The Ohio PES 3011 form is a necessary document for companies seeking a Certificate of Authorization to provide professional engineering and/or surveying services within the state. It outlines specific requirements such as a notarized Certificate of Authorization application, a notarized...

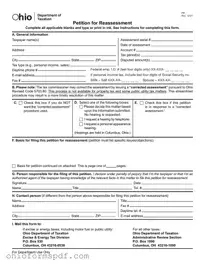

The Ohio Petition for Reassessment is a formal document that taxpayers can utilize to dispute specific assessments issued by the Ohio Department of Taxation. By completing and submitting this form, individuals or entities can present their case, listing specific objections...

The Ohio Power Statutory form is a legal document that allows a person, known as the principal, to designate another person, known as the agent, to make decisions regarding the principal's property and financial matters. It is crucial for the...

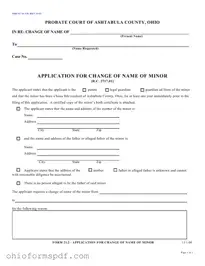

The Ohio PRB-NC-ACNM form, revised in August 2010, serves as a formal request for the change of name of a minor in Ashtabula County's Probate Court, under the provisions of R.C. 2717.01. It specifically requires the applicant, who must be...

The Ohio RCB 020 form is a crucial document for professionals seeking to verify their respiratory care credentials with the Ohio Respiratory Care Board. It outlines the necessary steps and fees for credential verification by the National Board for Respiratory...

The Ohio Sales Tax UST 1 Form serves as a comprehensive return document through which businesses report and pay state, county, and transit sales taxes to the Ohio Department of Taxation. It requires detailed information about gross sales, taxable sales,...

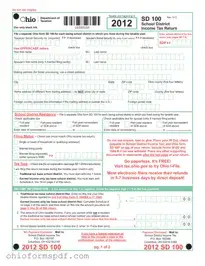

The Ohio SD 100 form stands as a critical document for residents who need to report and pay taxes to their respective school districts, based on where they lived during the taxable year. It is intricately designed for individual compliance,...

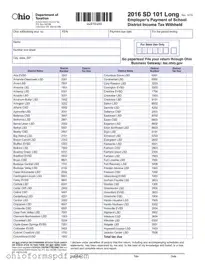

The Ohio SD 101 form, known formally as the Employer’s Payment of School District Income Tax Withheld, serves as a critical document for employers within Ohio. It facilitates the process of remitting withheld income taxes to the Ohio Department of...

The Ohio SD 141X form is officially known as the Amended School District Employer’s Annual Reconciliation of Tax Withheld, a document generated by the Ohio Department of Taxation for tax year revisions. It serves employers who need to correct previously...

The Ohio SD 40P form serves as a School District Income Tax Payment Voucher, offering taxpayers a method to submit their school district income tax payments electronically or via a mailed paper check or money order. Electronic payment options simplify...

The Ohio Secretary of State form serves as a critical document for individuals and businesses intending to file various types of registrations or updates within the state. Essential for maintaining accurate and current records, this form facilitates the appointment or...

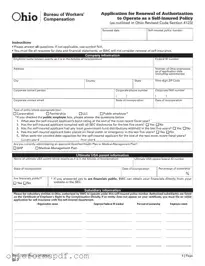

The Ohio SI-7 form serves as an Application for Renewal of Authorization to Operate as a Self-Insured Policy under Ohio's workers' compensation laws, specifically outlined in Ohio Revised Code Section 4123. Employers must complete this form to maintain their self-insured...