The Ohio Ifsac Grandfather Application form is a crucial document for firefighters seeking to receive recognition for certifications or training acquired before December 31, 2002. Designed by the Ohio Fire Academy, the form facilitates the grandfathering process, enabling applicants to...

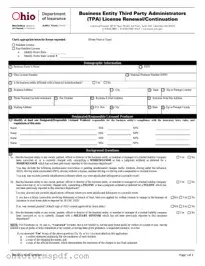

The Ohio Ins3213 form is a comprehensive document designed for Third Party Administrators (TPAs) seeking to renew or continue their business entity license with the Ohio Department of Insurance. This form, directed by Judith L. French, requires detailed information including...

The Ohio IRP (International Registration Plan) Application form is a crucial document for carriers operating commercial vehicles across state lines, providing a way to register fleets for travel in Ohio and other states. It requires detailed information about each vehicle...

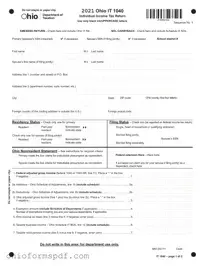

The Ohio IT 1040 form is a key document for residents of Ohio, facilitating the process of filing their state individual income tax returns. It requires detailed information such as personal identification, income, tax deductions, and credits to accurately assess...

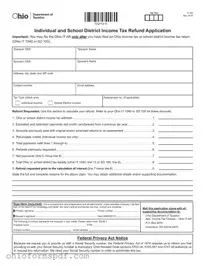

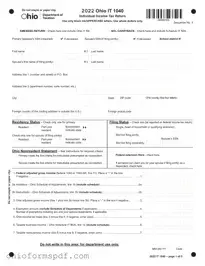

The Ohio IT 1040EZ form is a document designed by the Ohio Department of Taxation for individual income tax return purposes. This document instructs taxpayers to use only black ink and uppercase letters while filling it out, emphasizing the importance...

The Ohio IT 3 form is a critical document for employers, serving as a transmittal for W-2 and 1099-R statements to the Ohio Department of Taxation. It outlines explicit instructions for filing, including a January 31st deadline or a 60-day...

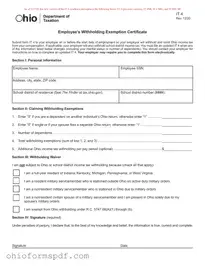

The Ohio IT 4 form, as of December 7, 2020, serves as an Employee’s Withholding Exemption Certificate, simplifying and consolidating the previous versions and specific forms such as IT 4NR, IT 4 MIL, and IT MIL SP. This essential document...

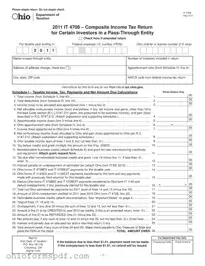

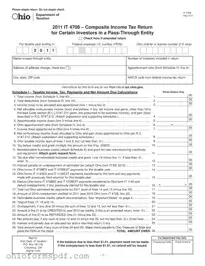

The Ohio IT 4708 form is a document used by pass-through entities to report and pay income taxes on behalf of their investors or members. This form simplifies the process, ensuring taxes are efficiently managed and submitted to the Ohio...

The Ohio IT 941 form serves as an annual reconciliation of withheld state income tax for employers. It allows businesses to report the total income taxes withheld from their employees' wages throughout the year. This form plays a crucial role...

The Ohio IT-942 form is a crucial document for businesses managing quarterly withholding tax adjustments in the state of Ohio. It offers comprehensive instructions and fields for accurately reporting and reconciling an employer's quarterly withholding tax amounts. This form is...

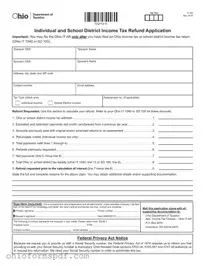

The Ohio IT AR form is a refund application for individuals and school districts who have filed an Ohio income tax or school district income tax return using forms Ohio IT 1040 or SD 100. It allows taxpayers to request...

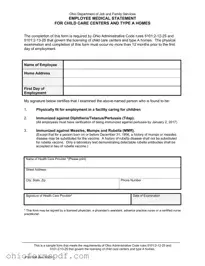

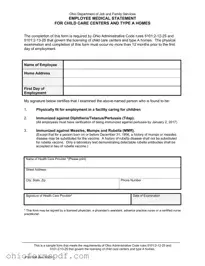

The Ohio Jfs 01296 form serves a crucial role in ensuring the health standards of individuals working in child care settings, such as child care centers and Type A homes, are upheld according to the state's guidelines. Mandated by the...