What is the Tax Exempt Ohio form?

The Tax Exempt Ohio form, officially known as the STEC B Rev. 3/15, is a sales and use tax blanket exemption certificate. It allows purchasers to claim an exemption or exception on all purchases of tangible personal property and selected services from a specific vendor. This claim is based on the purchaser's intended use of the items or services, their activity, or both.

Who can use the Tax Exempt Ohio form?

This form can be used by any buyer who is eligible for an exemption under Ohio law, based on the intended use of the purchased goods or services. However, it cannot be used by construction contractors to purchase materials for incorporation into real property under an exempt construction contract, nor can it typically be used by vendors of motor vehicles, titled watercraft, and titled outboard motors, except under specific conditions related to resale.

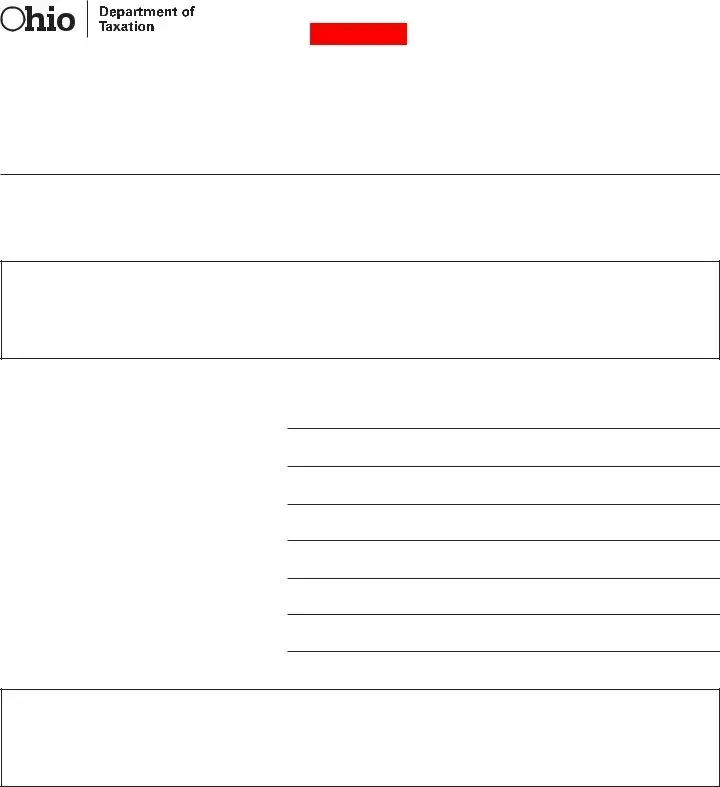

How do I complete the Tax Exempt Ohio form?

To complete the form, the purchaser must provide their name, type of business, street address, city, state, ZIP code, and the signature of an authorized representative, along with their title and the date signed. The purchaser must also include the vendor’s license number, if available, and a valid reason for claiming the exemption.

What reasons can be given for claiming an exemption?

Valid reasons include the purchaser’s proposed use of the items or services in a way that qualifies for an exemption under Ohio tax laws, the activity of the purchaser that qualifies for an exemption, or both. Specific eligibility criteria are outlined in Ohio's tax regulations and codes.

Can this exemption certificate be used for all purchases?

The STEC B certificate is a blanket exemption, meaning it can apply to all eligible purchases of tangible personal property and selected services made from the named vendor. However, it does not apply to items that do not qualify under Ohio tax exemption laws.

Is there a time limit on the use of this exemption certificate?

While the certificate does not explicitly state an expiration date, its validity may depend on the continued eligibility of the purchaser to claim exemption. Purchasers should consult Ohio tax laws or a tax advisor to understand any applicable time limits or re-certification requirements.

Can the certificate be used for purchases made before its completion?

Generally, the exemption certificate is intended for use on purchases made after its completion and signing. If a purchaser seeks to apply the exemption to a previous purchase, they may need to consult with the vendor and potentially amend their tax filings to reflect the exemption.

What happens if I misuse the Tax Exempt Ohio form?

Misuse of the exemption certificate, such as claiming exemption for non-qualifying purchases, can result in penalties, interest, and the revocation of tax exemption privileges. It is crucial to ensure that all claims made with this certificate are fully compliant with Ohio tax laws.

Do I need to submit this form to the Ohio Department of Taxation?

No, this form is not typically submitted to the Ohio Department of Taxation. Instead, it should be provided to the vendor from whom the purchases are made. Vendors are required to retain the certificate for their records to substantiate the exemption claimed by the purchaser.

Are there any special instructions for vendors accepting this form?

Vendors accepting the STEC B certificate should verify that the purchaser's claim of exemption is valid based on the provided reasons and the purchased items or services. Vendors are required to retain a copy of the certificate for their records and may be required to provide proof of exemption claims during audits.