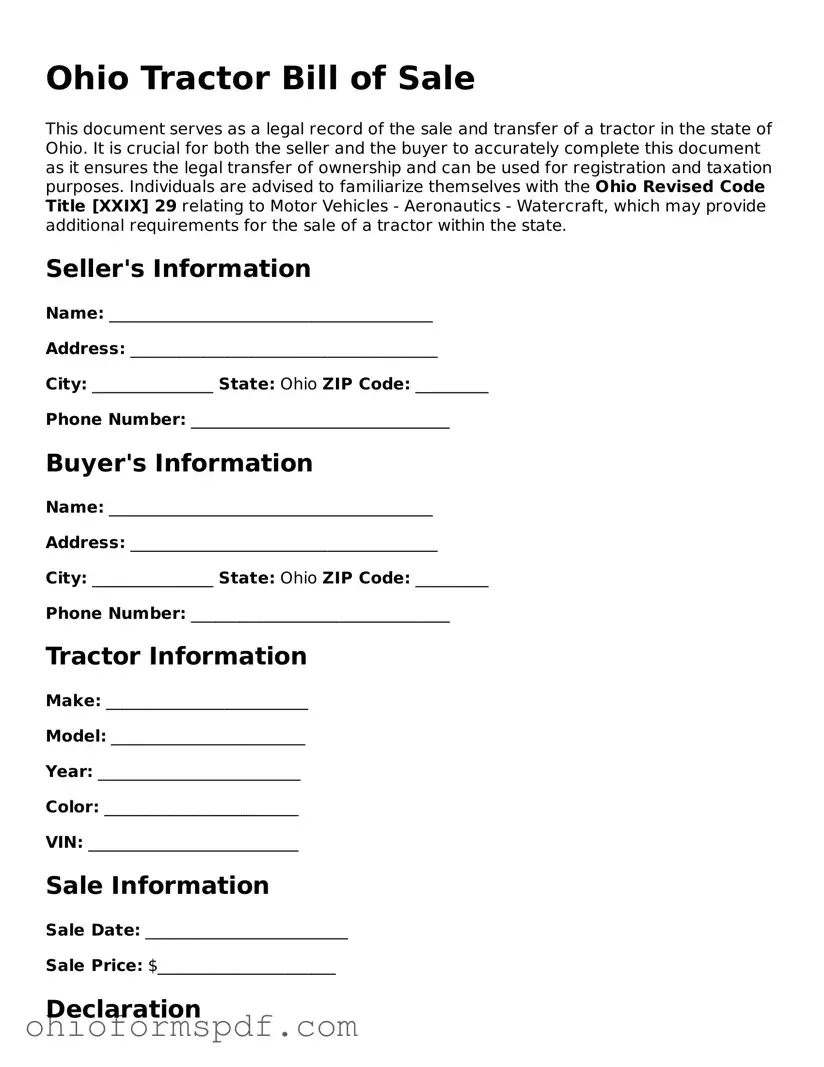

Ohio Tractor Bill of Sale

This document serves as a legal record of the sale and transfer of a tractor in the state of Ohio. It is crucial for both the seller and the buyer to accurately complete this document as it ensures the legal transfer of ownership and can be used for registration and taxation purposes. Individuals are advised to familiarize themselves with the Ohio Revised Code Title [XXIX] 29 relating to Motor Vehicles - Aeronautics - Watercraft, which may provide additional requirements for the sale of a tractor within the state.

Seller's Information

Name: ________________________________________

Address: ______________________________________

City: _______________ State: Ohio ZIP Code: _________

Phone Number: ________________________________

Buyer's Information

Name: ________________________________________

Address: ______________________________________

City: _______________ State: Ohio ZIP Code: _________

Phone Number: ________________________________

Tractor Information

Make: _________________________

Model: ________________________

Year: _________________________

Color: ________________________

VIN: __________________________

Sale Information

Sale Date: _________________________

Sale Price: $______________________

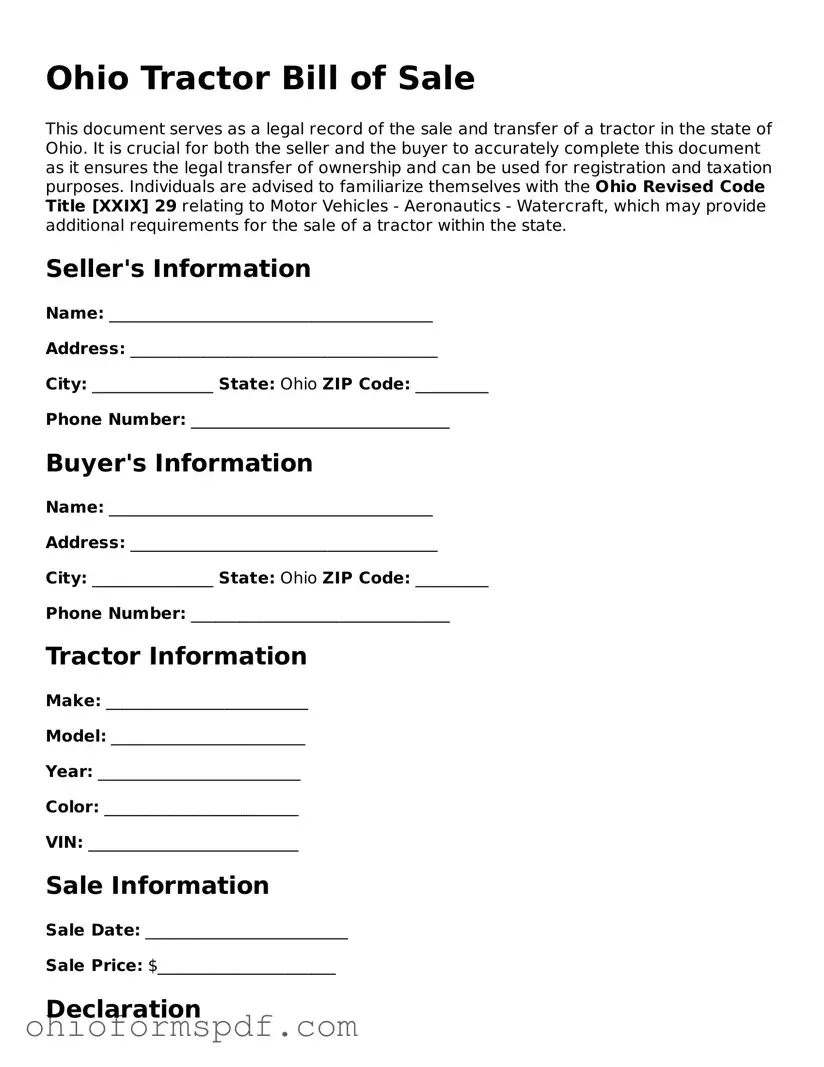

Declaration

I/we, the undersigned, hereby declare the information provided in this Bill of Sale to be true and accurate to the best of my/our knowledge. I/we understand that this document does not attest to the condition of the tractor and is solely a record of the transaction between the buyer and seller.

Signatures

Seller's Signature: ___________________________________ Date: _________

Buyer's Signature: ____________________________________ Date: _________

Witness (If applicable)

Witness's Signature: __________________________________ Date: _________

Print Name: ___________________________________________

Instructions for Seller and Buyer

- Complete all sections of the Bill of Sale with accurate information.

- Ensure both the buyer and seller sign and date the document.

- Keep a copy of the executed Bill of Sale for your records.

- Report the sale to the Ohio Bureau of Motor Vehicles (BMV) if required.

- Consult with the Ohio Revised Code for any additional steps required to complete the sale.

Disclaimer

This template is provided as a general guide and is not intended to provide legal advice. The creators of this template do not assume any liability for inaccuracies or omissions or for any damages resulting from the use of this template. It is recommended to consult with a legal professional for all legal matters pertaining to the sale of a tractor in Ohio.