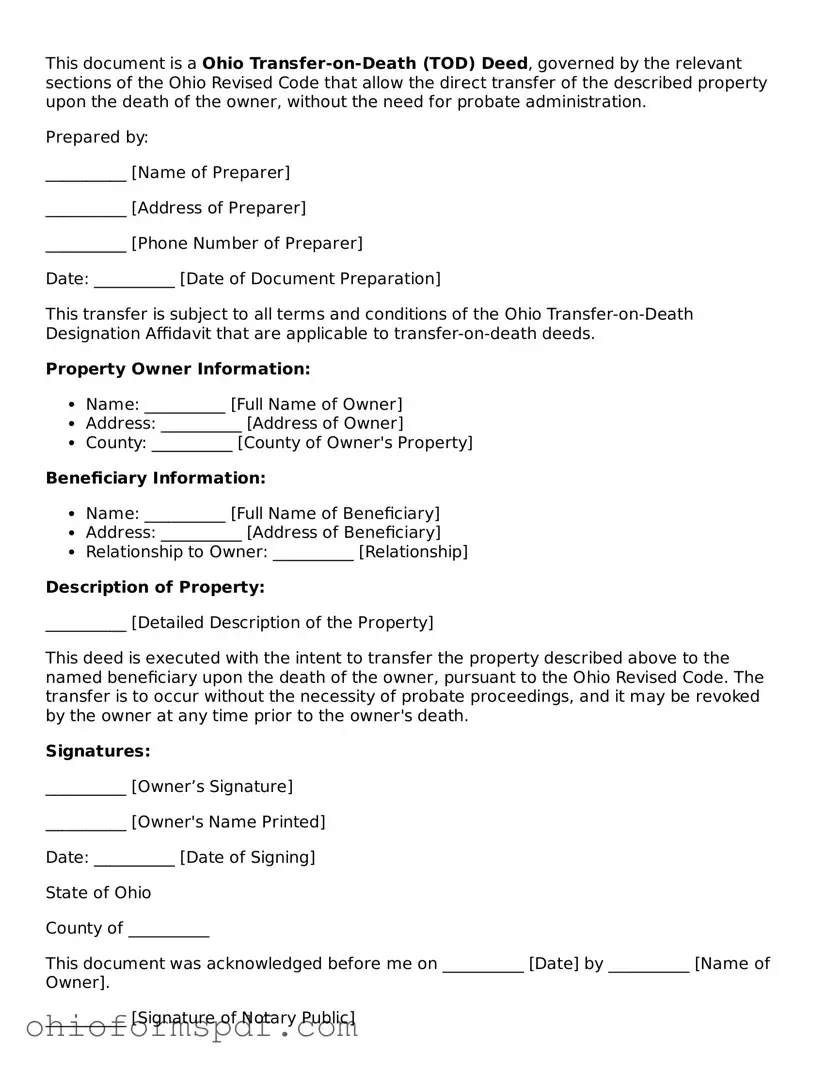

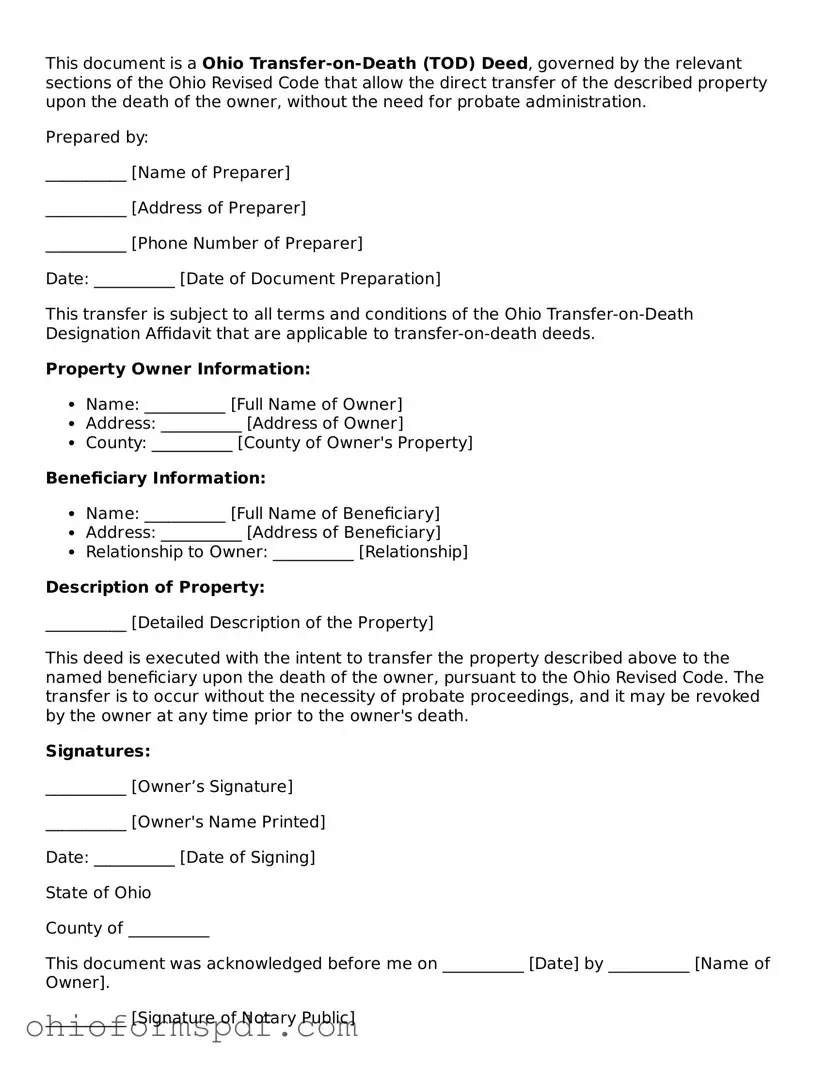

Blank Ohio Transfer-on-Death Deed Form

A Transfer-on-Death Deed form in Ohio allows property owners to pass on their real estate to a designated beneficiary after their death without the need for probate court. This document offers a straightforward way to manage the transfer of property, ensuring a smoother transition for loved ones. It's a valuable tool for estate planning, providing peace of mind for property owners and their beneficiaries.

Prepare Form

Blank Ohio Transfer-on-Death Deed Form

Prepare Form

Prepare Form

or

⇩ Transfer-on-Death Deed PDF

You’re in the middle of the form

Complete Transfer-on-Death Deed online — edit, save, and download smoothly.