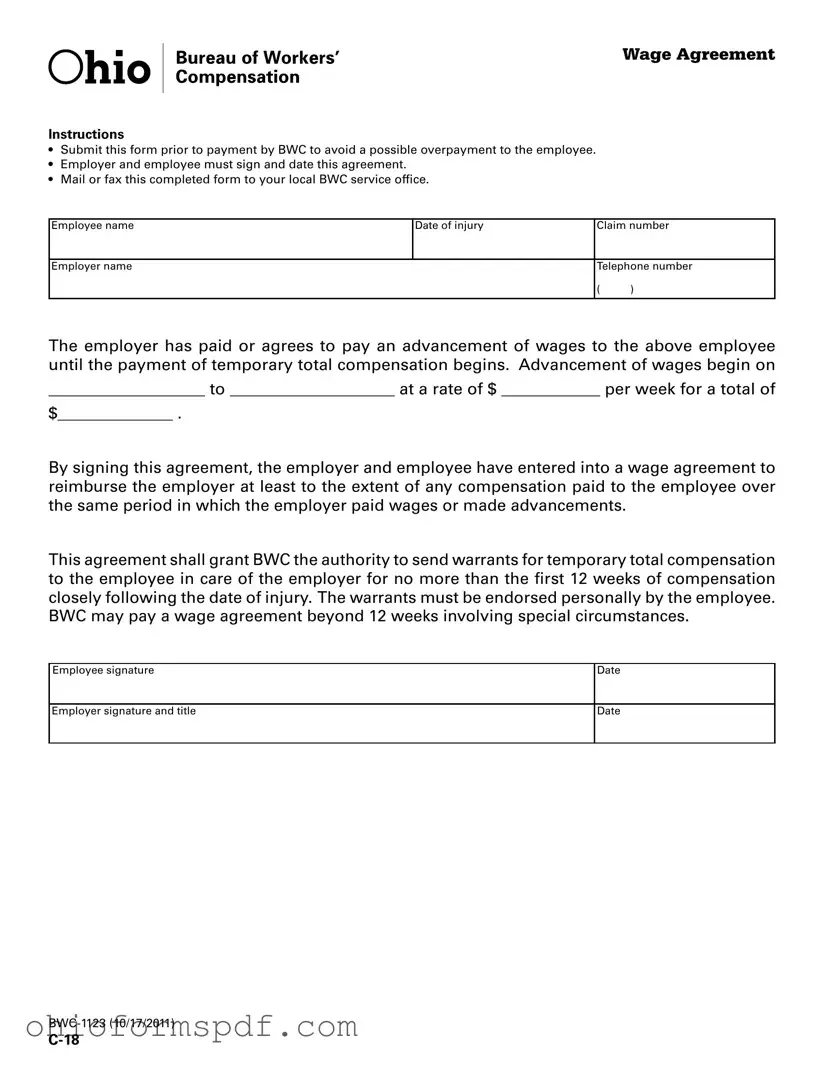

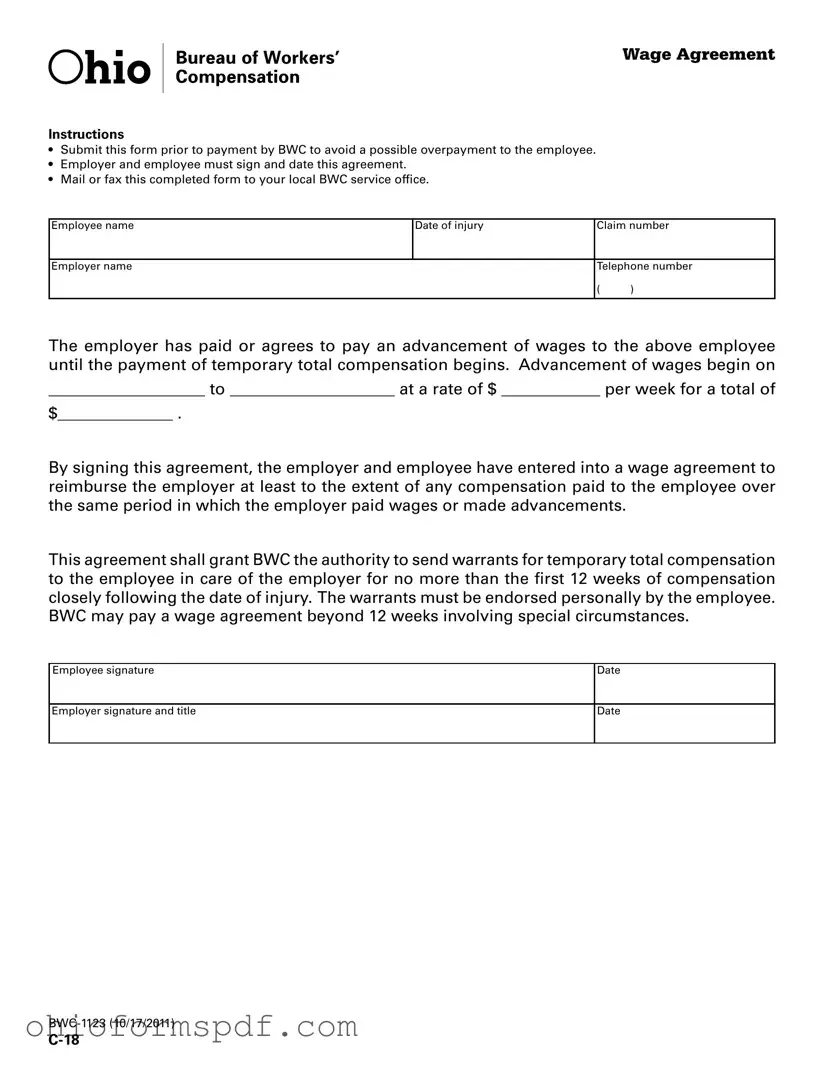

What is the purpose of the Wage Agreement Ohio form?

The Wage Agreement Ohio form is designed to ensure that an employee receives an advancement of wages from their employer while awaiting temporary total compensation from the Bureau of Workers' Compensation (BWC). This form must be submitted before BWC makes any payments to prevent any potential overpayments. It requires the signatures of both the employer and the employee and records the agreement about the advancement amount, the rate and period of the advance, and the method of reimbursement to the employer from the compensation paid.

Who needs to sign the Wage Agreement Ohio form?

Both the employer and the employee must sign and date the Wage Agreement Ohio form. This dual signature requirement ensures that both parties agree to the terms of the wage advancement and the subsequent reimbursement arrangement.

How should the Wage Agreement Ohio form be submitted?

The completed Wage Agreement Ohio form should be mailed or faxed to the local BWC service office. It is important to ensure the form is fully completed to avoid any delays in processing.

When should the Wage Agreement Ohio form be submitted?

To prevent any potential overpayment issues, the Wage Agreement Ohio form should be submitted prior to any payment by the BWC. Timely submission ensures a smooth process for the advancement of wages and the initiation of temporary total compensation payments.

What information is required on the Wage Agreement Ohio form?

The form requires details such as the employee’s name, date of injury, claim number, and employer’s name and telephone number. Additionally, it must include the period the wage advancement covers, the weekly rate, and the total amount advanced. All this information forms the basis of the agreement between the employer and employee about wage advancement and compensation.

What happens if the Wage Agreement Ohio form is not submitted on time?

Failure to submit the form timely could result in overpayment to the employee. In such cases, complications may arise in recovering overpaid amounts. To avoid these financial discrepancies, it's crucial to submit the form before BWC issues any temporary total compensation payments.

Can BWC pay wage agreements beyond the initial 12 weeks?

Yes, BWC may authorize the payment of wage agreements beyond the initial 12 weeks in cases involving special circumstances. The determination is made on a case-by-case basis, ensuring that the needs of the injured employee are adequately met while keeping the reimbursement agreement in place.

What does the requirement for employee endorsement of warrants mean?

This requirement means that any warrants for temporary total compensation issued to the employee in care of the employer for the first 12 weeks following the injury must be personally endorsed (signed) by the employee. This mechanism ensures that the employee acknowledges receipt of the compensation, which is part of the agreement to reimburse the employer for advanced wages.