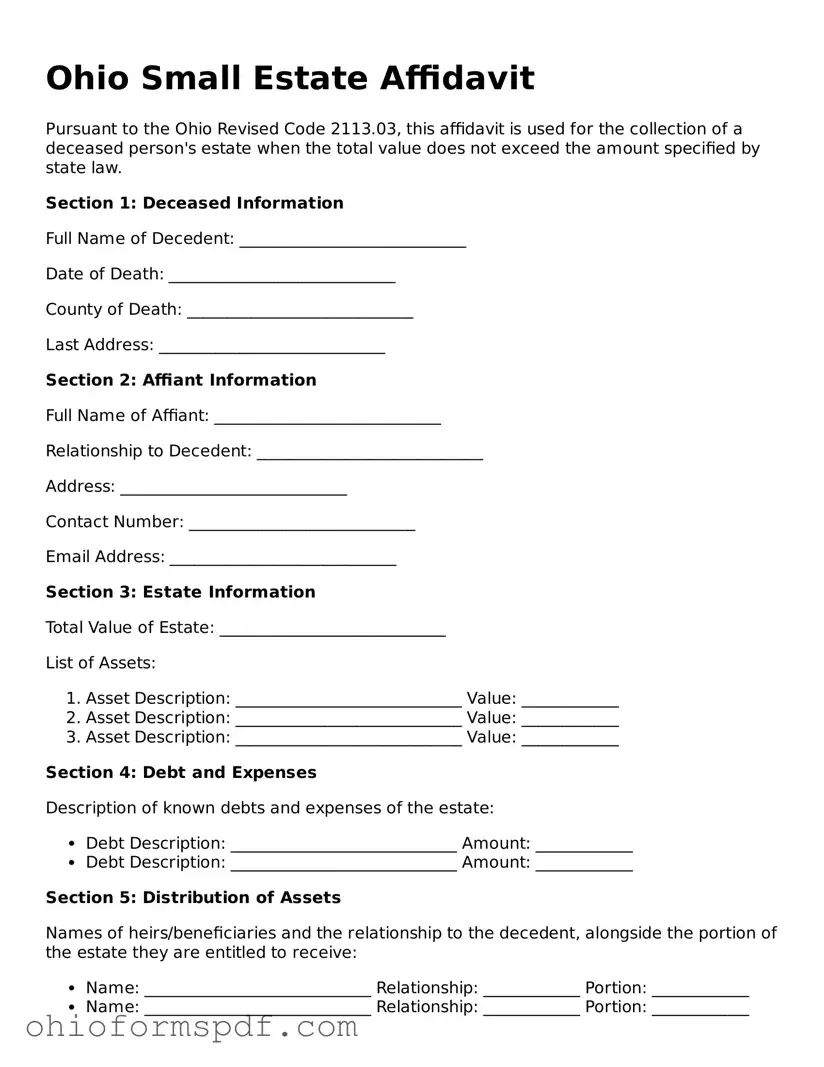

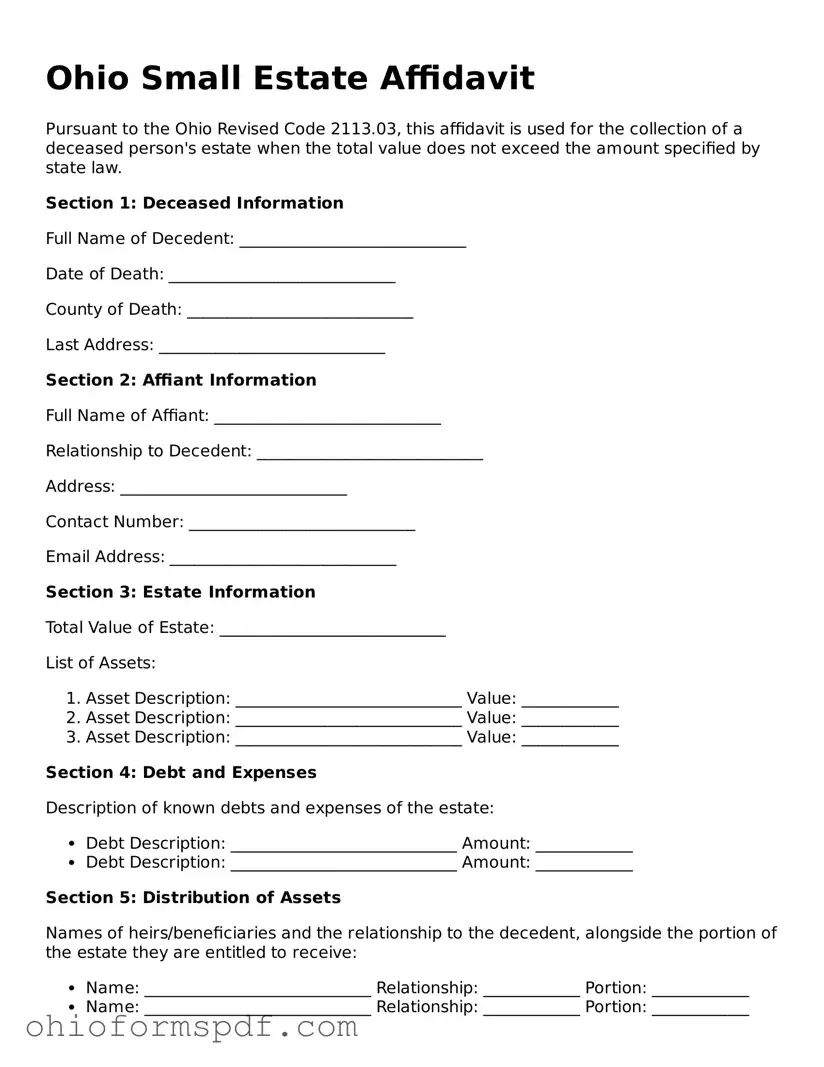

Blank Ohio Small Estate Affidavit Form

The Ohio Small Estate Affidavit form is a legal document used to handle minor estates without formal probate. It simplifies the process for distributing a deceased person's assets to rightful heirs or beneficiaries when the estate's value falls below a certain threshold. This form serves as an efficient way to manage and settle small estates in Ohio.

Prepare Form

Blank Ohio Small Estate Affidavit Form

Prepare Form

Prepare Form

or

⇩ Small Estate Affidavit PDF

You’re in the middle of the form

Complete Small Estate Affidavit online — edit, save, and download smoothly.