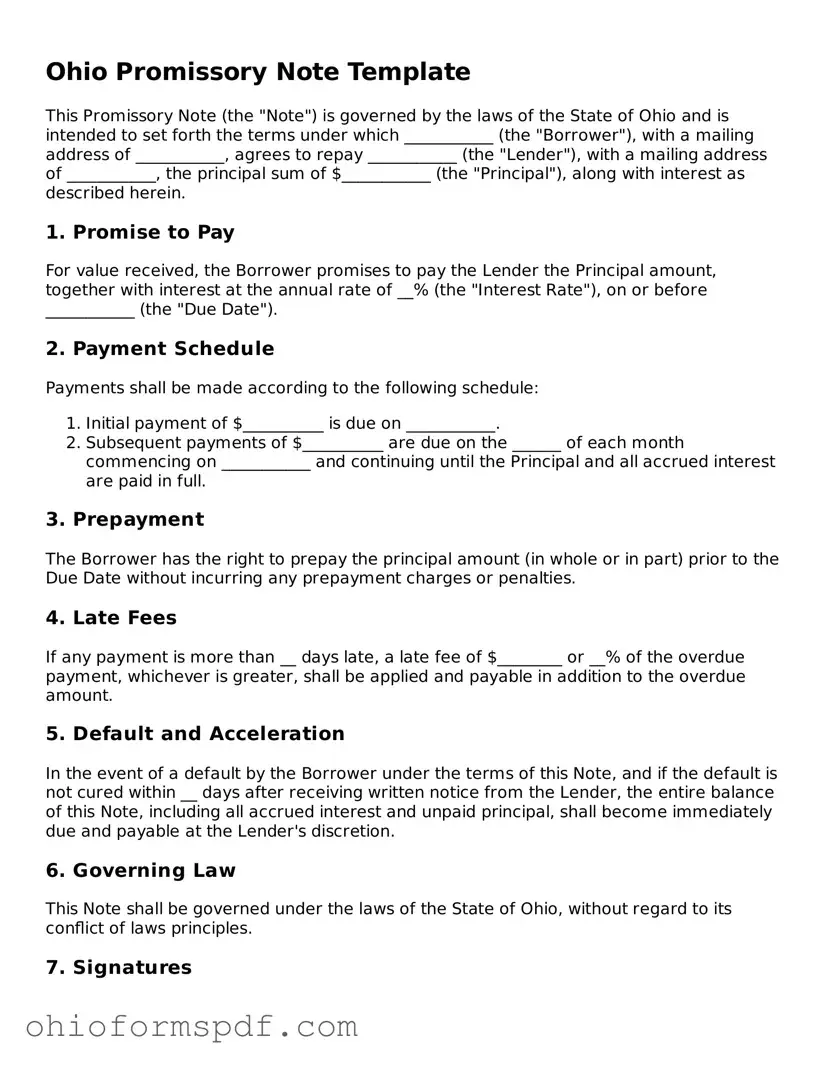

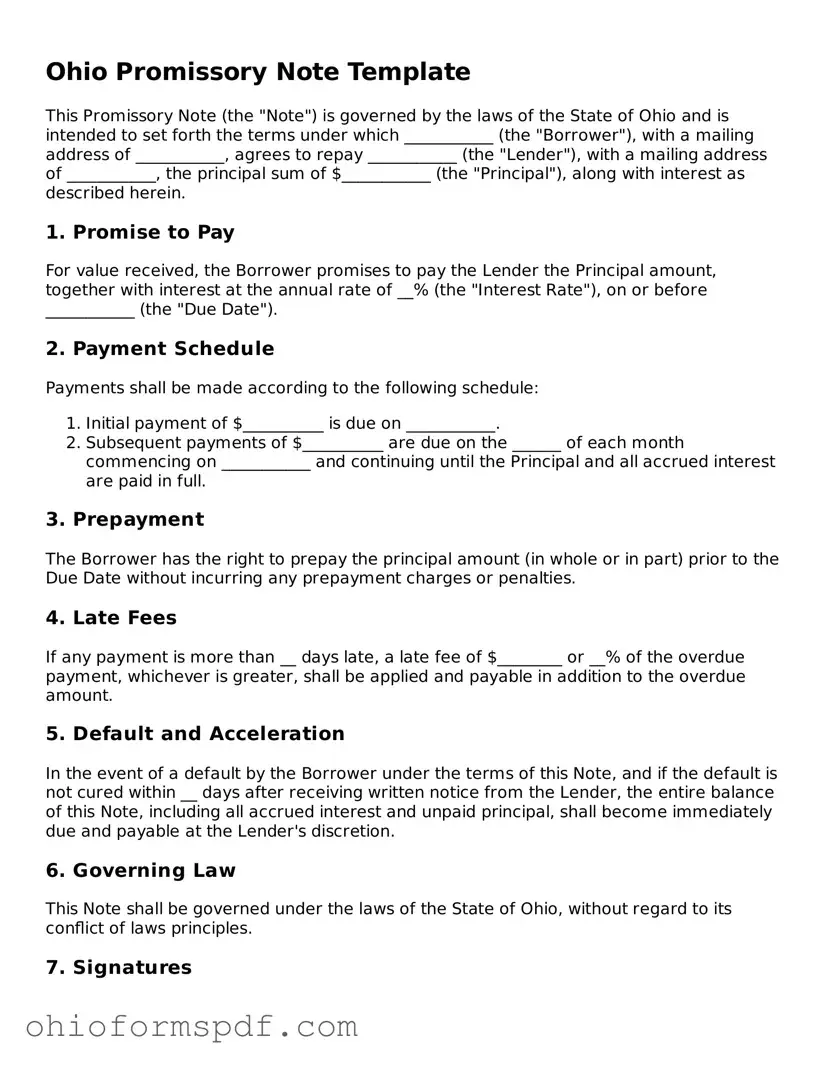

Blank Ohio Promissory Note Form

A promissory note is a written promise to pay a specified amount of money to another party under agreed-upon terms. In Ohio, like in other states, this legal document delineates the loan details, including the repayment schedule, interest rate, and actions in case of default. It serves as a crucial instrument for lending and borrowing, ensuring clarity and legal enforceability between parties.

Prepare Form

Blank Ohio Promissory Note Form

Prepare Form

Prepare Form

or

⇩ Promissory Note PDF

You’re in the middle of the form

Complete Promissory Note online — edit, save, and download smoothly.